Aston Martin secured a deal to sell a minority stake in the struggling company to billionaire Lawrence Stroll, providing the luxury U.K. automaker with much needed funds to build a new SUV.

A consortium led by Stroll will pay 182 million pounds ($239 million) for a 16.7 percent stake, while a subsequent rights issue supported by major shareholders including Stroll will raise a further 318 million pounds, Aston Martin said in a statement on Friday.

Stroll’s stake could rise to 20 percent upon completion of the rights issue.

The move will “immediately improve liquidity and reduce leverage,” Aston Martin said. “This follows the disappointing performance of the business through 2019.”

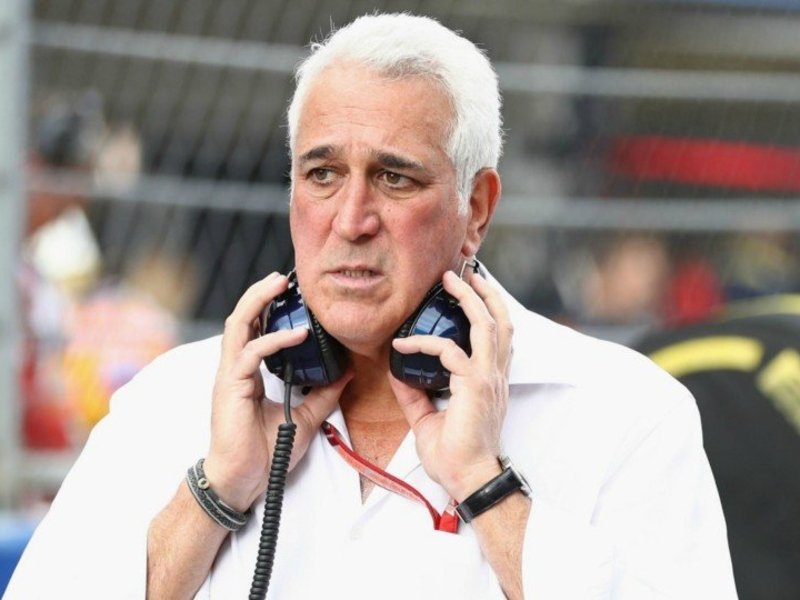

Stroll, a Canadian investor who owns a Formula One racing team, won the backing of Aston Martin’s board after rival suitor Geely cooled on the idea of investing in the sports-car maker. Geely, which controls Sweden’s Volvo, Britain’s Lotus Cars and holds a stake in Daimler, had been interested in a technology-sharing deal, sources said.

Geely wanted to instigate more fundamental change than the plan outlined on Friday, a person familiar with the talks told Reuters.

Aston Martin is mainly owned by Italian and Kuwaiti private equity groups. The fundraising plan hands the automaker a lifeline that will ease funding strains as it prepares to start building its first SUV, the DBX.

The DBX is meant to give the automaker a profit generator it can sell in higher volumes than the stylish sports cars made famous in the James Bond movies.

Nevertheless, the cash influx dilutes some of the existing shareholders, punctuating the disappointing turn of events since Aston Martin went public in October 2018. At the time, the company was touting a turnaround under CEO Andy Palmer, a former Nissan executive, helped by private-equity backing. Its share price has plummeted since the company was floated.

On Friday, Palmer said Stroll and the consortium he will lead bring several benefits to the automaker. “He brings with him his experiences and access to his Formula 1 team,” Palmer said.

“We have talked a lot in the past few years about wanting to be clearly rooted in luxury and obviously Mr. Stroll knows an awful lot about luxury,” Palmer said.

Stroll, 60, who owns a fleet of vintage Ferraris, made his fortune building and selling two fashion brands. He and his partner, Silas Chou, took Tommy Hilfiger public in 1992 and later sold it to private-equity buyers. In 2011, they listed the Michael Kors brand, eight years after acquiring majority control.

He led a group of investors who took over the Force India Formula One team after it was forced into administration. Renamed Racing Point, it is based in the U.K. and gets its engines from Mercedes-Benz. Stroll’s son Lance is a driver for the team.

Under Friday’s agreement, Stroll’s Racing Point will become the Aston Martin F1 works team from the 2021 season.

Stroll will join Aston Martin’s board as executive chairman, replacing Penny Hughes, who will step down.

The consortium that is led by Stroll is likely to include several other people such as JCB Chairman Anthony Bamford, entrepreneur Andre Desmarais, Michael de Picciotto, telecoms investor John McCaw and Hong Kong fashion sector investor Silas Chou, all of whom have worked with Stroll before.

“I look forward to working with the board and management team to continue to invest in the development of new models and technologies and to start to rebalance production to prioritize demand over supply,” Stroll said.

Aston Martin shares surged as much as 30 percent after the announcement.

Reuters contributed to this report