<!–*/ */ /*–>*/

| Like Dickens in reverse |

North Carolina dealer Don Flow invoked Dickens with a twist last week. He was reflecting on the dramatic swings of fortune that auto retailers have seen since the pandemic hit in March.

“It was like the reverse of Charles Dickens’ A Tale of Two Cities,” he said on our “Daily Drive” podcast. “Instead of saying, ‘It was the best of times, it was the worst of times’; it was the worst of times. And now, remarkably, you might actually say, it could be the best of times.”

The theme carries into the pages of Monday’s issue. Consider:

■ Ford and Fiat Chrysler posted robust third-quarter earnings. No one would have predicted that six months ago, when Ford was forecasting a $5 billion operating loss for the second quarter alone. As we note in a Page 1 story, Ford’s profit margins came in at the strongest level in five years. FCA’s North America profits were its highest ever.

■ Gentex, a maker of high-tech mirrors, “is riding high despite a year hammered by the pandemic.” It booked its second-highest quarterly sales in company history. It’s doing so through an uncommon route for a Michigan company: By scoring big success with Toyota.

■ Used-car disruptor Carvana recorded its first-ever operating profit and sharply narrowed its net loss from a year earlier. But a shortage of inventory took a toll.

■ It’s also a time of extremes in online reviews. As we note in another Page 1 story, Reputation.com tracked a sharp polarization in dealership reviews relating to COVID-19 protocols. The responses have triggered some of the most negative — and positive — reviews and social media posts about vehicle retailers that experts have ever tracked.

Eight months of worsts and bests. And perhaps more of the same ahead.

Dealer Flow expects a “fantastic” fourth quarter. He also sees “a potential for a winter of darkness.”

And Ford CFO John Lawler said: “You look around and see where the coronavirus is spiking and the impacts it could have; it is a concern that we have to keep in front of us and have to manage.”

|

Tell us if your company is considering freelance talent

The Automotive News Data Center is partnering with Toptal to examine the war for talent in the automotive industry. We are interested in understanding whether automotive companies are considering freelance/contract talent strategies to help fill strategic positions that require highly advanced and specialized skills and capabilities.

The survey should take approximately 10 minutes to complete. Responses will be anonymous. Should you have any questions, please contact Steve Schmith, executive director of custom research and data strategy, at [email protected].

|

|

Coming Monday in Automotive News:

Nissan looks to reignite U.S. growth: Nissan CEO Makoto Uchida, fighting a forecast for the company’s biggest-ever operating loss, says he won’t be able to restore profitability without shoring up the key U.S. market. In an interview with Automotive News, Uchida says that’s where Nissan really needs to improve operations and reestablish its brand image.

Toyota’s (literal) AV field testing: The Japanese automaker’s approach to self-driving vehicles begins in the middle of a cornfield in southeastern Michigan, where it uses intermodal freight containers to simulate densely populated Tokyo. Coincidentally, the testing is being done surrounded by Jeeps because Fiat Chrysler uses the facility as overflow shipping parking.

The CarLotz gambit: CarLotz, the latest online used-car player preparing to go public, sees enormous untapped potential in e-commerce. How is CEO Michael Bor separating his company from the crowd? “We are consolidating all the middlemen into one middleman.”

|

Ford, Fiat Chrysler see Q3 rebound: Two of the Detroit 3 reported earnings last week, and both Ford Motor Co. and Fiat Chrysler Automobiles enjoyed a third-quarter bounce as their plants reopened after coronavirus-forced shutdowns and consumer demand held up. FCA swung to net income of $1.4 billion, while Ford’s net income surged to $2.4 billion.

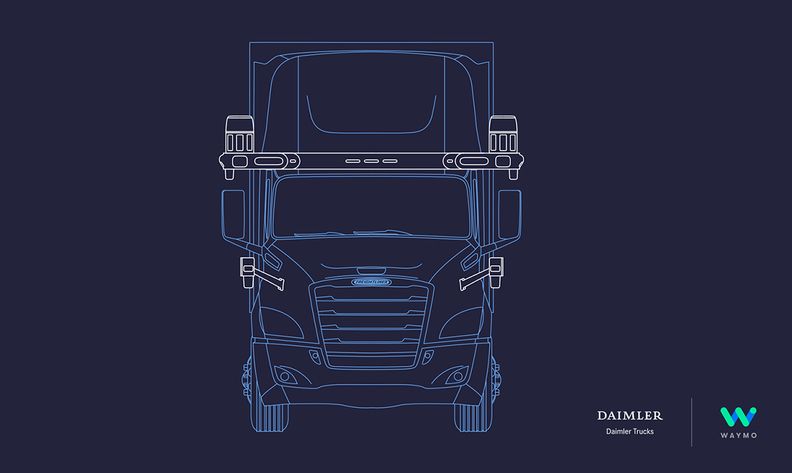

Doubling down on self-driving trucks: Daimler Trucks has embarked on a new partnership with Waymo, the self-driving technology company spun from Google, in which the two companies will jointly develop and deploy autonomous big rigs. The move comes more than a year after Daimler took a majority stake in Virginia-based autonomous vehicle company Torc Robotics.

<!–*/ */ /*–>*/

|

|

|---|

|

Why Bozard’s mobile service is ‘phenomenally well-embraced’: Bozard Ford-Lincoln in Florida has expanded its mobile service program beyond fleet customers by taking oil changes and recall fixes to customers’ driveways. The dealership says the effort is driving revenue growth and helping clients save time.

|

|

A selection from Shift and Daily Drive:

|

Nov. 2, 2013: Kjell Qvale (shel kah-VAH’-lee), the auto-retailing visionary who along with Max Hoffman was a pioneer of importing European auto brands to the U.S. in the post-World War II era, died at 94.

In a 2004 Automotive News interview, Qvale estimated that he had sold more than a million cars — as a dealer, distributor and importer — during 55 years in the car business to that point.

Qvale’s family emigrated from Norway in 1929, arriving in Seattle. He was a star sprinter at the University of Washington, and during World War II he flew DC-3s and DC-4s for the Naval Air Transport Service in California. After his discharge, Qvale considered becoming the regional distributor for Jeep and for some British motorcycle brands before seeing an MG-TC roadster while standing on a corner in New Orleans.

He soon fell hard for the business of importing foreign cars. He began bringing in any car that looked like it had half a chance. After several setbacks in business and a couple of outright flops, Qvale scored a huge hit when he snapped up the Northwest U.S. regional distributorship for Volkswagen in 1953. He later snagged the regional rights for Porsche and Audi as well.