TOKYO – Honda Motor Co., in the midst of a radical corporate makeover, said it will invest 5 trillion yen ($39.91 billion) over the next 10 years in electrification as it rolls out 30 full electric vehicles globally and builds production capacity for 2 million EVs annually by 2030.

In announcing the new push on Tuesday in Japan, Honda said it will also shift its business away from non-recurring hardware sales toward recurring sales of services that combine hardware and software.

It is part of new software-defined EV platform, dubbed e:Architecture, that the company will launch in 2026 to underpin the next generation of large-sized battery electric cars from Honda.

Honda said the 5 trillion yen dedicated to electrification and software constitutes the lion’s share of the total r&d budget of 8 trillion yen ($63.86 billion) allotted over the same period.

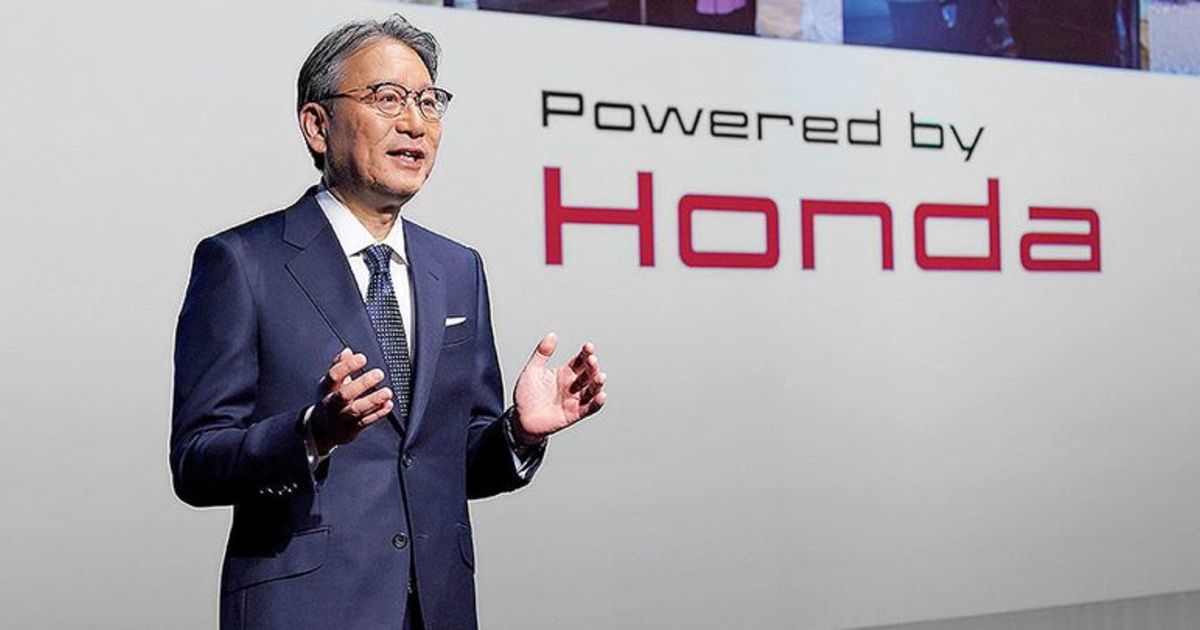

CEO Toshihiro Mibe detailed the plans at Honda’s global headquarters, saying Japan’s No. 2 automaker would pursue a multi-pronged approach toward its goal of having a gasoline-free lineup by 2040. On one hand, it will work with partners in the near term to achieve scale and cut cost. On the other, it will develop its own in-house technologies to sustain it in the long run.

Among other elements announced April 12, Honda will spend 43 billion yen ($343.2 million) to open a demonstration line for producing next-generation solid-state batteries in the spring of 2024. It wants to bring the lighter, energy-dense batteries to market in the late 2020s.

In the meantime, Honda will keep sourcing Ultium lithium ion batteries from General Motors and also explore other joint ventures for battery production locally in North America. In China, it will partner with CATL, and in the home market of Japan, it will get batteries for a new series of mini-EVs from Envision AESC, the battery maker that also supplies rival Nissan Motor Co.

Honda will also leverage swappable batteries as part of its future power pack strategy.

Mibe said that Honda also wants to launch two all-electric sports cars in the mid-2020s. One will be a “specialty” vehicle, the other will be a “flagship model.” Teaser shots of cars under wraps depicted low-slung silhouettes reminiscent of the NSX that will be discontinued this year.

“From 2030 and beyond, we believe that we will be entering into the full popularization period, and battery EVs will be commonplace,” Mibe said. “We will have small, medium and large-sized platforms in place and cover all the segments with these three platforms.”

The announcement builds on a string of initiatives Mibe is taking to transform the automaker.

