China’s carmakers risk falling behind global rivals because the country trails in the production of advanced components like chips and software that are crucial for modern vehicles, a prominent industry adviser warned.

The government should form a comprehensive component strategy and build a platform that connects automakers with suppliers, helping local developers of advanced parts, Zhang Yongwei, vice president of China EV 100, a high-profile electric-vehicle industry think tank, said Thursday at a forum in Nanjing, China.

China is pushing for greater self-reliance amid tensions with trade partners including the U.S. As the auto industry moves toward electrified and self-driving vehicles in a once-in-a-century shift, suppliers of software and semiconductors are gaining in importance.

“The supply-chain problem has to be solved,” Zhang said at the industry gathering. An automobile powerhouse must have a strong supply chain of its own, he said.

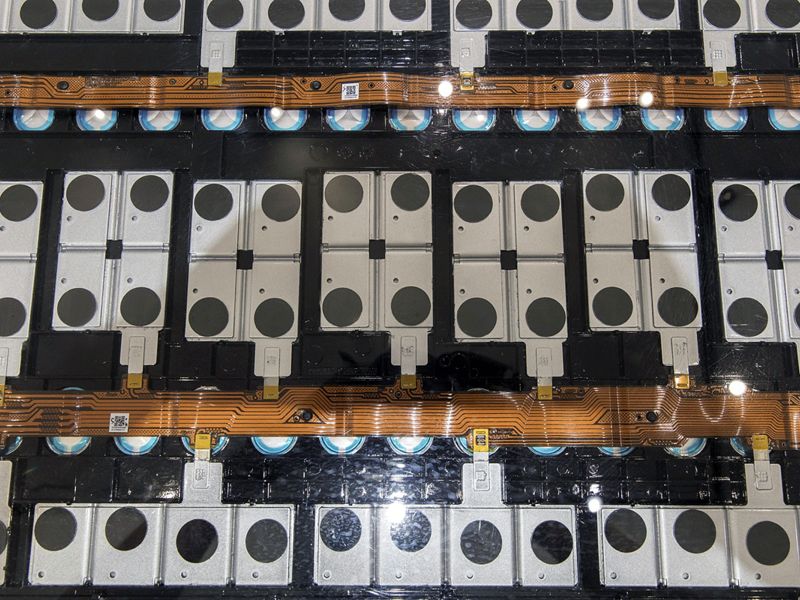

China has been the world’s biggest vehicle market and producer for a decade, claiming about a third of the global total. But in semiconductors, China has only one company in the top 20, Zhang said. Less than 5 percent of automotive chips are made in the country and for some key components, carmakers rely 90 percent on imports, he said.

Meanwhile, semiconductor-based components are set to account for more than 50 percent of a car’s manufacturing cost by 2030, up from about 35 percent now, according to a report by China EV 100 and Roland Berger.

During an inspection tour to carmaker China FAW Group Corp. in July, President Xi Jinping stressed the need to reinforce r&d of core technologies and key parts to promote China’s auto industry and make domestic brands stronger.