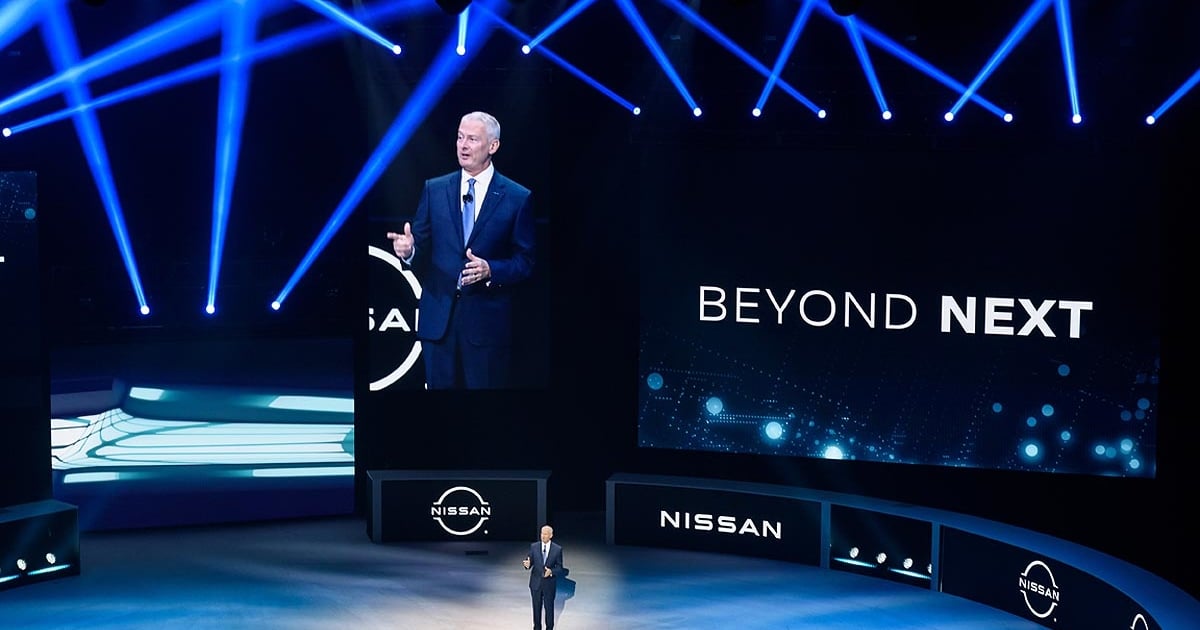

Nissan Motor Co. gave dealers a peek at its future product lineup — both electric and internal combustion — and laid out an ambitious data-driven retail model that calls for greater customer information sharing between dealerships and the factory to boost the customer experience.

The new retail model is intended to “create an ecosystem where customers love Nissan and buy Nissan for the [brand’s] value and not for the most recent rebate out there,” the automaker’s North America sales and marketing boss Michael Colleran told Automotive News ahead of a Las Vegas meeting on Wednesday with some 3,000 dealership executives and managers from across the Americas region.

Top Nissan executives in attendance previewed what will be a rapidly electrifying product portfolio of about a dozen new and updated vehicles.

Nissan CEO Makoto Uchida committed to a diversified powertrain strategy in which the company invests in both internal combustion vehicles and electric vehicles. He emphasized a greater focus on delivering products to market faster — addressing a long-standing dealer gripe.

The automaker will kick-start its EV offensive beginning around 2025, and will bring a promising series-hybrid technology to the U.S. about a decade after launching it in Japan, officials said. Dealers were told the company plans to launch 27 electrified vehicles globally by 2030, including 19 battery-electric models.

Nissan previewed three new battery-powered models expected in the second half of the decade — a crossover coupe-styled replacement for the Leaf hatchback, a performance sedan that could replace the Maxima and a crossover based on the CMF-EV platform underpinning the compact Ariya electric utility vehicle.

The replacement for the Leaf offers 25 percent more range than the hatchback, dealers were told. A dealer who asked not to be identified described the new model’s look as “a mini-Ariya.”

On the combustion engine side of the house, Nissan showed off its next-generation Kicks and Murano crossovers and the flagship Armada SUV.

Described by the dealer as “Range Rover-like,” the redesigned Armada debuts a 424-hp twin-turbocharged V6 engine with a nine-speed transmission. It is bigger and more rugged-looking, with redesigned headlights and taillights. An all-new interior includes upgraded finishes, large screens and the latest driver-assist and convenience technology.

Nissan said it will bring its e-Power series-hybrid technology to the U.S. in the redesigned Rogue scheduled for the second half of 2026. The technology introduced in Japan in 2016 uses a battery-powered electric motor to drive a vehicle’s wheels and a gasoline engine to charge the battery.

Until now, Nissan has been on the fence as to whether e-Power is right for the U.S. At one time, the automaker suggested that if the technology did enter the market, it would be limited to an Infiniti application.

Executives also revealed details about the advanced solid-state batteries Nissan is developing, saying they are thinner and smaller than current battery technology and capable of a fast charge to 100 miles in 15 minutes. One dealer said the new batteries have twice the range and power potential of a lithium ion battery.

Nissan plans to begin pilot production of the advanced batteries at its Yokohama plant next year.

As factory production and supply chains normalize, Nissan expects U.S. sales to continue rebounding from pandemic-era lows.

U.S. sales boss Judy Wheeler predicted a 30 percent sales hike in fiscal 2023, which ends March 31, 2024. That momentum should lift Nissan’s market share to 6 percent.

Top brass assured retailers in attendance that Nissan will not adopt a factory-direct sales model, despite the success of Tesla and otherEV startups in that area and some legacy automakers seeking to work around the franchise dealer model.

“We are in it with our dealers,” Colleran said. “We like the attachment and the connections to the local communities … and the service [dealers can] provide.”

But Nissan and its retailers must rethink some of their old business ways, Colleran said.

“Change is upon us. Those that can’t change, they’re going to find it difficult,” he said. “But those that find that secret sauce to change, they’re going to flourish.”

Nissan will use software and technology to drive “brand ecosystem stickiness,” as consumers are getting more deeply embedded into brands, Colleran explained.

“Technology enables that,” he said.

Nissan executives also called for more data sharing between the manufacturer and retailers to drive customer satisfaction. “We believe that the biggest change will be the battle for the customer,” Colleran said.

The automaker is planning to take an “integrated approach” to customer relationship management to create a richer profile of the shopping preferences, purchases and service history of its customers. Data sharing would allow Nissan to tailor marketing campaigns and help its dealers identify prospects, craft customized offers and provide service more efficiently.

“It’s about sharing a little bit more information for the [customer’s benefit],” Colleran said of the project, internally referred to as One CRM. “There’ll be some dealers that might be wary of that at the start.”

Nissan National Dealer Advisory Board Chairman Tyler Slade sees the value in more data sharing with the factory if it improves customer satisfaction.

“What is good for the customer is good for the dealer,” said Slade, operating partner for Tim Dahle Nissan Southtowne in suburban Salt Lake City. “We certainly don’t want to push back so hard that we become bad partners, and it makes legacy OEMs want to go to direct sales.”