The growth of software-defined vehicles is set to upend the traditional relationship between automakers and suppliers, according to a report released Tuesday by Deloitte.

Software-defined vehicles are expected to account for at least 90 percent of the new-vehicle market by 2029, up from only 2.4 percent in 2021, Deloitte said in the new study. Likewise, global revenue from over-the-air updates is expected to surge to about $14 billion by the end of the decade, compared with $3.3 billion in 2022.

Software-defined vehicles, those with software capabilities that continually improve over the vehicle’s life cycle, present both a major opportunity and a pressing challenge for traditional automakers, said Chris Ahn, connected services and electrification leader at Deloitte Consulting LLP.

“It’s a pretty significant paradigm shift for a lot of these automakers,” Ahn told Automotive News. “Once these traditional automakers figure out how to navigate that paradigm shift, it’s really going to change the game as far as the consumer experience of owning and operating a vehicle and experiencing mobility in itself.”

That will require rethinking how those automakers work with their supply base, with companies needing to become more collaborative and transparent with each other in order to boost the speed of software development, the report said.

Since the development of antilock braking systems in the 1970s, software has typically been developed by suppliers for use in a specific part or system that automakers buy from them. Once that software is implemented into the vehicle, it is typically never touched again, Ahn said.

“Over the years, more components have been driven by these small actuator triggers and you get this code spaghetti,” he said. “You have 300 different suppliers giving you 300 different types of code on 300 different standards on 300 different electronic control units, and it makes it difficult for the OEM to control the experience of a certain feature or function.”

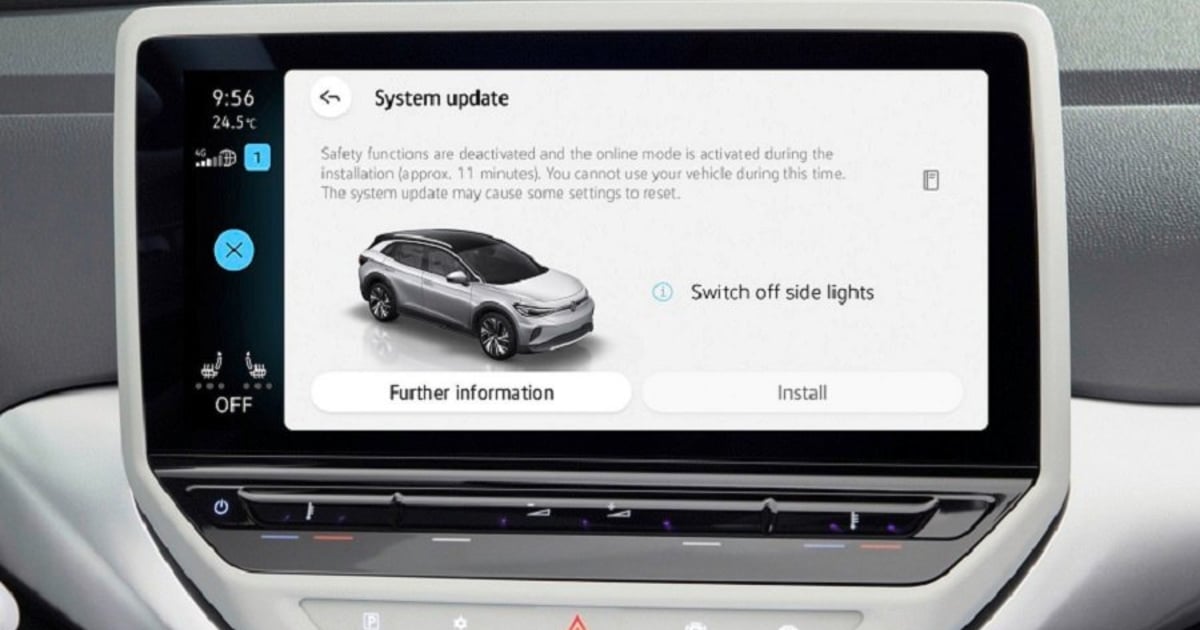

That’s not good enough for today’s consumers, who increasingly expect a vehicle’s software to function much like that of their smartphones and often expect continuous software updates in their vehicles, Ahn said. Nor will it help traditional automakers unlock value by offering more over-the-air software updates, he said.

That means automakers either need to bring much more of the vehicle’s software development in house — a potentially expensive proposition that requires competing with other industries for in-demand talent — or developing “tight collaborations” with suppliers and tech companies, Ahn said.

“That can get really complicated because you’re talking about the entire relationship of how you buy from your supplier and engineer with them fundamentally changing,” he said. “You can partner with your supplier or collaborate together, but what does that mean for the supplier? Do they need to sell different versions of the same component because they’re selling it to different OEMs?”

A “disconnected approach” on software is no longer possible, the Deloitte study says, especially as automakers look to develop new revenue streams from over-the-air software updates.

Over time, a company’s software capabilities and over-the-air functions are likely to become crucial to developing brand loyalty as customers pay to upgrade their vehicle’s performance or personalize their vehicle as much as possible, Ahn said.

“It creates this new feature experience powered by software that changes how you experience or even buy your vehicle,” he said. “Without having a centralized software operating system and the hardware components that integrate with it, that experience isn’t possible.”