Growing tensions between franchised dealers and legacy automakers over evolving sales models and vehicle service work are emerging as key issues in statehouses across the U.S. this year.

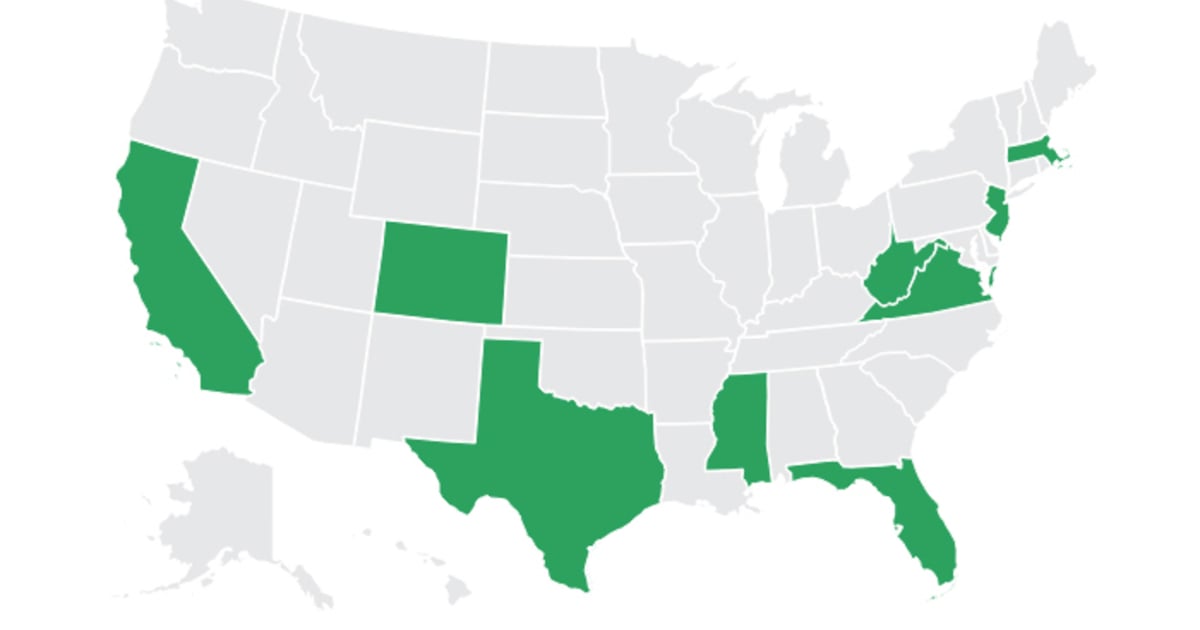

Several state dealer associations are backing legislation to amend franchise laws that govern the relationship between dealerships and the automakers whose brands they sell. The issues run the spectrum.

Some states, such as Virginia, are proposing language that would prevent traditional automakers from negotiating the sale or lease of a new vehicle directly with consumers or declaring dealers to be delivery agents. Other states want to spell out dealers’ role in participating in future subscription revenue that automakers may seek to activate with over-the-air software updates. Proposals to remove automakers’ right of first refusal in buy-sell deals — the ability to assign an alternative buyer — also are on the table.

And the question of how much automakers should compensate dealers for performing warranty repairs — which has been percolating for years and bubbled over in December with a lawsuit Volkswagen brought in Illinois — is surfacing in bills to align reimbursement rates closer to what retail customers pay for service work.

Taken together, “I do think that the biggest focus this year will be on emphasizing the importance of the independence of dealer operations and avoiding unfair competition by an OEM with their franchised dealers,” said Shawn Mercer, a partner with Bass Sox Mercer in Raleigh, N.C., who represents dealers on franchise law issues.

Automakers see it differently.

The Alliance for Automotive Innovation, which represents major automakers and other companies in the U.S. auto industry, said that while the franchise system works well, many of the laws governing it are “outdated, add unnecessary costs and make it harder to adapt to changing market demands and customer expectations.”

The group’s CEO, John Bozzella, said in a statement provided to Automotive News that he’s “never seen this many bad state bills” before. He cited efforts by leaders of state and regional dealer associations to push a flurry of legislation that he claimed would “add a lot of extra costs to the system and, in some cases, ban the innovations that would improve a customer’s buying and ownership experience.”

“That’s not a recipe for a strong franchise system in the long term,” Bozzella said in the statement. “OEMs and dealers rely on one another to deliver and service great cars and trucks across the country. We ought to be in the same boat rowing together to update the system, but that’s evidently not a view shared by all.”

Tensions over the future of the franchise system have been building for years, in part prompted by the rise of Tesla and its direct-to-consumer sales model that has been emulated by other startup electric vehicle manufacturers, such as Rivian.