Earlier this month, Honda announced it would team up with General Motors to to sell millions of co-developed “affordable” EVs starting in 2027. And last month, Honda said it would partner with Japanese electronics giant Sony Corp. to market co-developed EVs from 2025.

EV ambitions

Honda Executive Vice President Kohei Tekeuchi said the 2 million EVs Honda will be prepared to produce in 2030 represent about 40 percent of its 5 million global output plan that year.

With global volume around 5 million vehicles, Honda hopes to achieve a 7 percent operating profit margin, up from the 5.5 percent expected in the fiscal year just ended March 31.

Honda, which sells about 4.5 million vehicles a year worldwide, has a long way to go before going pure BEV. To date, it has sold only 32,649 battery-electrics, cumulatively, since marketing its first, the Honda EV Plus, in 1997. Honda sold almost half those EVs, 14,324 units, in 2021 alone.

Honda has made a much bigger dent with hybrids, a segment it helped pioneer with the Insight. It has sold 3.91 million cumulatively over the years, including 561,165 gasoline-electrics in 2021.

The limited-run EV Plus, a squat three-door micro car, was Honda’s first EV, but the battery-powered version of the low-selling Clarity sedan was the first to be marketed in the U.S.

Today, its only global all-electric offering is the Honda e urban runabout. Honda has sold 9,226 of the subcompact hatchbacks in Europe and Japan through the end of 2021, including 4,171 units last year. Honda also sells three locally-focused EV models in the China market.

Tailored and global

As a mid-sized player on the global stage, Honda needs the help of friends. For a long time, it has circled wagons with General Motors on a range of projects, from hydrogen fuel cell technology to electric vehicles. But Mibe has been actively courting new partners.

Mibe stressed that gasoline-electric hybrids would remain a key element of Honda’s lineup well into the 2030s and that he expects demand for them to increase in places such as middle America.

“We will continue to rely on hybrids as one of our powerful weapons,” he said.

In terms of EV offerings, Honda sees three platforms ahead in the near term.

One platform will be a mini and subcompact EV platform developed for Japan and Asia. In Honda’s home market, it will debut as a commercial mini vehicles. The other is a midsize EV platform being jointly developed with GM. The third is the in-house e:Architecture framework, which will underpin larger vehicles, especially those for North America and China, Mibe said.

Of the 30 EVs Honda plans to launch by 2030, 10 will debut in China through 2027.

“Through the second half of the 2020s, which will be the dawn of the popularization of EVs, we will introduce products tailored to the characteristics of each region, such as our key EV markets of North America, China and Japan,” said Shinji Aoyama, the senior managing executive officer in charge of Honda’s electrification strategy.

“After the second half of the 2020s, we assume it will be the period of EV popularity. At this stage, we will begin introducing the best EVs from a global perspective.”

Partnership bridges

Partnerships with GM and Sony can been seen as a bridge to the time when Honda develops its own next-generation EV platforms and advanced solid-state battery systems. Cooperating buys time for Honda by giving it quicker access to product for sale and help on technology.

Mibe said the new venture with Sony will be separate from the Honda brand and its existing electric vehicle strategy. The plan to share an EV platform with GM for the North American market, for instance, will stay on track and is important as a mass market play, he said.

The vehicles developed by Honda and GM, mostly compact crossovers, will be based on a new global electric architecture powered by GM’s Ultium battery technology and use jointly created advanced battery technology. Plans to sell millions could make the pair global EV leaders.

The companies have a North American alliance dating to 2020, in which GM agreed to help Honda build EVs on its existing Ultium battery platform. That collaboration is already on track to deliver two crossovers in 2024, the Honda Prologue and a counterpart EV from Acura.

Phasing out ICE

Mibe plans to phase out the company’s famed internal combustion engines by 2040 on the road to transforming Honda into a carbon-neutral power and mobility provider.

Its upcoming e:Architecture and solid-state batteries will play a key role.

Mibe calls solid-state batteries a “game-changer.”

Development is already underway as Honda is redeploying engineers from the company’s internal combustion engine business to battery development.

Outside of electrification of its automobile lineup, Honda is embarking on a wider makeover.

It is developing autonomous vehicles, in part with GM’s Cruise, under a mobility-as-a-service enterprise.

Last September, Honda said it will branch into electric vertical take-off and landing, or eVTOL, aircraft with the aim to commercialize the craft by 2030, and then break the bonds of earth all together by developing small, reusable rockets that can put satellites into low-earth orbit. Honda also confirmed last autumn it had already conducted combustion tests of its prototype rocket.

Another new focus area will be avatar robots — machines with arms, hands and fingers that motion-capture real human movement to “make virtual mobility possible.”

“Preparing for new growth” is the other direction Honda has been pursuing,” Mibe said in Tokyo. “We will create more free time for people and expand time and space where people take active roles, to remove any constraints on people’s freedom of mobility. By realizing such value, we will strive to expand the range of human living and activities, and become a driving force to help change our society.”