<!–*/ */ /*–>*/

| The legacy of Sergio’s failed pursuit of GM |

It’s hard to fathom, but at this time in 2015, the big story in Automotive News was Sergio Marchionne’s persistent — and fruitless — pursuit of a merger with General Motors.

We were in the midst of publishing a six-part series called “Industry on Trial.” In it, we explored the Fiat Chrysler CEO’s case that the auto industry as structured was a cash guzzler and that consolidation among its players was the answer.

The series stuck a chord with the boss himself. Amid it all, he invited Automotive News into his secondary offices in downtown Detroit to share his vision. As my now-retired colleague Richard Johnson would later write, it was the “weirdest, wildest, most entertaining interview of my Automotive News life.”

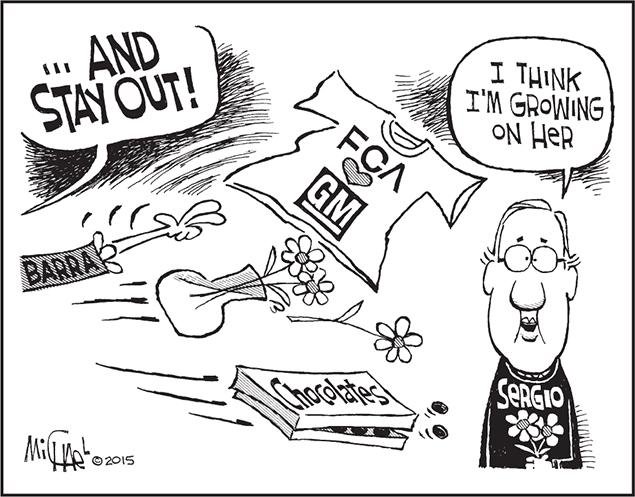

In that session, Marchionne laid out his case for why a merger made so much sense. Leo Michael‘s cartoon at the top of this column — published five years ago tomorrow — captured GM’s response perfectly. CEO Mary Barra wanted nothing to do with a fantasy-prone suitor.

Also on that day, we printed nearly three columns of responses to the proposed deal. It’s fascinating to reflect on how prescient some of the comments were. One reader suggested PSA would make a much better fit. Sure enough, the two companies are now just months away from becoming one.

Of course, Marchionne died in July of 2018, while Barra remains CEO of General Motors. But it sure seems like Marchionne’s presence still looms large over GM.

It’s reflected in the racketeering lawsuit that accuses FCA under Marchionne’s leadership of engaging in a bribery scheme with the UAW to gain an unfair labor cost advantage. Even though a federal judge in Detroit has twice dismissed it, GM isn’t giving up. It’s planning to appeal.

It also shows in GM’s historic agreement last week to work with Honda in a broad range of areas, which we explore in Monday’s issue. It may be Barra’s way of saying Sergio was right about cooperation, but we’ll pick our own partner, thank you.

In those reader comments published five years ago, Volkswagen was also mentioned as a more-suitable partner for FCA than GM. Within two weeks , that prospect would become laughable.

U.S. regulators would reveal that the German automaker had admitted to cheating on diesel emissions tests. As we’ll show in next week’s print edition, the aftershocks are still rattling VW.

|

“The selling rate in August demonstrates that there is base-level demand for new vehicles and dealers are finding ways to close deals and deliver product. The market is far from recovered, but considering the overall economic conditions, it is healthy.” |

– CHARLIE CHESBROUGH, COX AUTOMOTIVE SENIOR ECONOMIST |

|

From “Toyota, Honda, Hyundai sales fall in skewed month; SAAR tops 15M” |

|

Coming Monday in Automotive News:

The dEVil in the details? General Motors dealers had mixed reactions after being asked to sign separate agreements for electric vehicle sales and service. Dealers in states that are part of the California Zero Emission Vehicle Program are raising their hand to sell EVs as soon as possible, while dealers in states with fewer incentives and lower EV demand remain skeptical. The way they see it, if they’re Chevrolet dealers, for example, they should be able to sell everything Chevy builds without a separate agreement. Automotive News delves into dealers’ concerns and GM’s plans.

Nissan wanted to pull back from incentives. It’s now back in the game: The embattled automaker recognized that it went overboard on incentives in the U.S. Still, times being what they are, Nissan has jumped back into that pool. Some dealers, pleased with the sales targets they’ve been given, are cheering. Others remain skeptical that Nissan has the discipline to not ratchet up sales objectives to levels that hurt dealer profitability.

Subaru’s Sunbelt success story: A decade ago, Subaru of America realized that growing its U.S. business meant incremental growth in the Sunbelt. So Subaru played the long game, patiently bolstering its stores in a region that made up only 15 percent of retail sales. Today, some of the brand’s largest stores by volume are found in the region, which accounts for roughly 27 percent of Subaru’s U.S. retail sales. Jeff Walters, senior vice president of sales, tells Automotive News how Subaru was able to change its fortunes.

Weekend news:

Toyota among companies in Japan shuttering plants ahead of typhoon: The automaker decided to halt output at three plants in Fukuoka as Typhoon Haishen approaches.

<!–*/ */ /*–>*/

|

|

|---|

|

Will 2021 be a year of show bottlenecks? Get ready for a spring blitz of automotive events as the Los Angeles Auto Show, originally scheduled for November, will be postponed by six months because of the coronavirus. That puts it between April’s New York show and June’s North American International Auto Show in Detroit.

GM lightweighting, noise and vibration products supplier to get new owners: Shiloh Industries Inc. has filed for Chapter 11 bankruptcy and will be part of a stalking horse agreement auction and sale process. Private equity firm Grouper plans to acquire all of Shiloh’s assets in a bankruptcy court sales process for about $218 million in cash.

|

|

A selection from Shift and Daily Drive:

|

Sept. 11, 1989: The first vehicle, a Subaru Legacy, is built at the plant initially known as Subaru-Isuzu Automotive in Lafayette, Ind. The plant was a joint venture between Subaru’s parent company, then known as Fuji Heavy Industries, and Isuzu Motor Co.

The venture ended in December 2002 when Fuji bought Isuzu’s interest in the plant for $1. The plant was renamed Subaru of Indiana Automotive. In 2005, Toyota Motor Corp. became a major Fuji investor and by 2007, the first project between the two companies began: Toyota Camry production at the Indiana plant. Camry production lasted there until May 2016.

Today, Subaru builds the Impreza compact sedan and hatchback, Outback midsize crossover, Ascent large crossover and, still, the Legacy midsize sedan there.

On Sept. 23, 2019, the plant built its 6 millionth vehicle, which was, fittingly, a 2020 Legacy. The plant was also once home to Subaru Baja and Tribeca production, as well as the Honda Passport, back when the body-on-frame SUV was a rebadged Isuzu Rodeo.