Dealers’ concerns have been influenced by the pandemic’s acceleration of online sales and the growth in reservations and vehicle orders resulting from a shortage of semiconductors that curtailed new-vehicle production. At the same time, traditional automakers have rolled out more EVs and — in some cases — new sales models to accompany them.

But the advantages franchised dealerships have gleaned during the supply shortage have newer competitors wary of the legislative efforts.

“In recent years, franchised new car dealers have benefited from supply chain disruptions that have slowed car production. Dealers have reported record profits while buyers are commonly paying above sticker prices,” Rivian said in a statement. “State legislators must be mindful of these market conditions and resist pressure to pass laws that further entrench dealer protections that block competition and ultimately harm consumers.”

Dealer association leaders in several states say their aim is to prevent automakers from competing directly with franchised retailers, thus preserving dealers’ role in the sales model — whatever form it takes.

“The model is always changing. It’s been changing for 100 years,” said Brian Maas, president of the California New Car Dealers Association and 2023 chairman of the Automotive Trade Association Executives.

“Dealers don’t sell cars the same way they sold them 25 years ago before the Internet. They’re not going to sell them the same way they sell them now 25 years from now,” Maas said. “What we want to make sure is that dealers remain central as part of the retail experience for consumers because the franchise model is the best retail model.”

That can be accomplished by passing new legislation and enforcing existing laws, several dealer advocates said.

In Florida, for instance, pending legislation would give a motor vehicle dealer association standing to request that the state Department of Highway Safety and Motor Vehicles review an automaker’s practices to determine whether they violate franchise law. Currently, only individual dealers are allowed to make such requests.

“Dealers are very reluctant to challenge any particular practice of the OEM for the obvious reasons — it’s their business partner. It’s the entity that supplies their vehicles and handles so much of their day-to-day life,” said Ted Smith, president of the Florida Automobile Dealers Association, which advocated for the change in coordination with some dealership groups in the state.

With some past concerns, Smith said he found no dealer willing to put his or her name on a challenge, even after calling dozens of retailers.

“That’s a very telling need being exhibited for having the association to be able to bring something,” he said.

Automakers have said they are exploring the possibility of unlocking additional revenue — potentially in the tens of billions of dollars — in the form of certain in-vehicle subscriptions or software. Dealers, however, argue the practice could cut them out of vehicle sales revenue.

Automakers that activate additional capabilities after the sale are essentially selling the vehicle “in piecemeal fashion” by taking out optional equipment, thus lowering the sticker price and a dealer’s profit on the sale, said Len Bellavia of Bellavia Blatt in Mineola, N.Y., a law firm that represents dealers on franchise law issues.

“That will take a huge amount of revenue away from each dealership going forward and continuing each year,” Bellavia said. “I think it’s even a greater threat than the EV model that dealers are being faced with because that’s a slow process and market share will be very gradual over a long period of time, whereas the subscription model is an immediate and imminent threat.”

In New Jersey, a bill introduced last year would prohibit automakers and dealers from charging subscription or post-purchase fees to activate certain safety and convenience features already installed on the vehicle at the time of sale.

The bill applies to features such as heated seats and driver-assistance technology but excludes such third-party services as satellite radio or in-car Wi-Fi.

“You’ve paid something toward those components, and they should be working,” New Jersey Assemblyman Paul Moriarty, a Democrat sponsoring the bill, told Automotive News. “That’s my No. 1 concern, that components that are in a car that you paid for should be operational and not be toggled on or off, depending on whether you pay a monthly fee.”

The New Jersey Coalition of Automotive Retailers said it did not initiate the legislation and has not taken a formal position on it.

“Our dealers, of course, have serious concerns about subscription services because of the confusion and conflict such programs will cause on the showroom floor and because consumers do not want to be nickeled-and-dimed,” said Jim Appleton, the coalition’s president. “But at the same time, we are not sure the [New Jersey] state Legislature — any state legislature — is the right place to address issues caused by new and emerging automotive technology.”

The alliance opposes the New Jersey bill, stating that prohibitions or restrictions on subscriptions and software features generally will “limit consumer choice, stifle innovation, increase costs and harm used-car buyers.” It also said such bills are “premature,” as features are being developed and automakers are still experimenting.

Dealers know consumers want a modern buying experience and are working to evolve their processes to provide one, said Brett Morgan, CEO of Morgan Automotive Group, which has 61 dealerships representing 28 brands, all in Florida.

Automakers share that goal, but the parties differ in their approaches, Morgan said. Dealers are looking for “two partners at a table,” he said, and want automakers to trust that dealers are delivering the experience they’re asking for without taking more control of the transaction.

That’s the goal of legislation such as that in Florida, he said.

“It’s not about the independent EVs who want to come in and sell direct to consumers. It’s about enhancing our relationship with the legacy manufacturers and ensuring that we have the rights that we’ve always had,” Morgan said. “The reality is, the manufacturers have gotten further faster with the franchised dealer model, and at the end of the day, we don’t want to be forgotten.”