Digital retail platforms have mushroomed as car shopping steers online.

But the trend could stall a profit engine for auto dealerships — finance and insurance income.

About 70 percent of in-store car sales at Tim Dahle Nissan Southtowne carry an extended service agreement, said Tyler Slade, operating partner at the suburban Salt Lake City store.

“We’re not even half that on vehicle sales via the [email protected] digital platform,” Slade told Automotive News.

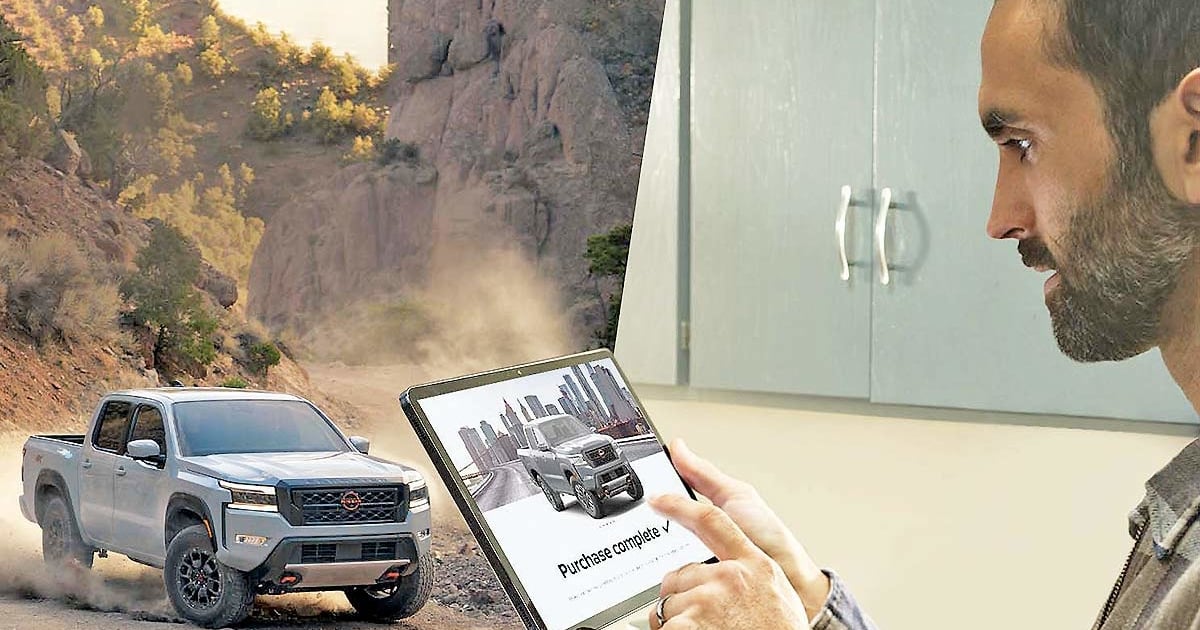

Nissan’s digital tool, launched in 2021, allows customers to shop for vehicles, schedule test drives, complete purchase paperwork and take delivery without stepping inside a brick-and-mortar store.

Slade echoes an industrywide concern that dealerships could leave F&I money on the table without face-to-face discussions with the customer.

It’s easier for customers to click away or decline F&I products online than in the store.

“The customer is not getting a good presentation of extended warranties or GAP insurance or any of the products that we typically sell in person where an F&I manager can help them understand why they need it,” said Slade, who is also Nissan National Dealer Advisory Board chairman. “It’s harder for customers to see value when it’s just on a screen.”

A hit to the F&I business can crush dealership profitability.

“Most dealers in the United States do not make nearly enough money on the front-end sale of a new vehicle to pay the bills,” Slade said. “If we don’t maintain our F&I per-car average, our profitability is done.”

Slade said 75 percent of his store’s vehicle gross profit comes from F&I sales.

“If we don’t figure this out profitably, dealers will not embrace digital retailing,” he said.

Dealer financing income per vehicle can take a hit on digital platforms because buyers can more easily shop interest rates online, said Scott Smith, CEO of Smith Automotive Group, which operates four Nissan stores in metro Atlanta.

Even so, the convenience of digital platforms creates an opportunity for dealerships to sell more service contracts and maintenance packages if they can effectively “convey the value proposition” and product benefits, Smith said.

Nissan is responding to dealer concerns.

[email protected] allows dealers to educate customers via online videos about the F&I products they offer, company spokesman Brian Brockman said.

“Going forward, [we] will enable customers to self-select videos on F&l products that interest them most, allowing our dealers to deliver a well-informed experience,” Brockman said.

Slade said Nissan is working on creating a “robust digital F&I menu” on the site.

Online shoppers “will be walked through a presentation on F&I products to help them better understand the value and potential benefits,” Slade said.