We are coming off three of the most eventful years in our industry’s history. Production dropped but profits soared. The buy-sell market also exploded as consolidators snapped up hundreds of dealerships even though prices for blue sky had more than doubled. Present conditions remain excellent for dealers, but how do they feel about the future? We spoke with Alan Haig, President of Haig Partners, to get his perspective on the market and what we can expect for dealership valuations and the volume of buy-sells for the balance of 2023.

Q: What changes are you seeing in auto retail?

Alan Haig: Vehicle production is ramping up at the same time that consumers are feeling pressure from rising vehicle prices and higher interest rates. These factors are decreasing gross profits on new and used vehicles. Fortunately, at the current level, gross profits on new vehicles still are more than twice what they were a few years ago.

Q: Are there any good developments for retailers?

Haig: Fixed operations have been growing rapidly for the past five quarters. We would have guessed that a declining number of units in operation would have meant lower levels of service work and parts sales, but the opposite has happened. Customers are spending more money to maintain their aging vehicles, dealers are increasing their labor rates, and the number of recalls has jumped.

Q: What is the net effect of higher sales, lower gross profits on vehicles and more service work?

Haig: Based upon what the public auto retailers reported recently, which we cover in our Q1 2023 Haig Report, average profits per store in the first quarter of 2023 have fallen about 22 percent compared with the same period last year. Normally, we would be tearing our hair out at such a decline, but the first-quarter profits per store are still 2.5 times what they were in 2019 before the pandemic hit. Plus, the first quarter of last year was the second-best ever, but conditions started trending down after that. Dealers don’t feel like conditions have changed a lot in the past few months. The 12-month period that ended in the first quarter of 2023 was down just 5 percent from the 12-month period that ended in the fourth quarter of 2022.

Q: Has this decline in profits hurt buy-sell values?

