CANTON, Miss. — Nissan’s plan to manufacture two new electric vehicles in the U.S. starting mid-decade could jolt the automaker’s prospects in an emerging market.

It also promises to transform the company’s production footprint in the country, starting with its underutilized 4.7 million-square-foot factory in Canton, Miss., where the Japanese automaker this week announced it would begin production of the sedan-style EVs in 2025.

The truck and sedan factory, which brought automotive production to the state when it opened nearly two decades ago, will be reincarnated as a “center for EV manufacturing and technology” as Nissan pivots toward a zero- emission future, the company said.

The planning for the $500 million project began in 2020, Nissan Motor Co. COO Ashwani Gupta told Automotive News on the sidelines of an event here.

“To prepare a plant, it takes time,” Gupta said. “On one side, you’re running the production, running the business, and on the other side, you are transforming.”

Nissan produces the electric Leaf at its older plant in Smyrna, Tenn., where it also has a dedicated EV battery plant. The decision to produce the new EVs in Canton came down to the factory’s competitiveness in quality and cost, Gupta said.

But it was also opportunistic.

The Canton factory has annual production capacity of 410,000 vehicles but operated at less than half of that last year, according to AutoForecast Solutions data.

Nissan builds the Altima midsize sedan and the Frontier midsize and Titan full-size pickups across two assembly lines.

A third line, which assembled Nissan’s NV cargo and passenger vans, was shuttered last year after the automaker exited the North American commercial van business to focus on its core sedans, crossovers and pickups.

Nissan will repurpose some of that freed-up space to build battery packs for the electric sedans. The EVs will be built on their own line at the plant.

“We have to capitalize the existing assets — including the work force,” Gupta said.

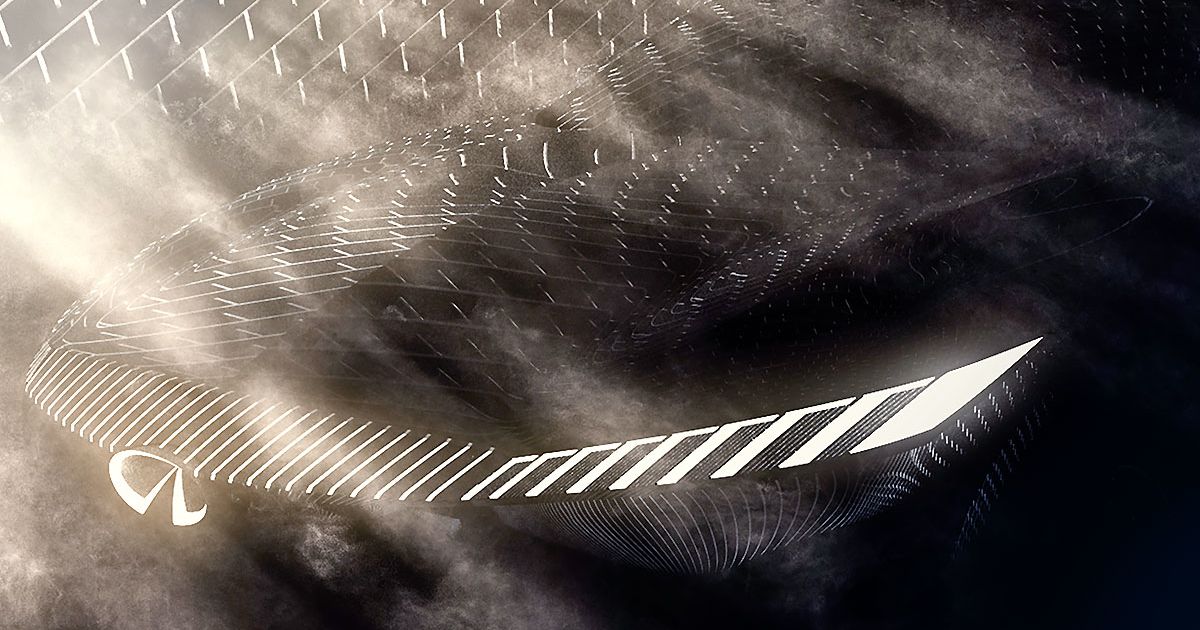

The new EVs — one a Nissan nameplate and the other an Infiniti — arriving in 2025 feature a sedanlike profile, with a sloping roofline, and new headlight and taillight designs. Product details were not revealed, but Gupta said the vehicles will share a platform.

But for some retailers, Nissan’s plan to bring electric sedans to the U.S. is a head-scratcher.

“I’ll be honest, I’m shocked,” said a Nissan dealer who requested that he not be identified. “Why in the world would Nissan be spending their limited R&D dollars developing sedans when their most important market is craving SUVs?”

Gupta said EVs will “redefine” traditional vehicle segments.

He cited Nissan’s Rogue-sized Ariya electric crossover, which will arrive in U.S. showrooms this fall.

“Should we call it C-segment or D-segment?” Gupta asked. “When you look at the space, it’s more than D. When you look at the price, it could be a C.”

The Canton project is the first of several Nissan investments in EV and battery production in the U.S. over the next five years, the company said.

It is making an $18 billion bet on electrification in that same time frame that includes delivering 15 battery-electric models globally by 2030.

Consumers in Nissan’s key markets are beginning to embrace electrification, Gupta said.

“Nissan is prepared to capitalize on this interest,” Gupta said. “We will leverage our strong DNA and decades of real-world EV experience.”

In its critical U.S. market, where EVs are viewed with greater skepticism, Nissan expects battery-only vehicles to account for 40 percent of sales by 2030. That’s ambitious, considering that the automaker’s sole electric product — the Leaf — accounted for a mere 1.5 percent of Nissan Group’s U.S. sales last year.

But Nissan will be flexible with its U.S. EV sales goals. Gupta said the 40 percent target is “just a hypothesis.”

“Our job is to prepare the business. The customer will decide how much is the percentage.”

Dialing up EV sales could mean expanding Nissan’s U.S. industrial footprint. The automaker operates two Southeast assembly plants and an engine factory. But Gupta did not reveal future manufacturing expansion plans this week.

“As of today, we have enough production capacity in Smyrna and Canton,” he said. “But in the future, you never know. If the demand increases and the customer is asking for more, then we are ready to do more.”

However, as Nissan builds more EVs, it will require more investment in battery production capacity.

Nissan sources batteries for the U.S.-made Leaf hatchback from the Smyrna battery plant, majority-owned by Chinese energy company Envision Group. That battery factory was originally built and owned by Nissan at the outset of the EV era, with plans to supply as many as 150,000 vehicles a year.

But Nissan’s early plans for EV adoption did not materialize. AutoForecast estimates that the Smyrna battery plant can supply 30,000 to 50,000 vehicles with battery packs.

Gupta indicated that Nissan is considering other sources.

“We will localize battery [production] in the U.S.,” Gupta said, declining to elaborate on the location or timing of new factories.

Meanwhile, Nissan is working to develop all-solid-state battery technology, which promises to lower the cost and weight of battery packs.

Asked whether Nissan would team up with Envision to build those new batteries, Gupta demurred.

“It’s too early to say,” he said. “First, let’s develop it by 2024. When we commercialize it, we will see our localization strategy in different markets.”