A startup seeking to nurture credit has partnered with an auto dealership on an initiative that could provide both parties with leads and get more car deals funded.

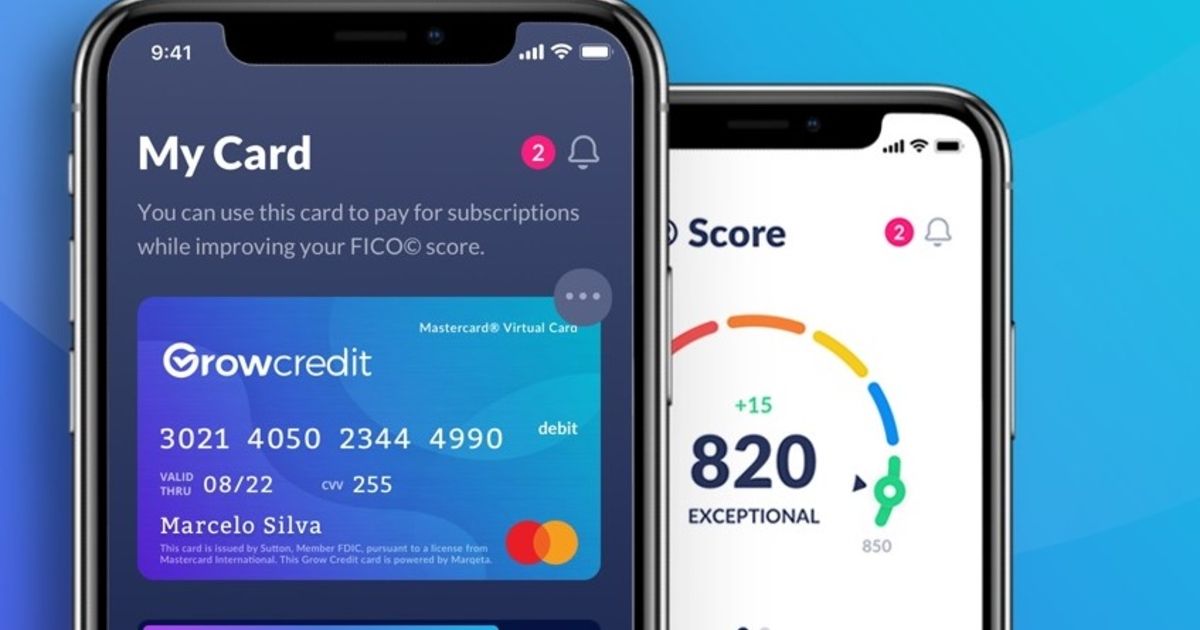

Grow Credit issues free, low-limit Mastercards to people lacking a credit history or with a poor FICO score.

These cards can only be used to pay for subscription services, such as Netflix, though it’s possible to get a version that also allows phone bill payments. Because the user is taking on and repaying debt, the activity improves their FICO score.

“It’s a loan that matters,” said Grow Credit CEO Joe Bayen.

The company reports the results to the three main credit bureaus. On average, a year with the service bumps up scores by 51 points, according to Grow Credit. Bayen said some users even obtain a 100-point increase in their first three months.

Since the platform is available for free, Grow Credit is a tool a dealer might have suggested to denied borrowers as a matter of course. But the arrangement Grow Credit announced last month with Murphy Auto Group, a five-location dealership group in the Southeast, rewards such recommendations by promoting the dealership back to the customer.

According to Bayen, under the Grow & Drive initiative, Murphy Auto Group would encourage rejected borrowers to sign up for Grow Credit. Once the buyer’s credit improved to the FICO score Murphy Auto Group needs to arrange a loan, the consumer would receive a notification and up to $200 in financing credit, Bayen said.

“Every single dealership has a vested interest in working with us,” Bayen said.

According to Bankrate, 21 percent of consumers polled in October 2020 had been denied some type of loan that year. Experian has estimated 28 million people have no credit history, and 21 million more have too little history for a score.

“With car financing APRs approaching pre-2018 levels, car ownership is more attainable than ever,” Murphy Auto Group Owner Michael Dennis Murphy said in a statement. “But having to turn away a consumer because of a low credit score is something we never want to do. With Grow Credit’s ‘Grow & Drive’ initiative, we’re able to provide a viable path to car financing that sustainably builds a customer’s credit.”

The free version of Grow Credit is available to those making at least $1,200 a month, though Bayen said the company planned to lower that to $800. It offers a $204 line of credit for use on subscriptions, but the money can only be spent in increments of $17 per month and must be repaid in full at the end of each month. Grow Credit makes its money here through interchange fees.

Another version is available for students who can’t meet the income threshold. It levies a $1 monthly fee and requires a $17 security deposit refundable after a year, Bayen said. Other paid versions increase the monthly and annual credit limits, including one plan that allows up to $150 per month in spending and can be used on phone bills, too.

“The innovation is the restriction,” Bayen said.