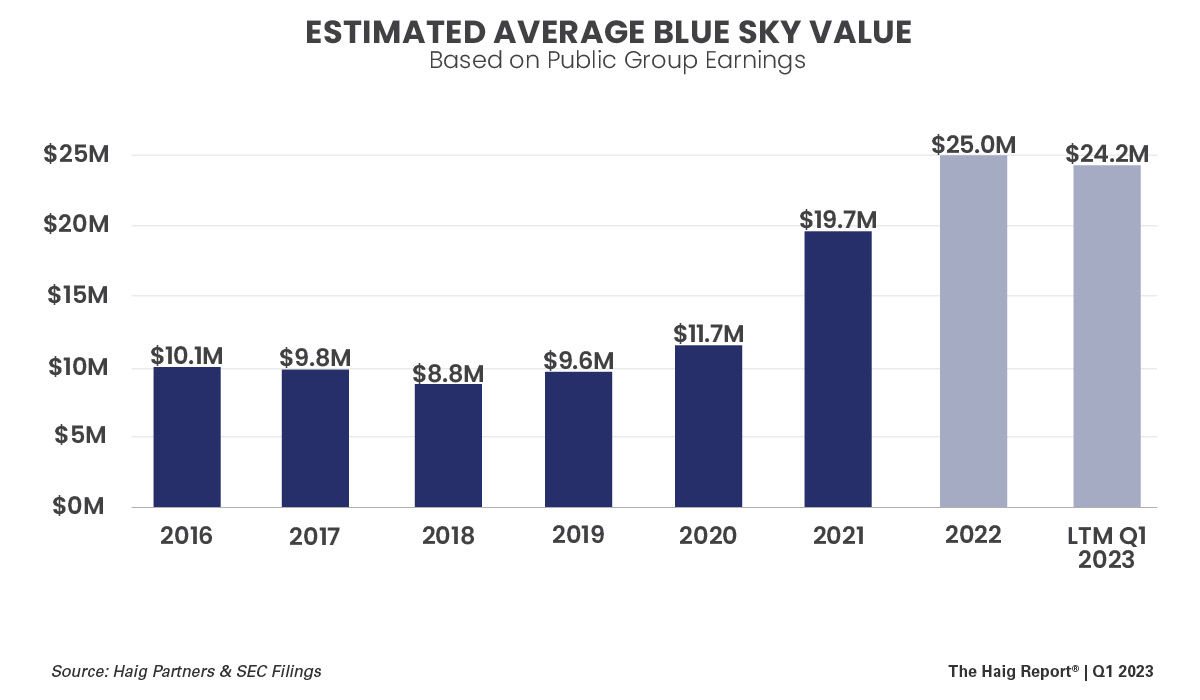

Haig: Not much. No buyer expected the level of 2022 profits to continue into 2023, so they were already factoring a decline in profits into their offers. Also, most buyers are using a formula that takes two or more years of earnings into account when they calculate their offers. As a result, the decline in the most recent period doesn’t have a significant impact. The 22 percent reduction in first-quarter earnings only yields around a 4 percent reduction in the average estimated blue-sky value per dealership, based on the transactions we are working on.

Some franchises, like Chrysler-Dodge-Jeep-Ram, have seen a greater decline due to conditions unique to them. And other franchises, like Toyota, have appreciated during the past year due to strong buyer demand for that brand and the expectation of particularly strong profits. We were able to source the highest price ever paid for a single dealership, a Toyota store owned by one of our clients. We don’t see any value declines for that brand.

Moreover, values can also vary by region. Dealers in Texas and Florida, for instance, are pinching themselves over their good fortune, thanks to pro-business policies and booming populations. Dealership profits have never been stronger.

Q: What else are you seeing in buy-sells?

Haig: We have seen about a 35 percent decline in the number of dealerships sold in the first quarter of this year, compared with the same period last year. This decrease could signal some nervousness on the part of buyers, who may be unsure about how to project profits. These buyers are waiting for prices to decline or for the perfect deal to surface before they reenter the market. Another possible explanation could be that sellers are asking for too much money for their stores. They might be basing their expectation on last year’s profits instead of understanding that buyers are expecting lower profits in the future. Despite the decline in the number of stores selling, what is important to our clients is that we are still able to obtain for them the same values in 2023 that we were seeing in 2022.

Q: What advice would you give to someone interested in selling their dealership?

Haig: My first recommendation is to get an accurate estimate of goodwill value to determine if now is the right time for the owner to exit the industry or divest a non-core asset. At Haig Partners, we have a finger on the pulse of the market because each year, we see dozens of offers that come in for the dealerships and dealership groups that we represent. We regularly provide these estimates at no cost or obligation to dealers who are considering using our services. However, the market is changing, and sometimes it is difficult for us to predict what buyers will pay for franchises. And we also see a wide range of offers for the dealerships that we are selling. As a result, it is critical to run a limited auction process with numerous qualified buyers to find the most motivated buyer. You don’t need to talk to 15 buyers, but you should certainly talk to more than one.

The value of working with a trusted buy-sell advisor like Haig Partners is not only knowing who the best buyers might be for your business, but that we run a confidential and competitive auction process using compelling offering materials to tell the unique story of your store(s). Through this process, we help you Maximize the Value of Your Life’s Work®. We know which groups are acquiring and which ones are on the sidelines. And we can tell the story of what the future of a dealership can look like, including higher sales to offset lower margins. Through this information and a limited auction process, we can help a dealer to Maximize the Value of Their Life’s Work®.

ABOUT HAIG PARTNERS

Haig Partners LLC helps dealers maximize the value of their businesses when they are ready to sell. The team at Haig Partners has unmatched experience, with executives from leading retail dealer groups and financial institutions. The team has advised on the purchase or sale of more than 530 dealerships worth more than $9 billion and has represented 25 groups that qualify for the annual Automotive News list of Top 150 Dealership Groups, more than any other firm. Haig Partners leverages its expertise and relationships to lead clients through a confidential and customizable sales process that also maximizes the value of their businesses. It publishes the Haig Report, the industry-leading quarterly report that tracks trends in auto retail and their impact on dealership values, and is the co-author of the National Automobile Dealers Association’s guide, Buying and Selling a Dealership. For more information, visit www.haigpartners.com or contact Alan Haig at [email protected] or (954) 646-8921.