<!–*/ */ /*–>*/

Automotive News is trying something new with our subscribers in mind. We’d like to know what’s on your mind. Please email us with your feedback on The Intersection. What would you like to see, or see improved? We can only get better with your help.

| New jobs, new chances to make a mark |

In 2007, on his first day at Hyundai, marketing boss Joel Ewanick fired the ad agency that had previously employed him.

Last year, on his first day as Daimler CEO, Ola Källenius laid out a 20-year vision for building a carbon-free — and profitable — business.

This first week of September will mark a number of chances for executives to make strong opening moves in new positions. Among them:

The ever-optimistic Jack Hollis takes over as Toyota’s senior vice president of automotive operations on Tuesday. He succeeds Bill Fay, who is retiring after 38 years at the automaker.

In Monday’s issue of Automotive News, Fay reflects on the “totally different world” that he started in — one without cellphones, the Internet, social media or any Toyota vehicles built in North America.

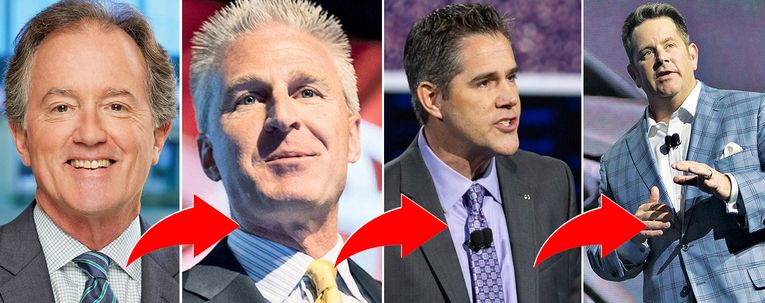

In typical Toyota fashion, the retirement of one high-ranking executive spells opportunity for loyal lieutenants. Lexus boss David Christ (26 years at the automaker), will succeed Hollis (28 years) at the Toyota Division. And Andrew Gilleland (27 years) takes over for Christ at Lexus.

If past patterns are any sign, you’d be safe in considering that a short list of candidates who will be leading the company someday.

Kimberly Rodriguez, meanwhile, will step into a CEO role for the second time this year. The former chief executive of Rush Trucking Corp. takes the helm at parts supplier Dura Automotive Systems.

Incoming leaders often wait months before sharing their plans publicly. Not Rodriguez. She’s already spelled out her vision with our sibling publication Crain’s Detroit Business.

And John Roth, a 31-year veteran of General Motors, takes over on Tuesday as head of customer care and aftersales. He most recently had been president of Africa and Middle East operations. He succeeds the retiring Tim Turvey.

They and others in the industry no doubt will be watching to see how U.S. sales fared in August. It’s tough gauging things now that most automakers have abandoned monthly sales reporting.

August’s performance may be harder to figure because of some sizable asterisks. There were two fewer selling days this month than in August 2019. And last year, many of the sales that occurred during the robust Labor Day weekend were chalked up as August deliveries. This year, with the holiday falling on Sept. 7, they’ll all go into the September bucket.

The upshot: In straight percentage terms, forecasters at Cox Automotive and J.D. Power/LMC Automotive are looking at a 20 percent decline.

A better gauge may be the seasonally adjusted annual sales rate. Cox pegs it at 14.9 million; J.D. Power/LMC put it at 15.1 million. Either way, that would mark the fourth straight month of recovery following April’s pandemic-clobbered 8.6 million.

|

“We know that we are sort of at the crossroads of this new retail model, and certainly the impacts of COVID-19 have highlighted that even more. We have some customers, obviously, who still prefer the more traditional [dealership] experience, but we also see a fast-growing population of customers who want to go online, find their color and purchase it with very little intervention.” |

– DUSTIN KRAUSE, DIRECTOR OF E-MOBILITY, VOLKSWAGEN OF AMERICA |

|

From “VW will take $100 reservations in U.S. when ID4 is revealed in September” |

|

Coming Monday in Automotive News:

Ongoing Hurricane Laura coverage: As the storm continues its northerly path, Automotive News will check in with dealers in the line of fire for the latest on damage and the impact on auto sales.

Toyota’s latest high-tech concept vehicle is, literally, a real moonshot: Japan’s biggest automaker is building a hydrogen-powered moon rover it hopes will be traversing the rocky lunar surface in a decade. Automotive News will take a look at the team leading this gambit and the reason for the pursuit. It is the ultimate test of Toyota’s talent in making durable, cost-effective vehicles.

Don’t expect Ford to make its own electric-vehicle batteries. The automaker plans to source batteries for upcoming EVs such as the Mustang Mach-E and F-150 EV from suppliers. Outgoing CEO Jim Hackett says there’s “no advantage” for Ford in developing and manufacturing its own EV batteries. It’s a departure from the strategies of Tesla and GM, but is it the right path? Automotive News examines the pros and cons of each strategy.

Weekend news:

Calif. approves utility program to expand EV charging: The $437 million effort will fund the installation of nearly 40,000 chargers, the California Public Utilities Commission said in a statement.

|

|

|---|

|

Automakers have had mixed success with vehicle subscriptions, so Porsche is tweaking things a bit. The automaker is making its subscription program more accessible with a new entry-level tier that drops the monthly starting price to $1,500 and is limited to a single vehicle for either one or three months. The automaker also is expanding the service to Los Angeles — the epicenter of luxury car sales.

After a historic deal, Park Place Dealerships is now Avondale Group. Asbury Automotive Group finalized the purchase of Park Place, which will add an expected $1.7 billion in annual revenue for the public company. Park Place founder Ken Schnitzer chose the name Avondale, comprised of the dealerships not part of the Asbury deal, from the cross street at Oak Lawn Avenue in Dallas where he founded the company in 1987.

|

|

A selection from Shift and Daily Drive:

|

Sept. 3, 2015: After evading scrutiny from regulators for years, Volkswagen admits privately to U.S. regulators that it installed illegal defeat devices in nearly 500,000 2.0-liter diesel engines to fool U.S. emissions tests.

Fifteen days later, the EPA would make its investigation public. The events set off a global crisis for the German automaker and much of the European auto industry. It ultimately saw VW plead guilty to felonies in the U.S. and high-level executives incarcerated on two continents, costing the company more than $30 billion in penalties and restitution.