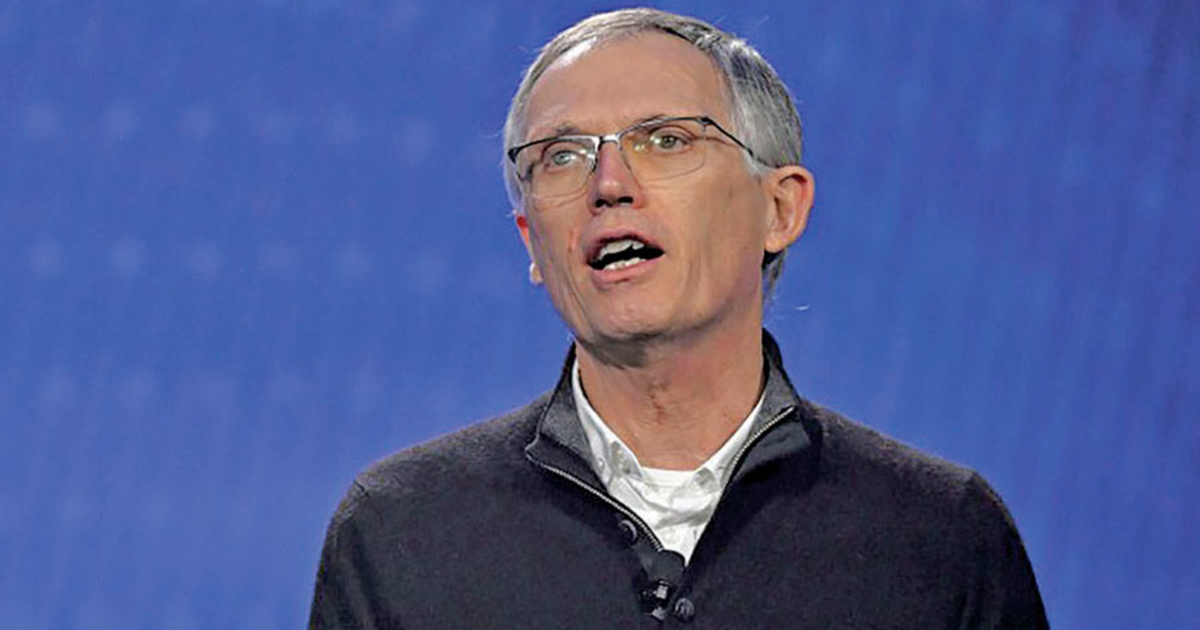

It’s not that there aren’t many electric vehicles at the $25,000 price point that Stellantis CEO Carlos Tavares asserts is the sweet spot.

There are none at all, from Stellantis or any other manufacturer, with sticker prices below that mark today.

Whether Stellantis and other manufacturers can hit such an ambitious target on a wide scale in the coming years remains to be seen, but Tavares said producing EVs that are attainable for the middle class should be a topic of discussion during this year’s UAW contract negotiations.

Reaching that price range, Tavares said last month, will be crucial to protecting jobs in the long run. Tavares has said in the past that Stellantis would need to absorb the additional costs that come with building EVs and not pass them onto consumers.

The company’s imperative to reduce its fixed-cost structure in pursuit of more affordable EVs is clashing with the UAW’s demands for higher wages and benefits at the bargaining table.

Stellantis has budget-friendly electric options on the way in Europe from Fiat and Citroen. The Citroen e-C3, arriving early next year and a Fiat Panda-inspired model to be unveiled in July 2024 are expected to be priced below €25,000 ($27,500).

“We need to work very hard to reach that point,” Tavares said of a $25,000 EV for the U.S. market. “Part of the things we need to discuss with our union partners is how we make affordable EVs in the U.S. that the middle classes can buy and that they are sustainable because they are profitable.”

UAW President Shawn Fain said automakers can build affordable EVs in the U.S. but not by making workers sacrifice.

“The electric vehicle transition does not have to be a race to the bottom. Unfortunately, Stellantis has taken the low-road approach, resulting in closed plants and destroyed communities,” Fain said in a statement to Automotive News. “Stellantis’ business model is broken, and until they fix it, they’ll never hit that $25,000 target.”

The industry still has a ways to go before it consistently delivers EVs under $30,000 in the U.S. The outgoing generation of the Chevrolet Bolt EV is the least costly, at $27,495 including shipping.

The other option is the Nissan Leaf, which, like the Bolt, is a small car. Consumers wanting more space and variety have to look upstream.

Some industry observers wonder if profitability will be nonexistent for an EV around $25,000. And getting to that price could mean stripping out much of what consumers want in a vehicle.

Doug Betts, president of global automotive at J.D. Power, pointed to Tesla’s minimal interiors as an approach that could be adopted by more manufacturers. Betts said $25,000 EVs would definitely open up the market, but he thinks building them would require more cost reductions in addition to the savings realized as battery prices come down in the coming years.

It has been rumored that Tesla could add a $25,000 hatchback to its lineup at some point.

“One of the things about the Teslas is that they’re very spartan,” Betts told Automotive News. “They pull it off in the name of technology. They’ve got the one big screen in the car. There’s not a lot of other stuff so, practically, they’re putting everything into that screen, and they’re probably saving a lot of money by not having all the redundant buttons and things like that.”

Tavares’ $25,000 goal is interesting but not one that can be achieved quickly, said Stephanie Brinley, associate director of AutoIntelligence for S&P Global Mobility.

The industry is going to need more affordable products of all powertrains, Brinley said, to return to U.S. sales of 16 million or 17 million vehicles a year, meaning automakers should be looking to shave EV price tags however they can, even if they’re not beholden to a specific dollar target.

“The broader question and issue is getting electric vehicles that are more affordable price points more so than specifically $25,000 being that price point,” Brinley said. “Because we have some that, with incentives, get that low [although] not very many.”

Another challenge is getting the EV supply chain to the level that it can support an influx of new entries.

“Right now, it looks like EV sales are not necessarily slowing or collapsing or anything of the sort, but the take rate is slowing down a little bit,” Brinley said. “If somebody waved a magic wand and said these are affordable and profitable, and all cars are going to be EV tomorrow, it’s just not possible. “

Bringing out a profitable yet “cheap” EV in the $25,000 range is still about a decade away for most automakers, said Sam Fiorani, vice president of global vehicle forecasting for AutoForecast Solutions. Fiorani sees limitations on which segments manufacturers could enter at that price, with many of them likely being compact models for the time being. The journey to profitability, he said, will take time.

“Everybody keeps saying how Ford is losing money on their EVs, and Tesla is profitable, but it took a decade to be profitable, so expecting the legacy automakers just to be profitable on Day One is absurd,” Fiorani told Automotive News. “Lower the price to $30,000, it’s going to push that profitability even further out.”