Tesla Inc. has posted four quarters of positive earnings. That’s enough to get it into the S&P 500, right? Not necessarily, says DataTrek Research.

Fans of Elon Musk’s automaker have been on high alert for news Tesla will be added to the index ever since the company reported a $104 million profit for its June quarter. But while the results would seem to satisfy rules for inclusion, aspects of its earnings may give the index committee at S&P Dow Jones Indices pause, the research shop said.

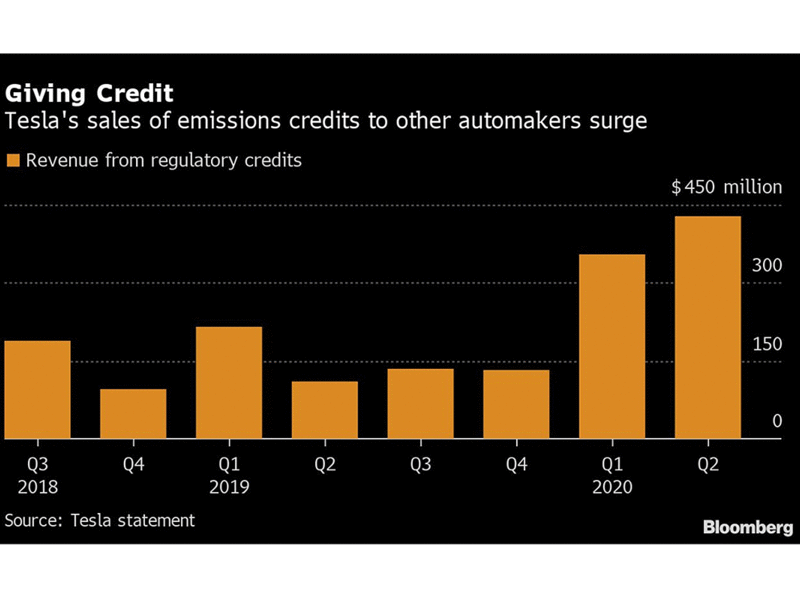

Specifically, Tesla would not have made money on a generally accepted accounting principles basis the last several quarters without the sale of regulatory credits to carmakers that need help complying with toughening emissions standards around the world.

In the first half of this year, the company booked $782 million of revenue from the sale of those credits, which are pretty much all profit, according to Nicholas Colas, DataTrek’s co-founder. That compares with $220 million posted in GAAP net income.

“This puts the S&P committee in charge of adding names to the 500 in a real bind, because while to the letter of their ‘law’ Tesla qualifies for inclusion this is purely due to regulatory arbitrage — not fundamental profitability from designing, manufacturing and selling cars,” wrote Colas, who in the 1990s spent nearly a decade as an equity auto analyst at First Boston.

Tesla shares have risen more than 380 percent this year

Essentially, Colas’s concern is that the money Tesla earns from its core business may still be too skimpy and volatile for S&P Dow Jones to be comfortable with. A lot rides on whether such judgments would keep it out of the index, given at least some of the stock’s 380 percent rally this year is predicated on anticipation it will be included.

Ray McConville, an S&P Dow Jones spokesman, declined a request for comment. The company has in the past said the S&P 500 isn’t reconstituted on a pre-determined timeline and that companies that meet the requirement aren’t automatically added to the gauge.

Additions and deletions to and from the index are dynamic. Since the start of the year, S&P Dow Jones has added at least 10 companies, according to data shared by the firm. In June, for instance, Tyler Technologies Inc., Bio-Rad Laboratories Inc. and Teledyne Technologies Inc. joined, while Harley-Davidson Inc., Nordstrom Inc. and Alliance Data Systems Corp. were removed.

To be sure, Colas’s analysis is simply speculation. Others doubt the situation is a huge barrier to S&P 500 entry.

Kevin Tynan, senior automotive analyst with Bloomberg Intelligence, says Tesla has managed to get to the goal. “Four quarters of GAAP profitability are required. They did it,” he said. “Nothing states it had to be driven by automotive operations. Solar shingles, robotaxis, regulatory credits or flamethrowers are fine too.”

Tesla’s CFO Zachary Kirkhorn said he expects revenue from regulatory credits to roughly double this year versus last year, but also said it’s difficult to forecast precisely. In addition, the trend could fade as competitors start to meet emissions requirements on their own.

Tesla representatives didn’t immediately respond to an emailed request for comment.

Tesla sports a market cap of around $375 billion, larger than that of Walmart Inc. Going by that measure, the automaker would be one of the largest stocks in the S&P 500, were it to join the index today.

“There is simply no precedent for adding such a large piece of fresh equity into the index,” said Colas. “The larger issue is what Tesla’s inclusion will do to S&P 500 volatility over time and whether the S&P committee will ever change its profitability requirement. If not now, when?”