WASHINGTON — America’s labor market defied forecasts for a Depression-style surge in unemployment by rebounding in May, signaling the economy is picking up faster than anticipated from the coronavirus-inflicted recession.

A key gauge of payrolls rose by 2.5 million, trouncing forecasts for a sharp decline following a 20.7 million tumble the prior month that was the largest in records back to 1939, according to Labor Department data Friday. The jobless rate fell to 13.3 percent from 14.7%.

U.S. stocks jumped after the report, adding to weeks of gains in equities since mid-March.

While the overall picture improved, one key number in the report deteriorated. Unemployment rates declined among white and Hispanic Americans, but the level ticked up among African Americans to 16.8 percent, matching the highest since 1984. That comes amid nationwide protests over police mistreatment of African-Americans, which have drawn renewed attention to black people’s economic plight.

U.S. payrolls climbed 2.5 million in May, beating forecast for significant drop

The unexpected improvement wasn’t limited to the U.S. figures. North of the border, Canadian employment rose 290,000 in May, compared with forecasts of a 500,000 slump, its statistics office reported Friday.

The better-than-expected results follows U.S. auto sales results that were somewhat better than forecast in May, albeit with limited data from the industry.

The data show a U.S. economy pulling back from the brink as states relax restrictions and businesses bring back staff, while supporting a rebound in the stock market.

“Clearly the labor market turned the corner in late April, early May. We’re seeing a rebound of labor-market activity,” said Michael Englund, chief economist at Action Economics, who had estimated a payrolls decline of 2 million, the second-closest estimate. He expects June economic and labor-market data to show further improvements and plans to revise up his forecast for second-quarter gross domestic product.

The latest figures may give a boost to Trump, who has fallen behind Democratic challenger Joe Biden in polls amid the pandemic, recession and now nationwide protests over police mistreatment of African-Americans. The numbers also come amid a debate over the timing and scope of additional stimulus, with Democrats and Republicans at odds following record aid approved by Congress to cushion the downturn.

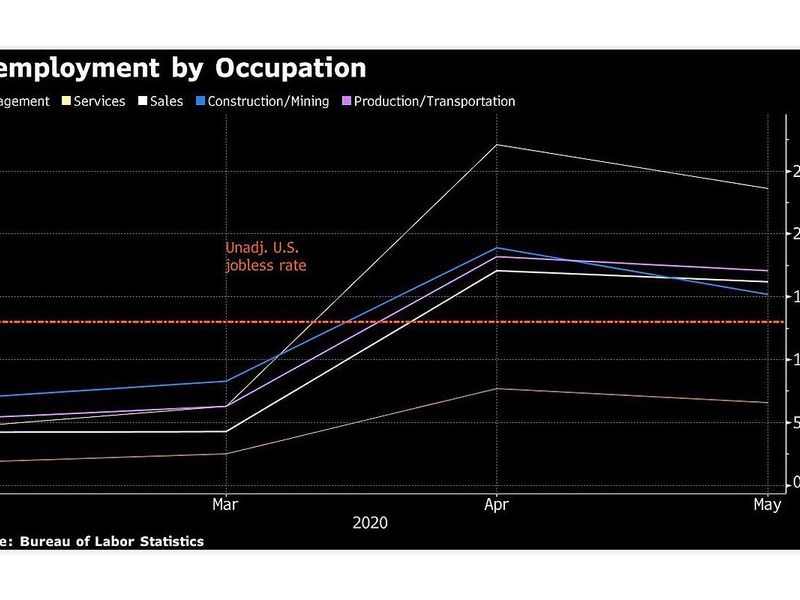

Unemployment by occupation

Economist forecasts had called for a decline of 7.5 million in payrolls and a jump in the unemployment rate to 19 percent.

No one in Bloomberg’s survey had projected improvement in either figure.

One caveat noted by the U.S. Labor Department: the unemployment rate “would have been about 3 percentage points higher than reported” if data were reported correctly, according to the agency’s statement. That refers to workers who were recorded as employed but absent from work due to other reasons, rather than unemployed on temporary layoff.

The broader U-6, or underemployment rate — which includes those who haven’t searched for a job recently or want full-time employment — fell to 21.2 percent in May from 22.8 percent. In February, it was 7%, with the main unemployment rate at a half-century low of 3.5 percent.

The employment-population ratio rose to 52.8 percent from 51.3 percent. The participation rate — or the sum of employed and unemployed Americans as a share of the working-age population — advanced to 60.8 percent from 60.2 percent. Hiring in May was broad-based, with hard-hit restaurants rebounding along with retail and health care. But state and local government workers were hammered for a second month, with 571,000 job cuts.

“The bounceback started earlier than most expected, but don’t get too excited about this one month of data,” said Nick Bunker, an economic-research director at jobs website Indeed. “Sectors hit hardest by the coronavirus are the ones seeing the largest bounceback in employment.”

Millions more Americans in May worked less than full week because of pandemic

Manufacturing payrolls rose by 225,000, following a 1.32 million decline in April. Most automakers and their suppliers resumed limited U.S. production last month.

The share of the unemployed on temporary layoff fell to 73 percent from a record-high 78.3 percent. Goldman Sachs Group Inc. economists said before the report that if job losses remain concentrated in furloughs, “it would increase the scope for a more rapid labor market recovery.”

Average hourly earnings for employed private workers rose 6.7 percent in May from a year ago, following 8 percent in April, as the return of low-wage workers skewed pay figures back downward a bit.