Polly’s acquisition of marketing and analytics firm Driven Data Technology will let it find the optimal time for it and dealerships to pitch auto insurance to a customer shopping for a car, the company’s COO said this month.

“You can actually be more targeted,” Polly’s Wayne Pastore told Automotive News.

Different segments of shoppers might respond to an insurance offer at different times, he said.

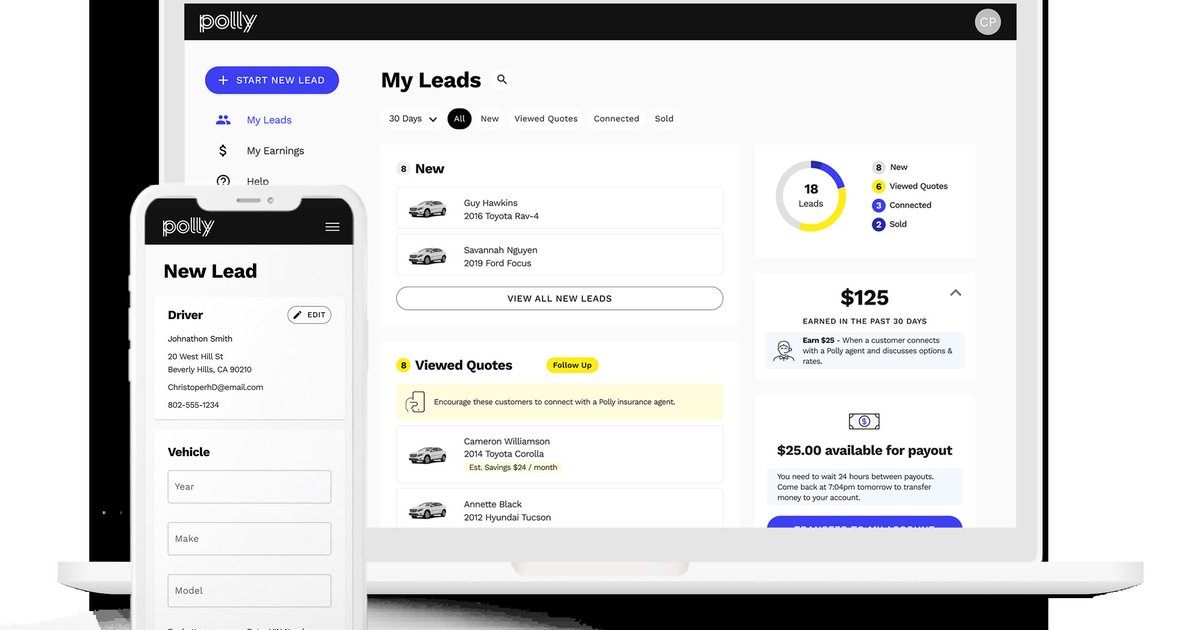

Polly, formerly known as DealerPolicy, allows dealerships and customers to shop multiple auto insurance quotes to see if the consumer can save money by switching to one of them. It makes agents available to lock in final quotes.

Both the dealership and salesperson can earn money for facilitating the transaction; the savings realized by the customer could free budgetary capacity for the car purchase itself.

“Our overall strategy is to really embed insurance everywhere in the buying cycle,” Pastore said.

However, this should not be done indiscriminately but instead “where it’s meaningful for the shopper,” he said.

This could involve the physical store and a dealership’s website, according to Pastore, whose company works with firms such as CarNow, Dealer.com, Tekion and Darwin.

Polly didn’t buy Driven Data to branch out into other business lines, according to Pastore. The industry already had strong digital marketing companies, he said.

“I don’t think they need Polly to be one,” Pastore said.

But one possible use case would be insurance ads directly to consumers to provide more dealer value, he said.

However, while Polly wasn’t going to change its own business model, it wouldn’t cease supporting existing Driven Data customers, said Pastore, who said he has a background in digital marketing. He also saw Driven Data’s digital retail agency network as a potential distribution arm for Polly’s insurance business.

Polly also didn’t plan to sell the dealer information available through Driven Data.

“We’re not in that business,” he said. “What we’re trying to do is work with dealers on the data they have and enhance that value with an insurance offering in their retailing solution.”

Pastore said his company has spent the past year educating its three main partners — Assurant, JM&A and Zurich — about Polly and its value proposition. The three training and F&I product companies are now equipped to pitch and train dealerships on Polly the same as any other product in their portfolios, he said.

This allowed Polly to focus its sales efforts on the top 150 dealership groups. He said larger groups understand the value of embedded insurance, and their Polly use and performance runs “kind of 2-to-1” compared with smaller retailers he characterized as resistant to changing their sales process.

“It’s allowed us to grow with the dealerships that are more progressive in their thinking, and that’s been very successful for us,” he said.

Polly is in almost 1,600 dealerships now, he said.

Despite Polly’s F&I industry partners and insurance-centered business, the company finds dealerships largely sell auto insurance on the sales floor rather than in the finance and insurance office, according to Pastore. (Some purely online sales “without any agent help” also have arisen following Polly’s Dealer.com integration, he said.)

Sales staff have a customer relationship, they can promote the insurance during downtime in the sales process and they understand the vehicle being purchased, he said. However, the fact a customer saved money on insurance through Polly — and now has capacity to buy more F&I products — can be shared with the F&I office through a salesperson or Polly’s software.

Though Pastore described Polly as making headway among large dealership groups in recent history, he also said the past18 months have been more difficult for the company.

Car dealerships originally embraced Polly’s insurance revenue stream because “they weren’t making money on the new car,” he said. But that hasn’t been the case lately, and Polly had a harder time demonstrating the value to retailers.

“I think right now we’re actually seeing that shifting again,” he said.

Interest rates are rising and offsetting the additional expense with car insurance savings becomes more attractive to a consumer.

“We’re starting to see that messaging come through again with the dealerships,” he said.