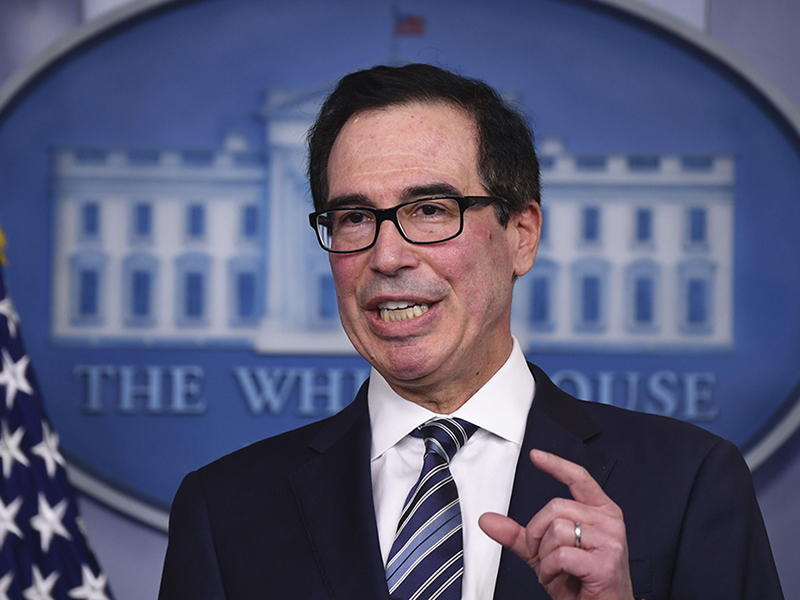

Companies seeking relief funding through the Small Business Administration’s new loan program will receive their loans within the next week or so, Treasury Secretary Steven Mnuchin said Wednesday.

Lenders began processing loan applications for the Paycheck Protection Program on Friday, April 3. The $349 billion program within the $2.2 trillion stimulus package provides forgivable loans to small businesses that keep their workers on payroll. The forgivable loans are a top priority for dealers trying to keep their businesses afloat as showrooms are ordered to close throughout the United States because of the coronavirus pandemic.

More than 17,500 loans valued at $5.4 billion were approved on the first day, according to Jovita Carranza, administrator for the small-business agency.

President Donald Trump said the Small Business Administration has processed more than $70 billion in guaranteed loans as of Tuesday, April 7. The White House has asked Congress to pass legislation to fund an additional $250 billion for the program.

“We have 3,500 lenders up on the system, with many more getting signed up every day,” Mnuchin told CNBC during an interview Wednesday.

“I want to assure all small businesses out there: We will not run out of money. The president has asked us to go back to Congress. We hope they pass this tomorrow and Friday,” he said. “And we want to assure everybody if you don’t get a loan this week, you’ll get a loan next week or the following week. The money will be there.”

National Automobile Dealers Association spokesman Jared Allen said, “The Paycheck Protection Program is a vital tool for helping dealerships keep their employees on the payroll during this unprecedented economic downturn.”

“We are encouraged that the administration and congressional leaders continue to demonstrate their commitment to keeping this program funded and operational so that the auto retail industry can retain as many of its employees as possible,” he added in an emailed statement to Automotive News.

For many dealerships, the Paycheck Protection Program is crucial for maintaining their businesses, the American International Automobile Dealers Association said.

“The government needs to do everything in its power to ensure the program doesn’t run out of money before it fulfills its purpose,” the group said in a statement.

AIADA Chairman Jason Courter said he believes the program is “not developed to have a loser.”

“This has hit employees so hard — so quickly, so rapidly — that this program is really good for any small business to be able to, even for a small period of time, pay the employees what they’re used to,” Courter, who owns Honda Auto Center of Bellevue and Honda of Kirkland in Washington state, told Automotive News.

Both dealerships have applied for loans through the Paycheck Protection Program, Courter said, but as of Wednesday he has not received any confirmation or loan documents from the banks.

“But I have faith that it’s there,” he said. “I have faith that we’ve done everything that the banks have requested us to do. And I believe that it will be there because I just think [with] our country that’s the intention and that’s what I’m going to believe in.”