For dealers dependent on auctions for cars and trucks, elevated wholesale used-vehicle prices were a pain point throughout 2021.

But there could be some relief in store: Forecasters saw limited price hikes during the 2022 spring selling season. Wholesale prices grew modestly for about eight weeks in a row — a pattern usually exhibited during the spring season as consumers spend their tax refunds on vehicles.

But now that the market is past that window, prices could smooth out even more.

“Dealers are starting to see the wholesale market behave pretty normally, just like we’re seeing in retail pricing, so I think down the road, there’ll be less pressure on that front,” Cox Automotive Chief Economist Jonathan Smoke told Automotive News.

Dealers who source inventory from auctions have been taking the brunt of up-to-date market prices, which have gone through an extended bout of inflation, Smoke said.

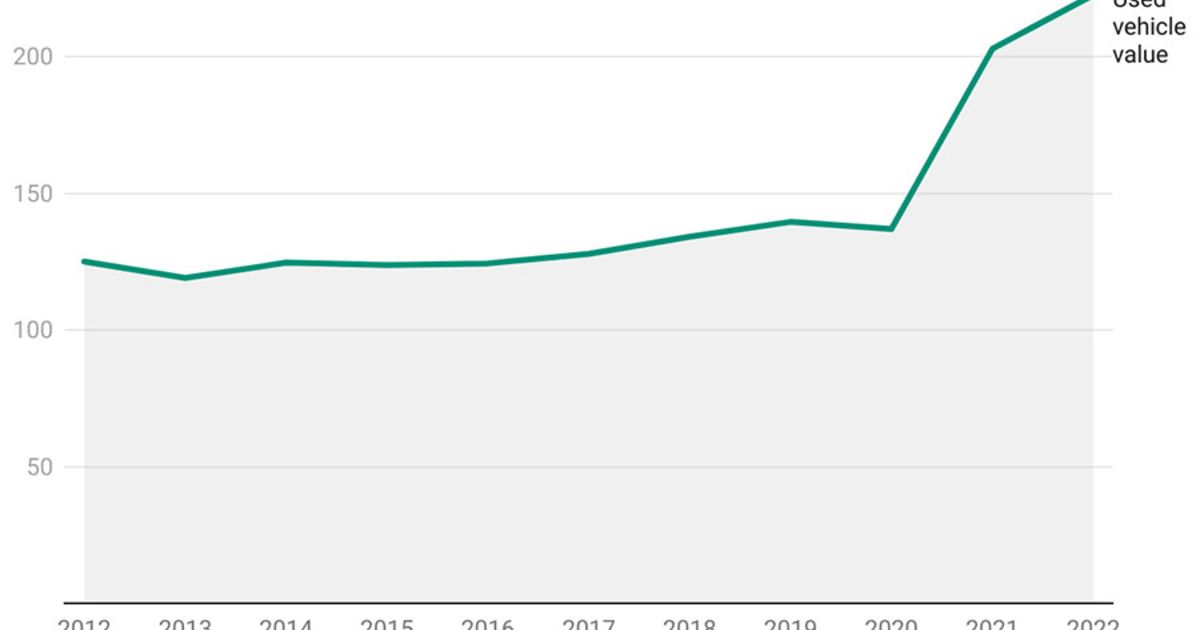

Wholesale prices broke records last year, according to the Manheim Used Vehicle Value Index, which tracks vehicles sold at U.S. auctions. A long stretch of price elevation lasted from December 2020 to May 2021, only broken when prices cooled a bit in June, July and August, which is typical for the summer.

Prices rose again from September to January 2022. That streak came as a surprise to forecasters because prices typically wane in the winter months.

Prices slightly fell through the first four months of 2022, which has been taken as an indication that the wholesale market might be returning to a semblance of normal.

Wholesale prices grew again in May, but not at the pace at which they increased one year ago. Cox Automotive said last week the Manheim Index rose just 0.7 percent from April to May.

Still, when adjusted for mix, mileage and seasonality, wholesale prices are nearly 10 percent higher now than they were in the same period a year earlier.

In these conditions, the dealers who are buying directly from consumers, sourcing inventory off the street or working with a robust new- and used-retail market that supplies trade-ins all have a competitive advantage over dealers who are exclusively sourcing from wholesale channels, Smoke said.

All in all, independent dealers more likely to source from that channel might be having a tough time if they don’t have a thriving new-vehicle business and they can’t access off-lease vehicles.

“This was an issue prepandemic, in terms of access to inventory, and it just has gotten worse because of the price increases that have been more significant in the wholesale market,” Smoke said.

Dealers who have multiple inventory channels are currently in better shape to be competitive and control their costs compared with those who are more dependent on the auction market, Smoke said.

One wild card that could impact wholesale prices later in the year is if rental car companies aggressively buy at auctions. If those companies continue to have trouble acquiring new-vehicle inventory because of industrywide microchip shortages and supply chain issues, they will be more likely to buy potential fleet vehicles at auctions, which could affect prices.

Average wholesale prices for 3-year-old vehicles — the largest model-year cohort at Manheim’s auctions — rose 0.4 percent over the last five weeks.