<!–*/ */ /*–>*/

| Sales bounce back, mostly |

You can expect some outsized scrutiny as the pundits try to make sense of the U.S. sales numbers coming out Thursday.

Comparisons to what happened a year earlier will be skewed. That’s because sales tanked after the coronavirus shut down the U.S. in mid-March of 2020.

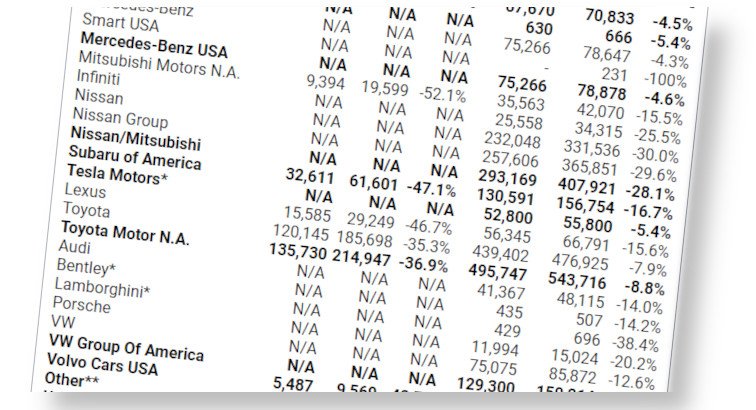

To cite just two reminders of a month we’d rather forget: Toyota sales dropped 37 percent and American Honda plunged 48 percent. Only three brands posted gains for the entire quarter. And this was after January and February gave a strong start to the year.

“There’s not much use in looking at last March,” said Charlie Chesbrough, senior economist at Cox Automotive.

For what it’s worth, Cox projects a 50 percent increase in light-vehicle sales for the month and an 8.7 percent gain for the first three months of the year.

But there are always trends worth noting below the big numbers. And here are some that Chesbrough has his eyes on:

■ There’s been no significant impact — yet — on inventory from the shortage of microchips that is curtailing auto production around the globe. It will be “a big headwind” in the second quarter, he said

■ Average transaction prices continue to rise. “People are interested in expensive vehicles.”

■ Good used cars continue to be hard to find.

Getting back to the numbers, Cox projects a seasonally adjusted annual sales rate of 16.5 million for March, aided in part by the stimulus checks from the American Rescue Plan. The SAAR will approach January’s post-pandemic high after that deep freeze in Texas dropped February’s figure below 16 million.

For a stretch, at least, Cox will also be looking at 2019 numbers for a truer sense of how the market is doing. And Cox sees March sales down about 5 percent from 24 months earlier.

“We’re back,” Chesbrough said. “But not all the way back.”

|

“At the moment, I don’t expect a completely new engine family to be launched again. We still need them for a certain time, and they have to be as efficient as possible.” |

– VOLKSWAGEN BRAND CEO RALF BRANDSTAETTER |

|

Coming Monday in Automotive News:

What to do when you want to keep doing business in an expensive place to do business? Price Simms Auto Group, facing the extreme property values of Silicon Valley, is taking a novel approach to make the economics of a long-overdue facilities upgrade to its Toyota of Walnut Creek dealership make sense: a proposed $279 million project that would include hundreds of units of rental housing as the dealership’s upstairs neighbors. The massive project plans also call for a nearby display lot and inventory garage, which also will be a mixed-use building. Automotive News looks at the reality facing dealers whose land may be more valuable than their business, and whether the creative solution of inviting in neighbors to keep down costs may work elsewhere.

Will 2021 be a record year for dealership buy-sells? Kerrigan Advisors counted 289 dealership transactions last year, including more than 100 deals that closed in the final three months of the year, which the firm counted as all-time highs. Buy-sell advisers tell Automotive News another record is possible in 2021 as spending by public groups has accelerated and many private dealers want to take advantage of high prices and sell their stores now.

|

One more store for Terry Taylor: The Toyota store in Boston, purchased from Prime Automotive Group, adds to the dealership owner’s sprawling U.S. business empire.

McLaren taps Chase as exclusive banking partner: The relationship will focus on the automaker’s leasing business, a key part of its strategy to open the exotic brand to consumers at different price points.

<!–*/ */ /*–>*/

|

|

|---|

|

|

A selection from Shift and Daily Drive:

|

April 1, 2017: John Mendel retires. He joined American Honda in 2004 after years at Ford and Mazda and was promoted to executive vice president of its auto division in 2007, just in time to lead the company through the Great Recession and the Takata airbag crisis. As co-leader of Honda’s Takata response committee, Mendel pushed for action and transparency to find the 10.7 million Hondas and Acuras impacted. He also championed the brands’ strict discipline against fleet sales and heavy incentives.