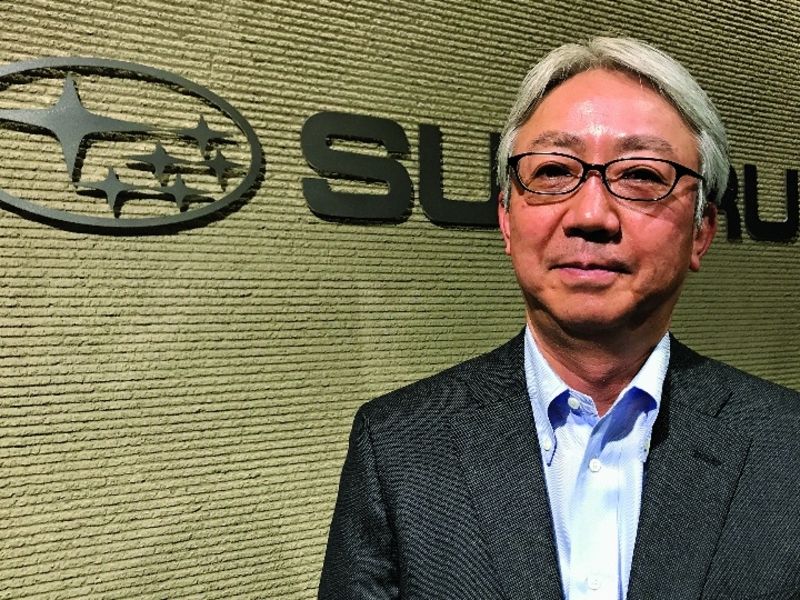

TOKYO — CEO Tomomi Nakamura saw the COVID-19 crisis blow Subaru Corp. off course from achieving an astounding 12th year in a row of record U.S. sales in 2020.

But churning out record volume isn’t the top priority for Nakamura, who chaired the Japanese carmaker’s U.S. operations before taking the helm at world headquarters in 2018.

Nakamura, 61, is instead focused on overcoming the company’s quality woes and steadily building market share. Despite the pandemic, Subaru has made progress on both goals over the past year, with U.S. market share now eclipsing 4 percent. Nakamura’s next milestone: 5 percent.

Speaking through an interpreter, Nakamura met with Asia Editor Hans Greimel at the company’s head office in Tokyo to discuss Subaru’s sales goals, its partnership with Toyota and the company’s outlook for electrified vehicles. Here are edited excerpts.

Q: How has the Subaru work force weathered the COVID-19 pandemic so far?

A: We’ve had about 40 cases, entirely within the group, just in Japan. In the U.S., the number of affected people is still at a low level.

How about the business side?

In November, we kept a good sales pace. It’s difficult to say why because the number of people infected with COVID has been increasing in the United States. For overall U.S. sales in 2020, we initially expected around 600,000 units, but it currently is about 605,000. So it is a little better.

What is Subaru’s forecast for next year?

For 2021, we think overall U.S. market demand will be around 15 million units.

The current market share of Subaru is 4.3 percent. If we think about a healthy increase from that next year, it may be around 650,000 or 660,000, though we don’t really know about COVID.

What is the status of Subaru’s goal, under the STEP midterm business plan, to achieve U.S. deliveries of more than 800,000 in the fiscal year ending March 31, 2026?

Regarding the STEP goals for the United States, we will have to reconsider the numbers and timing. We actually hit 700,000 in 2019. To recover to that level of sales, we think it’s going to be the year after next or maybe a little bit more, so maybe 2022 or 2023.

After 2022, like around 2023 to 2025, it is more difficult to make a forecast. In previous years, the overall U.S. industry was at 17 million. But out to 2025, is the market going to hit that level of total demand? It might not be realistic.

What we’re focusing on is not the absolute number of sales but the share. So we’re looking at 5 percent market share. That would be the target to hit, not the absolute number.

Is there a size that is too big for a small company such as Subaru?

We’re not putting a ceiling on the sales level. It depends on how much overall industry demand is. Based on that, we want to pick the right position. So that is the 5 percent.

I’m not saying we’re going to be able to grow to, like, double our current size. That may be a little premature, based on our current lineup and industry level. But we’re also not putting a cap on total sales. Right now, I think 5 percent is the number. Then, once we hit that mark, we will ask what’s the next strategy to pursue. Either way, we are putting the U.S. market first. That is not going to change.

Can you give an update on Subaru’s efforts to address recent quality issues?

We are making good progress in quality reform. There are two approaches.

One is to ensure we have the right quality for vehicles currently in development. The other is to react and come up with solutions to defects in vehicles already in the market.

New models that have come to the market recently are the Forester and the Outback and the new Levorg, for Japan. We’re changing the entire development process to improve quality. And we definitely see an improvement.

But car development takes a lot of time. We started this activity from 2018, and total vehicle development takes five years. So even for the new Levorg, we think only 50 percent or 60 percent of the essence of these quality reforms is incorporated into this vehicle.

To see a 100 percent impact, it will take until the vehicles in the next full model changes.

How is Subaru handling vehicles already in the market?

We’ve been putting a lot of resources into this area. The reaction speed is coming up. Solutions for defects in the market are getting better. But the vehicles in the market were produced years ago.

So even though we see improvements in the vehicles being developed today, retailers and customers are still dealing with those on the market, one by one.

There are a lot of vehicles to take care of. Retailers and customers aren’t feeling that improvement yet. Retailers text me and say, “You don’t understand the situation in the market.” But we do understand.

Retailers are coping with these defects and working hard every day. They might not see that improvement yet. But I am putting all my heart and soul into improving quality, and I know the situation in the United States. People might not be feeling the improvement right now. But it will come, and they will feel it.

Why does Subaru need a capital tie-up with Toyota?

Because the automotive industry is going through this once-in-a-century transformation and dealing with the coronavirus, the situation is very uncertain.

Subaru is a small manufacturer, and we’re not going to be able to cope with all the changes by ourselves. So we need to have the right partner, and we think that is Toyota.

The Toyota tie-up will soon deliver an all-electric crossover. How does Subaru benefit?

We wanted to minimize our investment because we’re not sure how much profit this project is going to make. We also wanted to minimize the risk of entering in the EV market. To hedge, the partnership with Toyota helped.

Toyota has a lot of knowledge in electrified vehicles. So we thought working with Toyota would allow us to introduce an EV or hybrid faster. We can absorb Toyota’s knowledge.

Is Subaru’s upcoming electric crossover a compliance car for California emissions?

Yes. For the U.S. market, we’re not sure how rapidly the EV market will grow. Based on that, we’ll have to think about our strategy and how to add electrified vehicles.

Is there room for Subaru’s lineup to expand into new segments?

We can’t say we have any plans at this point. But it’s something we’re constantly thinking about.

For example, consider the SUV C-segment, where we have the Forester. If the crossover segment keeps growing, maybe there is the possibility to have two models in that same segment. We can change their characteristics and sell them to different customers.

Nothing has been decided. But we want to keep a close eye on what’s going to be taking over the losing segment share of passenger cars. And there may be some possibility there.

The retailer request for us is not to introduce a new product but to make sure that the quality off the production line will be better than before.