| Are dealers’ good times coming to an end? |

Dealers fear the optimal economic conditions that propelled them to three straight years of robust profits are further eroding.

And though demand for both new and used vehicles is strong, we are seeing and hearing more about how the dynamics of said demand have changed. Thanks to inflation and higher interest rates, cash-strapped buyers are no longer willing and able to entertain paying as much for a used vehicle as a new vehicle.

Franchised dealers are seeing evidence of that. Their concerns about this evolved sales environment take center stage in our print issue this week.

Automotive News conducted its 2023 Dealer Outlook Survey in January. A large majority of the 264 dealers and dealer managers who participated in it — 70 percent of respondents — said higher interest rates are their top worry. A potential recession and vehicle affordability tied for the next most-concerning factor, with about 42 percent of respondents selecting those. Dealers could select up to three top worries.

Affordability also was on the minds of dealers, analysts and company executives at the NADA Show in Dallas, who noted in panels and presentations how the average consumer profile has changed from just two years ago.

All things considered, mixed outlooks prevail.

About 44 percent of respondents fear their profits will worsen in 2023. Nearly 30 percent expect profits will be flat compared with 2022 — a year in which some said their stores earned record profits.

To what degree demand wanes in 2023 remains to be seen. Should a recession arrive, we’ll bring you coverage of how it disrupts dealers’ sales operations.

One thing’s for certain: dealers are battening down the hatches.

|

|---|

|

|---|

In Monday’s Automotive News:

Ford dealers aren’t happy: Well, some aren’t. Ford is working with its dealer council on changes to its EV certification program in response to arguments from state associations that it’s unfair and breaks franchise laws, according to the brand’s council chairman. Changes would include narrowing the differences between the program’s two tiers, one of which limits EV sales in exchange for a reduced investment in charging equipment. Tim Hovik, head of the Ford National Dealer Council, walked Automotive News through changes to three major aspects of the program, which has drawn rebukes from dozens of U.S. state dealer associations and prompted legal action even as two-thirds of Ford’s retail network agreed to adhere to the standards.

Getting ready for EVs: Conversely, Cadillac dealers say General Motors has done a great job advising them on how to prepare for the rollout of more EVs as the brand’s lineup transitions away from internal combustion. “They’re much further ahead than other manufacturers as far as installing the chargers, the training,” said Inder Dosanjh, chairman of the Cadillac National Dealer Council and CEO of Dosanjh Family Auto Group in the San Francisco Bay Area. As Automotive News explains, GM has said it aims to have a fully zero-emission light-vehicle portfolio by 2035, led by Cadillac and Buick, which plan to eliminate internal combustion offerings by 2030. Cadillac provided clarity to dealers early in the process and also gave them the option to walk away, Dosanjh said. “I think such a clarity from Cadillac from the start really helped the whole process,” he said.

Weekend headlines

Musk faces SEC probe for role in Tesla self-driving claims: The review is part of an ongoing Securities and Exchange Commission probe of the company’s statements about its Autopilot driver-assistance system.

Why Super Bowl auto ad spending is trending down: The economy and supply concerns weigh on automakers—and fewer are using the game to push EVs. Ford CEO Jim Farley: “If you ever see Ford Motor Co. doing a Super Bowl ad on our electric vehicles, sell the stock.”

|

|---|

Manchin seeks immediate cutoff of credits for EVs that don’t meet battery rules: In a proposed amendment to the Inflation Reduction Act, Sen. Joe Manchin, D-W.Va., wants the U.S. Treasury Department to immediately stop issuing $7,500 consumer tax credits for EVs that do not meet strict critical mineral and battery component requirements. If enacted, no credit would be available to any new EVs that do not meet the requirements, effective retroactively as of Jan. 1.

Manchin seeks immediate cutoff of credits for EVs that don’t meet battery rules: In a proposed amendment to the Inflation Reduction Act, Sen. Joe Manchin, D-W.Va., wants the U.S. Treasury Department to immediately stop issuing $7,500 consumer tax credits for EVs that do not meet strict critical mineral and battery component requirements. If enacted, no credit would be available to any new EVs that do not meet the requirements, effective retroactively as of Jan. 1.

Another rough year ahead for suppliers? A convergence of factors made 2022 a difficult year for parts companies, even as their automaker customers reported sizable profits. While inflation and the microchip shortage have shown signs of easing in the opening weeks of 2023, those situations are expected to continue well into the year, says Michael Robinet, executive director of automotive advisory services at S&P Global Mobility.

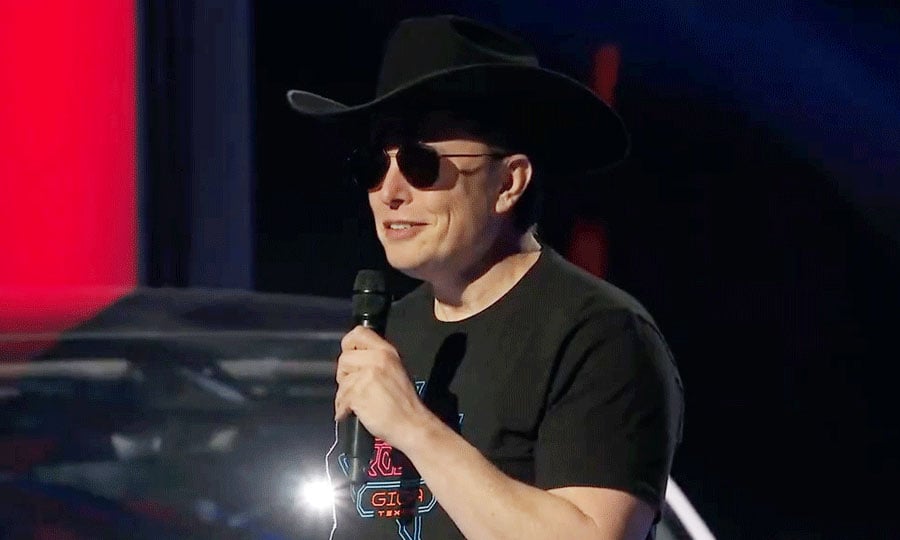

Elon Musk defends himself in court: Tesla’s CEO testified last week that he intended to inform and not deceive shareholders when he tweeted in August 2018 that he had funding lined up to take the electric car maker private, which shareholders allege was a lie. Musk is defending against claims he defrauded investors by tweeting he had “funding secured” to take Tesla private at $420 per share and that “investor support is confirmed.”

|

|---|

|

|---|

|

|---|

|

|---|

|

|---|

Feb. 3, 2009: Volkswagen begins construction of its assembly plant in Chattanooga, Tenn.