The northeastern Chinese city of Shenyang is considering buying a stake in Hong Kong-listed Brilliance China Automotive Holdings, giving it exposure to a local joint venture with BMW Group, according to people familiar with the situation.

The municipal government is discussing a potential acquisition of a 30 percent stake in Brilliance China held by state-backed Brilliance Automotive Group Holdings Co., which is in a court-led restructuring process, the people said, asking not to be identified as the information is confidential.

A 30 percent stake in Brilliance China is worth about $588 million based on the company’s current market value of around HK$15.4 billion ($2 billion). Shares of Brilliance China closed 2.7 percent higher after climbing as much as 5.1 percent following the Bloomberg News report.

Shenyang is considering eventually acquiring control of all of Brilliance China, the people said. Buying a stake of 30 percent or more in a Hong Kong-listed company would trigger a mandatory unconditional offer to purchase the remaining shares, though the buyer could seek a waiver from the market regulator.

The city’s potential move to become an investor in a local automaker with a lucrative joint venture comes as China’s vehicle industry matures into a fierce competitor on the global stage. The country is poised to become the world’s No. 2 exporter of passenger vehicles, even as a price war has broken out among the country’s fast-growing electric vehicle makers, pressuring margins.

Deliberations are ongoing and may not eventually lead to any transaction, the people said. Representatives for BMW, Brilliance China, Brilliance Auto Group and the Shenyang government didn’t immediately respond to requests for comment.

A deal could provide funds for Brilliance Auto Group, also sometimes referred to as Huachen Automotive Group Holdings Co., to repay creditors. The company is looking to exit the restructuring process that began in 2020 after it defaulted on debt.

The administrator overseeing the restructuring has solicited strategic investors that may bid for all or part of Brilliance Auto Group’s assets, including the Brilliance China stake. They are set to sign agreements on divesting the assets as soon as the end of May, the people said. Shenyang’s government has set up a new entity called Shenyang Automobile Co. for the proposed acquisition, the people said.

Any deal would be included in the bankruptcy settlement, which is subject to final creditor approval, one of the people said. Creditors rejected the company’s first proposal in July.

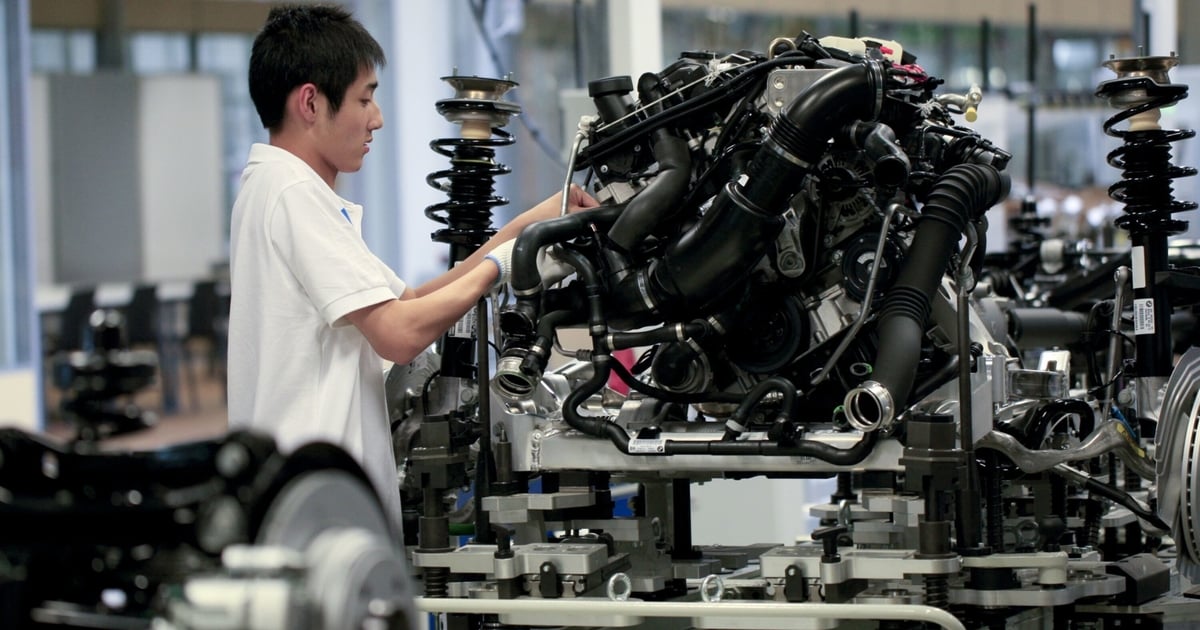

Brilliance China holds a 25 percent stake in BMW Brilliance Automotive, its joint venture with BMW, after the German automaker boosted its stake to 75 percent from 50 percet late last year for about €3.6 billion ($3.9 billion). The deal saw BMW record in 2022 a one-time gain of €7.7 billion from the re-measurement of its equity interest in the venture.

Buying Brilliance Auto Group’s entire 30 percent stake would make the local government the biggest shareholder in Brilliance China, giving it effective control over the company’s stake in the BMW joint venture.

BMW’s China venture posted strong results despite a challenging operating environment due to COVID-19 last year. It launched two new models in 2022 and saw EV sales in China grow by more than 80 percent to over 39,000 cars, according to Brilliance China’s annual report.

Brilliance China reported net income of 2.4 billion yuan ($348 million) from the JV in 2022, compared to 14.5 billion yuan a year earlier, attributing the decline to the sale of the 25% stake to BMW, the report shows. As a result of the disposal, the company now has cash and equivalents amounting to 28.5 billion yuan.