Customers financed $41,445 on the average new-vehicle loan and $27,768 on the average used vehicle loan during the 4th quarter. Those loans on average had higher interest rates and higher monthly payments than a year earlier. Meanwhile, a larger proportion of customers were behind on their loans. Here are more highlights from Experian.

Market share of total financing

Hover over chart for more detail.

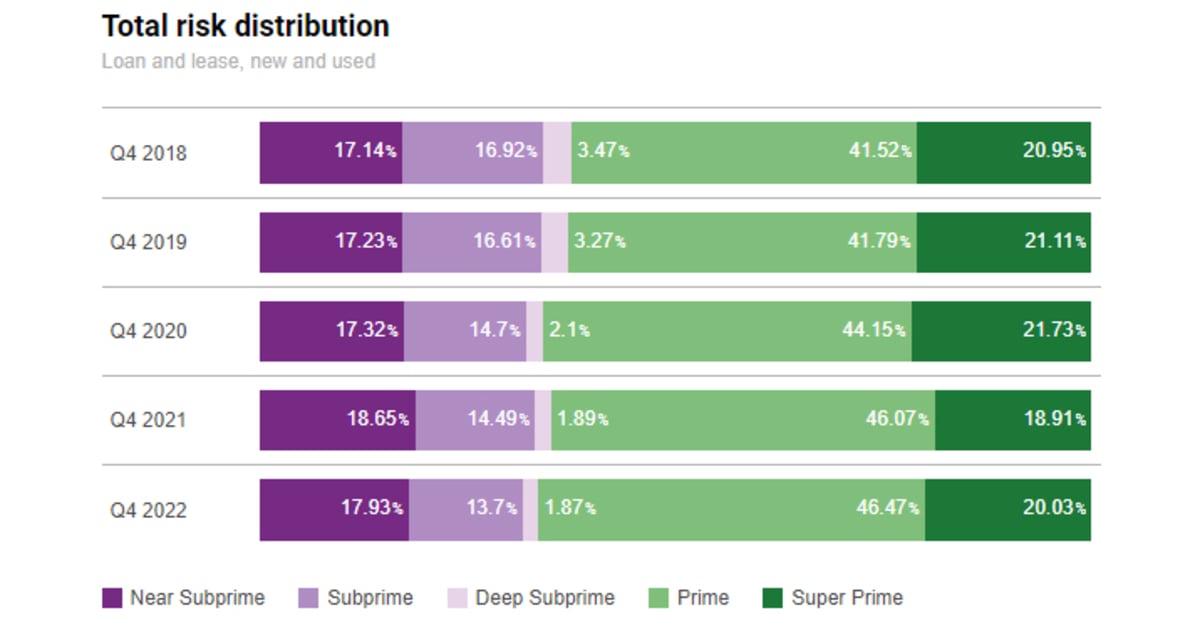

Total risk distribution

Loan and lease, new and used

| Q4 2018 | |

| Q4 2019 | |

| Q4 2020 | |

| Q4 2021 | |

| Q4 2022 |

Near Subprime

Deep Subprime

Super Prime

30-day delinquency

Percentage of loans delinquent

| Q4 2018 | 2.43% | |

| Q4 2019 | 2.42% | |

| Q4 2020 | 1.81% | |

| Q4 2021 | 1.86% | |

| Q4 2022 | 2.31% |

60-day delinquency

Percentage of loans delinquent

| Q4 2018 | 0.83% | |

| Q4 2019 | 0.83% | |

| Q4 2020 | 0.64% | |

| Q4 2021 | 0.66% | |

| Q4 2022 | 0.87% |

New-vehicle loans

Average amount financed

| Q4 2020 | $35,420 | |

| Q4 2021 | $39,834 | |

| Q4 2022 | $41,445 |

Average loan rate

| Q4 2020 | 4.3% | |

| Q4 2021 | 3.88% | |

| Q4 2022 | 6.07% |

Average monthly payment – lease

| Q4 2020 | $469 | |

| Q4 2021 | $535 | |

| Q4 2022 | $578 |

Average monthly payment – loan

| Q4 2020 | $578 | |

| Q4 2021 | $646 | |

| Q4 2022 | $716 |

Average term – lease (In months)

| Q4 2020 | 36.49 | |

| Q4 2021 | 36.74 | |

| Q4 2022 | 35.42 |

Average term – loan (In months)

| Q4 2020 | 69.63 | |

| Q4 2021 | 69.64 | |

| Q4 2022 | 69.44 |

Used-vehicle loans

Average amount financed

| Q4 2020 | $22,643 | |

| Q4 2021 | $27,390 | |

| Q4 2022 | $27,768 |

Average loan rate

| Q4 2020 | 8.41% | |

| Q4 2021 | 8.22% | |

| Q4 2022 | 10.26% |

Average monthly payment

| Q4 2020 | $417 | |

| Q4 2021 | $490 | |

| Q4 2022 | $526 |

Average term (In months)

| Q4 2020 | 65.66 | |

| Q4 2021 | 67.35 | |

| Q4 2022 | 68.01 |

SOURCE: Experian