LOS ANGELES — California’s plan to end sales of gasoline-burning vehicles in 2035 could have a ripple effect nationwide if history is any guide. The Golden State’s unique ability to set its emission standards has been shaping the U.S. auto industry for five decades.

But the initial effects will be felt inside the state, the nation’s biggest auto market, and will start well before its 15-year deadline that all new vehicles be zero-emission.

Tesla is already climbing the sales charts in California, and its electric vehicles are threatening bestsellers such as the Honda Civic and Toyota Camry.

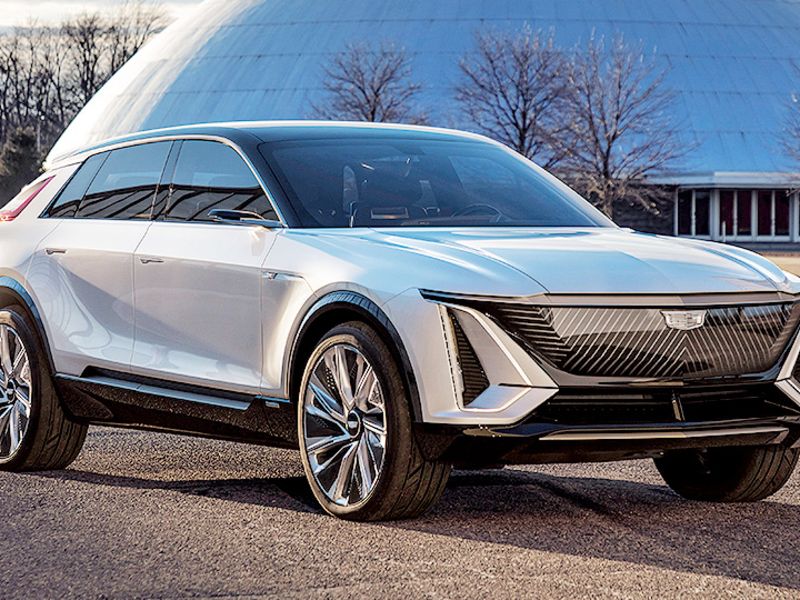

Automakers that have been dragging their feet on battery-electric vehicles, which include state market leaders Toyota and Honda, are likely rethinking their strategies, analysts said. And EV-friendly brands such as Volkswagen, Hyundai, Ford and Cadillac could add share.

A shift toward EVs is already taking place in China and Europe — the executive order last month by Gov. Gavin Newsom now puts California on the same path. Other states that have adopted California emissions rules could follow.

“The decree from Gov. Newsom puts a more definitive timeline on the move to electric vehicles,” said Jessica Caldwell, executive director of insights at Edmunds. “Fifteen years may seem like a long time, but it’s a comparatively short window for automakers, given how far they need to map out their product cycles.”

Market leader Toyota, with a 20 percent California market share last year between its Toyota and Lexus brands, does not sell an EV in the state, although it does sell many popular hybrids. And while Ford, VW, Nissan and others have electric crossovers around the corner, Toyota does not.

“Toyota, which can be credited with the modern green car movement thanks to the Prius, generates a lot of sales with its hybrid technology but will perhaps have to move quicker to full electric than anticipated if the order in California comes to fruition,” Caldwell said.

Although new EV sales were just 5.3 percent of California’s total volume last year, they came despite consumers having few choices — particularly in the popular family-size crossover and compact to midsize sedan segments.

The Tesla Model 3, despite being a “near-luxury” vehicle, had 59,514 sales last year, overtaking the Toyota Corolla, Honda Accord and Toyota RAV4, according to the California New Car Dealers Association. This year, Tesla launched a new electric crossover, the Model Y.

Even the Chevrolet Bolt, which has not been a big hit nationwide, was California’s No. 2 subcompact vehicle, with 8,239 sales last year — just shy of the Kia Soul. Other EVs among the top five in their segments: the Tesla Model S, Tesla Model X and Nissan Leaf.

Karl Brauer, executive analyst at ISeeCars, noted that Newsom’s executive order came on the heels of Tesla’s public Battery Day event, at which CEO Elon Musk promised a $25,000 electric car for the masses, along with cheaper and higher-capacity batteries using more sustainable materials.

“You look at someone like a GM or a Volkswagen that’s got the global reach to be able to rally together a supply chain to produce that volume of batteries over the next 10 to 15 years, it certainly seems doable,” Brauer said of the notion of a mass-market EV. “Smaller automakers, like a Honda, are going to be more challenged.”

Honda is partnering with General Motors to make its first EVs for the U.S., but GM controls most of the technology. Toyota has said it will jump into the EV market when there is greater volume. There still is time to do so, and the California mandate could evolve over time.

“It’s a long way off; so many things can change,” Brauer said of the 2035 deadline. “I still question a lot of things about that mandate, like whether Gavin Newsom even has the power to do that.”

Brauer also noted that outside the Tesla community, there have yet to be any wildly popular EVs, including the Jaguar I-Pace and Audi E-tron, which arrived on the market with a lot of hype.

“When is one going to hit that’s an undeniable success of an electric vehicle, and it’s not a Tesla?” he asked. “I’m still waiting for that vehicle. I haven’t seen it yet.”

Sam Abuelsamid, principal research analyst at Guidehouse Insights, said some obstacles will need to be overcome fairly quickly for the California plan to become a reality. They include resolving global battery production constraints and accelerating vehicle development programs. Some brands are moving forward quickly; others could be left behind.

“It’s going to be tough, and I think we will see a shuffling in the order of who’s on top in California,” Abuelsamid said. “Whether Toyota or Honda can stay in the top two slots unless they add a bunch more EVs in the next few years is going to be interesting to watch.”