Nikola Corp.’s chaos isn’t necessarily General Motors’ disaster.

The partnership between GM and the electric truckmaker is slated to close by Wednesday, Sept. 30, and despite accusations of fraud against Nikola and founder Trevor Milton that led to Milton’s resignation as executive chairman, GM likely will move forward with the partnership relatively unscathed, analysts say.

Because GM hasn’t committed capital as part of its agreement to engineer and build Nikola’s pickups — in exchange for an 11 percent stake, a $700 million payment and valuable electric vehicle credits — the deal is still low-risk financially for GM and has the potential to be high-reward, analysts say.

“Even if Nikola completely imploded and went out of business tomorrow, GM financially would not be hurt by that,” said David Whiston, senior equity analyst for Morningstar. “If Nikola is not a fraud, the long-term upside option value of the deal is still there for GM.”

A report this month from short seller Hindenburg Research accused Milton of various instances of fraudulent behavior, such as misleading investors about Nikola’s capabilities and products and by making vehicles appear fully functional. The U.S. Securities and Exchange Commission and the Department of Justice are investigating the claims, according to various reports.

Milton, who frequently promoted Nikola on Twitter and sparred with critics — at one point declaring that only a “coward” would run from such adversity — abruptly deleted his “@nikolatrevor” Twitter account last week after stepping aside.

Nikola CFO Kim Brady said at an Evercore investor conference last week that Milton was passionate about Nikola, but “it became increasingly clear that the attention was being focused on Trevor rather than on the company as well as the company’s mission.”

Many of the allegations predated June, when Nikola went public with funding from a company run by former GM Vice Chairman Steve Girsky. He has taken Milton’s place as Nikola’s chairman.

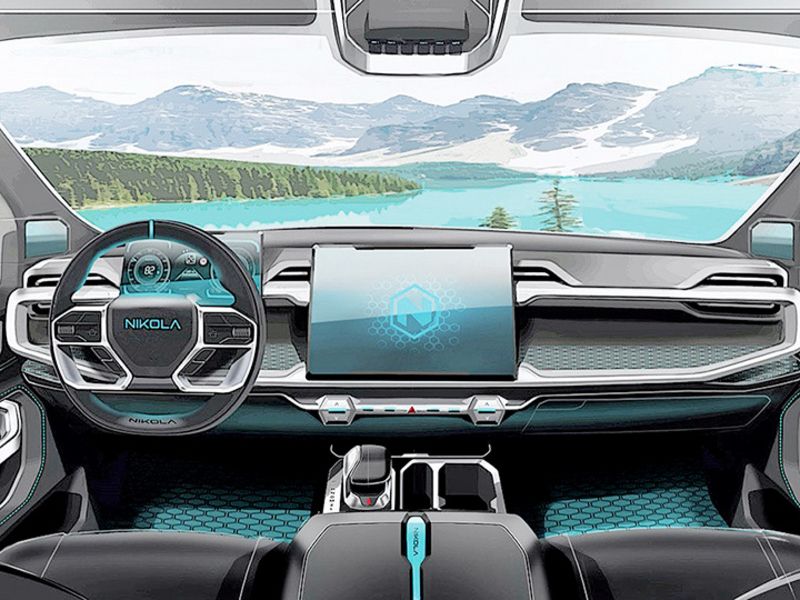

“Nikola moved quickly to change its management and bring in a stabilizing force,” said Stephanie Brinley, principal auto analyst at IHS Markit. “How much impact that has and what impact it has over Nikola’s performance over time, we’ll see. But certainly the management moves were meant to stabilize the company and try to insulate it.”Asked whether GM might try to renegotiate the deal after the allegations and wild swings in Nikola’s stock price, a GM spokesman last week said the automaker remained committed to the agreement as outlined Sept. 8. The deal calls for GM to build the Nikola Badger electric pickup with its proprietary Ultium batteries and provide fuel cells for the Badger and Nikola’s semitrucks.

“We will work with Nikola to close the transaction we announced … to seize the growth opportunities in broader markets with our Hydrotec fuel cell and Ultium battery systems, and to engineer and build the Nikola Badger,” GM said in a statement. “Nik-ola, Honda and other companies who are looking to GM’s technology as a platform for their products represent just one part of our overall EV strategy. Our overall goal is to put everyone in an EV and accelerate adoption.”

The allegations against Nikola disrupted talks with other potential partners, including BP, to build hydrogen-refueling stations, according to The Wall Street Journal.

The GM-Nikola agreement doesn’t hinge on Nikola’s technology proving successful, Brinley said. “GM agreed to supply them with batteries or fuel cells, and they agreed to build a truck under contract manufacturing,” she said. “The goal wasn’t to validate what level of technology development Nikola had already done. GM’s deal was about what those trucks might use in the future.”

GM takes on little risk by moving forward with the agreement. GM will own 11 percent of the company and be paid $700 million — the amount of funding Nikola obtained through a June merger with Girsky’s VectoIQ Acquisition Corp. — in capital expenses for manufacturing.

“The risk is that [GM] invests some engineering and resources and time, and maybe something doesn’t end up working out the way they wanted it to,” Brinley said. “On the flip side, it could work just fine. And they’ve got a new customer” for batteries and fuel cells.

GM has said it expects to realize at least $4 billion in benefits from the equity stake, EV credits, contract manufacturing of the Badger and supply contracts for batteries and fuel cells. Most of those benefits likely will remain intact, but Nikola shares were worth about half as much last week as when the agreement was announced. News of the deal sent shares above $50, but they fell below $20 last week.

“If Nikola’s stock never gets back into the $40s or higher than that,” Whiston said, “GM is not going to realize the benefits they announced.”