DETROIT — Automakers’ aggressive product launch cadence over the next few years, normally a sign of a strong industry, could be a detriment in the near term as the coronavirus pandemic hampers demand, according to the annual “Cars Wars” study of the U.S. product pipeline.

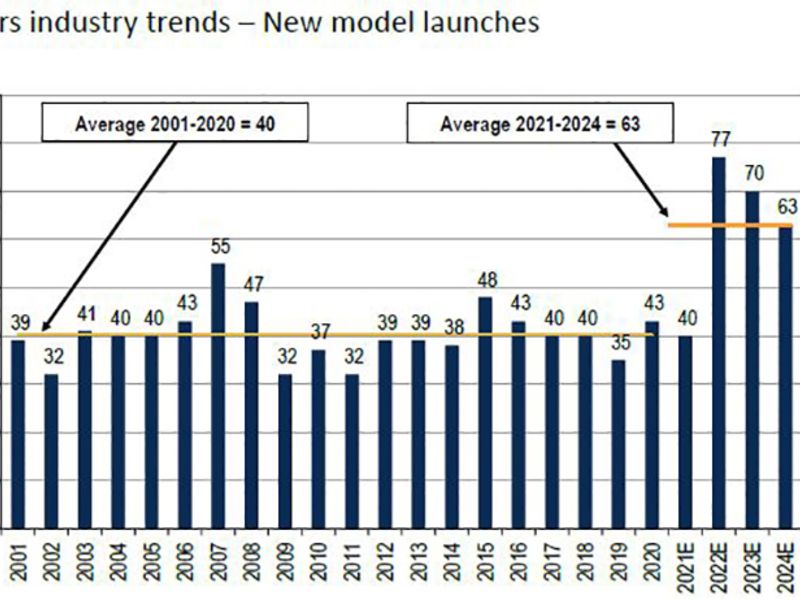

John Murphy, a senior auto analyst at Bank of America Merrill Lynch, said he expects automakers to launch roughly 250 new models over the next four years. That averages out to 63 per year, well above the average of 40 over the past two decades.

Of those vehicles, nearly half will be crossovers, and 28 percent will be SUVs or pickups.

In the immediate future, however, Murphy expects the pandemic to continue to hurt sales. Bank of America forecasts that U.S. sales will plunge about 25 percent in 2020 to 12.7 million vehicles, although it expects a recovery in 2021 to roughly 14.5 million.

The study expects 43 new vehicles to be introduced this year, but Murphy argues that automakers might not receive the bump in profits typically associated with launches because the economy has fallen into a recession.

When the industry recovers, the study suggests, Honda, Hyundai-Kia and Ford will be best positioned in terms of replacement rate. The annual study, published since 1991, is based on the notion that newer products directly drive increases in market share for automakers and thus an automaker with a higher replacement rate has a better chance to increase market share.

Other findings from this year’s study:

- Of the new models coming in the next four years, only half will have internal combustion engines, while 26 percent will be electric and 23 percent will be hybrids.

- The Detroit 3, in total, lag the industry replacement rate. Ford has an above-average rate as it introduces the Bronco, Mustang Mach-E and a redesigned F-150 pickup within the next 12 months, but GM is focused on lower-volume EVs, and FCA is coming off several “hot launch years.”

- Japanese automakers each have a volatile product cadence over the next four years. Honda leads in cumulative replacement rate, followed by Nissan, while Toyota lags.

- Replacement rates for Hyundai and Kia are well above the industry average, although most of their introductions come in the near term. They have a higher focus than others on small cars.

- European automakers’ total replacement rate is just below the industry average, although Daimler is above, while Volkswagen and BMW are below.