China’s auto market has rebounded smartly from the COVID-19 crash in recent months, executives said on Saturday, as a rare in-person trade show was dominated by talk of recovery in the world’s biggest car market.

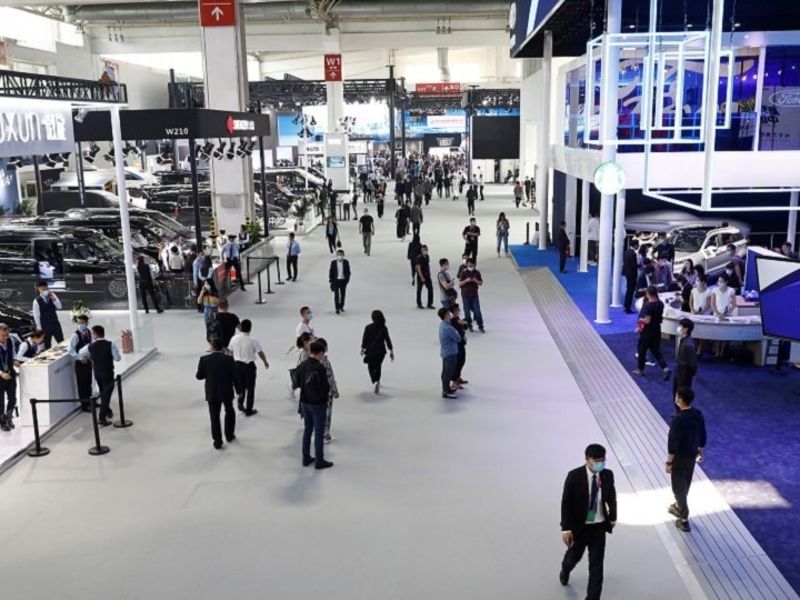

While conditions have improved vastly from lockdowns that froze economic activity in the country where the pandemic erupted, the Beijing auto show is a far cry from the usual ebullience as fewer attend, new models are scant and prospects remain uncertain.

Doubts remain over the durability of the recovery, but the focus for now is on bright spots such as strong demand for midsized to large luxury vehicles and a flood of interest — and investment — in electric vehicles.

“The recovery in the Chinese market has been very remarkable, and our key segments have returned to the previous year’s level if not slightly better,” Nissan Motor Co. CEO Makoto Uchida told a news conference via a video link from Japan.

“I expect this rebound to continue, but we need to watch for signs of trouble,” said Uchida, who announced Japan’s second-biggest carmaker would launch a number of new vehicles in China over the next five years as it struggles to return to profit.

China’s auto sales rose 11.6 percent in August from a year earlier, the fifth straight monthly rise after plunging during the lockdown.

When almost all residents were told to stay home in February, sales collapsed by a record 79 percent to their lowest since 2005.

Executives at Germany’s BMW Group and Guangzhou-based GAC, which has partnerships with Toyota Motor Corp. and Honda Motor Co., forecast full-year sales growth in China, while Chongqing Changan Automobile predicted the same for its local joint venture with Ford Motor Co.

Great Wall Motor Co., China’s top pickup truck maker, aims to boost overseas sales this year, helping to ease an overall drop caused by COVID-19.

Germany’s Audi AG is in talks with long-term partner China FAW Group Corp. about creating a second joint venture to build EVs on its PPE platform in China, Germany’s Automobilwoche reported.

China’s typically busy car-buying season, “Golden September, Silver October”, is off to a good start, according to preliminary data, with passenger car sales up 12 percent in the first 20 days of September.

The rebound means this year’s sales will fall less than 10 percent, the China Association of Automobile Manufacturers estimates, better than its May forecast of a 15 percent to 25 percent decline.

Much of the upturn is driven by sales of larger passenger cars by makers such as Daimler AG and BMW, boosted by new models, automakers’ discounts and a broader recovery in the world’s second-largest economy.

Premium vehicles accounted for a record 15 percent of the Chinese market in August, up from around 10 percent for all of last year, the China Passenger Car Association said.

Electric vehicles are also providing buzz to the Beijing show, as a boom in Tesla shares has propelled interest in China.

EV startups such as Nio, Xpeng, Li Auto and WM Motor have together raised more than $8 billion this year.

But the recent improvement reflects Chinese carmakers making earlier model launches as they could not wait for the usual hype from the delayed auto show before going to market. That suggests a more limited upside to the current sales rise.

“This year’s auto sales are very different from previous years,” said LMC Automotive senior analyst Alan Kang. “Many cars were sold during summer because customers delayed purchases after the lockdown.”

Sales of larger sedans and sport-utility vehicles have returned to last year’s levels, but competition among mass-market brands is intensifying, said Yale Zhang, head of Shanghai-based consultancy AutoForesight.

That’s a key battle ground for international and domestic brands including Volkswagen, Toyota, and Geely.

“Sales performance in these two months will give us a clue of what will happen next,” said Zhang.