Two Connecticut consumers have sued a DARCARS Lexus dealership in the state alleging it charged more for vehicles than advertised and improperly added commissions to the bill.

Arkadiusz Gaska and Katarzyna Gaska in September sought federal class-action status for themselves and potentially more than 1,000 consumers from Connecticut and 34 other states whom DARCARS Lexus of Greenwich allegedly treated unfairly. The case was originally filed in the Connecticut Superior Court system Aug. 17 and moved to federal court Sept. 23.

Using their own demands for $2,764.23 in actual damages and $10,000 in punitive damages as a baseline, the plaintiffs have extrapolated the lawsuit could mean about $3 million in actual damages and $5 million in punitive damages classwide.

Contacted for comment on the allegations, DARCARS Automotive Group issued the following statement Tuesday:

“Our many satisfied customers — including thousands of repeat customers — have kept our family business open and thriving for decades. We are very proud of the men and women who deliver for our customers every day. We are confident in our position on the facts and the law, and trust our legal experts to manage the process.”

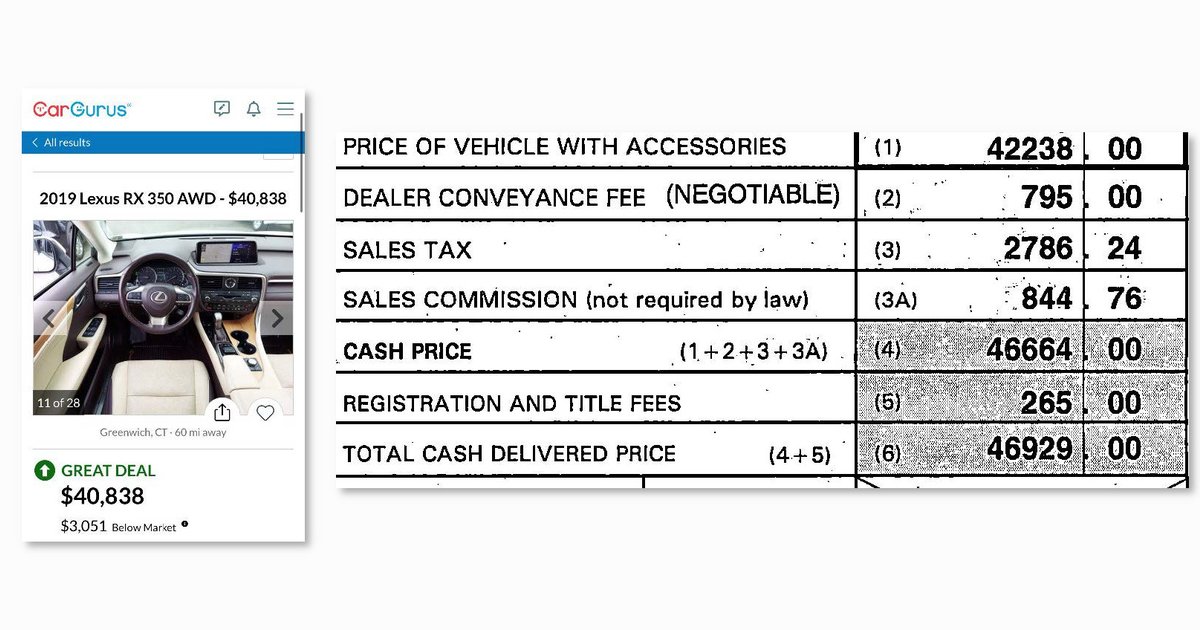

The Gaskas said they saw a used 2019 Lexus RX 350 from DARCARS Lexus of Greenwich advertised on CarGurus for $40,838. They visited the dealership Jan. 11 and purchased the vehicle after being told again the price was $40,838.

But the retail installment sales contract listed the vehicle’s price with accessories as $42,238 and included a charge for a “sales commission” of $844.76 — 2 percent of the vehicle price, the Gaskas said.

Both of these actions were illegal under the Connecticut Unfair Trade Practices Act, the Gaskas alleged.

“It shall be an unfair or deceptive act or practice for a new car dealer or used car dealer to fail to sell or lease, or refuse to sell or lease, a motor vehicle in accordance with any terms or conditions which the dealer has advertised, including, but not limited to, the advertised price,” a state regulation cited by the case states.

Breaking any state or federal law related to vehicle sales or leases also violates the Connecticut trade practices law, according to state regulations.

Connecticut law requires dealerships to include any “conveyance fee” either within the vehicle prices they advertise or alongside it separately in 8-point font.

“The selling price quoted by any dealer to a prospective buyer shall include, separately stated, the amount of the dealer conveyance fee and that such fee is negotiable,” the law states. “No dealer conveyance fee shall be added to the selling price at the time the order is signed by the buyer.

“… No dealer shall include in the selling price a dealer preparation charge for any item or service for which the dealer is reimbursed by the manufacturer or any item or service not specifically ordered by the buyer and itemized on the invoice.”

Charging more than was advertised and charging for a commission unordered by the customer both represented unfair trade practices, the Gaskas alleged.

“Due to the well-documented shortage of motor vehicles available for sale, we are currently in a seller’s market,” Gaska attorney Dan Blinn wrote in a Tuesday email to Automotive News. “Many dealerships are taking advantage of that by increasing the prices of the cars that they sell. While that development is unfortunate for consumers, car dealerships are generally permitted to charge whatever prices they choose for vehicles. In Connecticut, however, they are not permitted to sell vehicles for prices higher than the prices at which they had advertised[.] They are also required to be up front about their prices, and they are not permitted to hide a portion of the price of cars by adding other fees.”

According to the lawsuit, more than 1,100 plaintiffs in 35 states could have either been illegally charged more than DARCARS Lexus of Greenwich advertised, seen an illegal commission added to their bill or both. The litigation seeks to add plaintiffs from the dealership’s customer base dating to the store’s opening August 2020.

“By charging a Commission in addition to the stated price, DARCARS has a competitive advantage over other dealerships, because consumers engaged in price comparison can easily reach the false conclusion that DARCARS vehicles are relatively less expensive compared to vehicles offered by its competitors,” the Gaskas’ lawsuit states.

The litigation comes as the Federal Trade Commission is considering new rules to crack down on dealership practices nationwide, including bait-and-switch advertising. These proposals could include forcing dealership ads to contain a vehicle “offering price,” defined as the “full cash price” (except for government fees) the retailer would honor for any customer.