Vehicle listings company TrueCar is piloting an online credit application for Southern California car shoppers looking to buy or lease a vehicle. The feature means customers won’t need to go to the dealership to complete finance and insurance forms and will have access to real-time final pricing information.

If the launch goes smoothly, the company plans to offer the application to TrueCar customers in other markets, Alain Nana-Sinkam, senior vice president of business development, told Automotive News.

TrueCar, of Santa Monica, Calif., connects car buyers with inventory from about 12,000 dealerships in its U.S. network. The company has about 200 dealership partners in the Southern California market. In June, TrueCar announced its acquisition of digital retail platform provider Digital Motors of Irvine, Calif.

On the TrueCar website, customers select a specific vehicle in stock at a dealership in its network and directly contact that dealership to complete the deal. A newer TrueCar Plus website, which launched in Florida and expanded in November to Alabama, Georgia, North Carolina, South Carolina and Tennessee, allows consumers to move from the vehicle search stage to delivery all online.

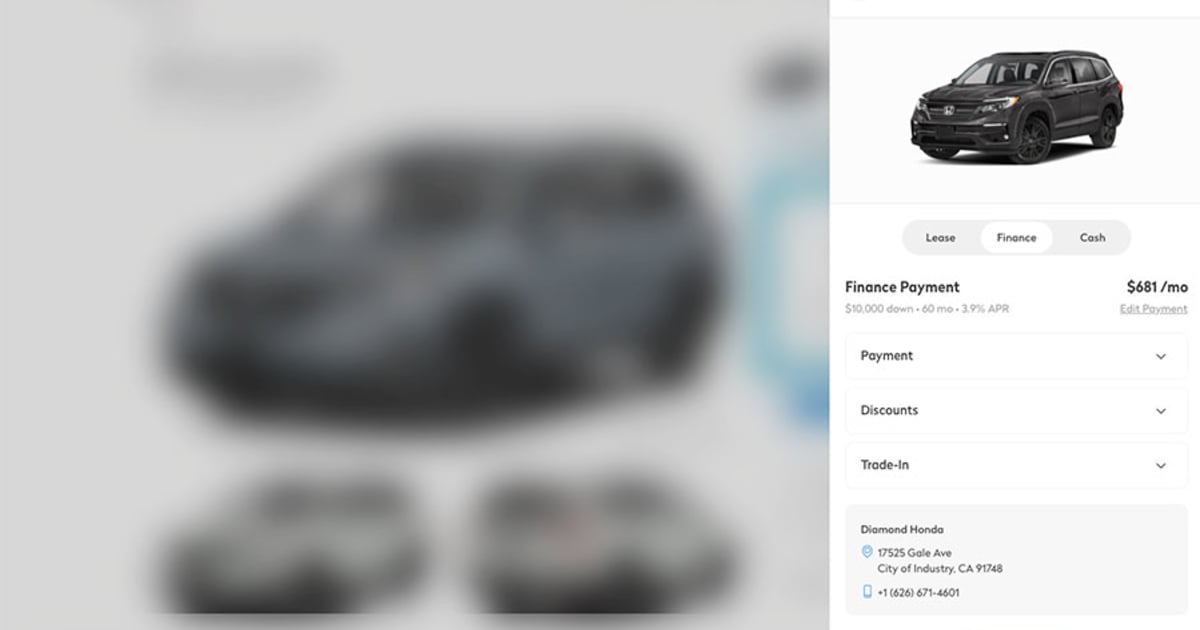

The application now available to TrueCar shoppers in Southern California is the same technology used on TrueCar Plus. Customers can build deals with self-reported credit levels and then submit their credit application online for approval. TrueCar sends the customer’s credit information to the dealer’s preferred lender.

Once credit is approved, customers can see what their monthly payment would be for their selected vehicle — taking into consideration incentives, their credit score and their preferred lease terms. The website shows them details on incentives, applicable taxes, fees and trade-in value.

“It shows you the top-line price, but there’s more to the deal — taxes, license fees; we show you all of that,” said Nana-Sinkam, who previously worked at a Chevolet, Geo and Hyundai dealership. “The payments are changing in real time to show the changes you made.”

The automated process ensures the same pricing information is given to any customer entering the same information on any given day, which helps dealers ensure F&I transparency, Nana Sinkam said. Transparency is a top-of-mind issue with dealers because the FTC has been cracking down on unfair and deceptive practices in the car-buying process.

“This is an important issue because of that concept of consistency,” Nana-Sinkam said. “If we all dialed in our same deal parameters — how much down, credit score range — we’d see the same monthly payments.”

But he does realize some consumers will want and need to engage directly with the dealership and stresses the importance of F&I managers.

“There’s extraordinary value F&I managers provide to the car-buying process,” he said. “What we’re doing helps to offload some of the sausage-making that exists in the process and allow the finance manager to concentrate on the things they do extraordinarily well.”

TrueCar competitor Cars.com launched an instant financing program in early 2022 across its marketplace and Dealer Inspire websites. It is powered by CreditIQ, which the company bought in 2021, and is being used by more than 2,000 Cars.com retail partners to get real financing terms and bank approvals directly from its platform.

“We have entered the next phase of instant financing and are expanding our capabilities to allow car shoppers to see what their real monthly payments on qualified vehicles could be, allowing them a greater understanding of how their purchase impacts their monthly budget,” said Bill Liatsis, vice president and general manager of CreditIQ.

Marko Petricevic, internet sales director for San Diego Chrysler-Dodge-Jeep-Ram, says TrueCar’s new online credit feature will create efficiency for his store at time when consumers are looking for it.

“It will assist the dealership in obtaining improved [customer satisfaction scores] and increased referrals, retention of clients,” Petricevic told Automotive News. “We have already reached a point where we desire convenience in everything from grocery shopping to the purchase of an automobile.”

On Nov. 15, retail giant AutoNation Inc. announced it bought a 6.1 percent minority ownership stake in TrueCar — the latest move in its on-again, off-again partnership. AutoNation in July 2015 cut ties with TrueCar, complaining about customer data-sharing requirements. The retailer started working with the company again in 2016, crediting then-CEO Chip Perry’s leadership.

In states that allow a pay-per-sale model, dealerships generally pay TrueCar $299 when they sell a new car using the company’s lead services and $399 per used car, Nana-Sinkam said. Other states pay on a performance-based subscription model.

TrueCar, founded in 2005, posted a third-quarter loss of $77.1 million compared with a $6.8 million loss the same period a year ago. Regarding the loss, the company pointed to a one-time impairment charge of $59.8 million related to a major decline in its share price.