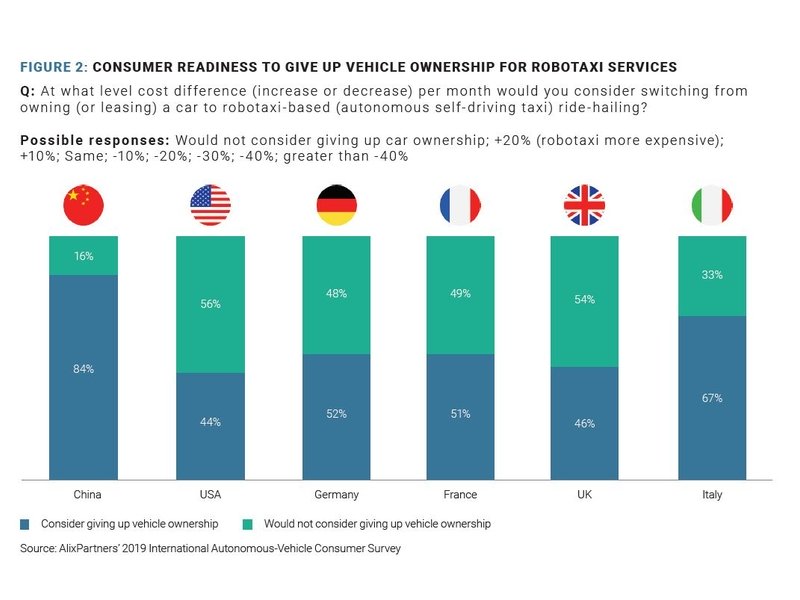

U.S. consumers aren’t as enthusiastic as the rest of the world about giving up vehicle ownership in favor of robotaxi services, according to a report by AlixPartners, a global consulting company.

The Global Autonomous Vehicle survey of more than 6,500 consumers in six countries found 44 percent of U.S. respondents said they would consider giving up personal vehicles if ride-hailing robotaxis become widespread and cost about the same as ownership. Eighty-four percent of respondents in China said they would consider giving up ownership.

Italy followed with 67 percent of respondents saying they would consider giving up personal vehicle ownership.

Consumers overall are less interested in paying more for advanced driver-assistance systems (Level 2 autonomy), the report showed, than they are for hands-off-the-wheel technology (Level 4 autonomy).

U.S. respondents said they would pay just 9 percent more for hands-off-the-wheel autonomy. Chinese consumers were willing to pay just 8 percent more, while respondents in Germany said they were willing to pay 24 percent more.

Alexandre Marian, a managing director in the automotive and industrial practice at AlixPartners, told Automotive News that consumers are probably less excited about paying more for Level 4 autonomy because they haven’t been able to experience it for themselves.

“There’s always the challenge of assessing what is true value when it comes to something they haven’t been able to test,” he said.

AlixPartners said one possible reason consumers are cautious about purchasing AVs is concern over safety. But 58 percent of consumers in China said they were confident in the ability of the highest levels of autonomy — Levels 4 and 5 — to navigate safely.

“If you look at China, they are both open to adopting autonomous vehicles as well as they are confident the AV will be able to navigate them,” Marian said. “If you’re able to make the technology work and the investment work, it could lead to a commercial path rather than a personal vehicle.”

Just 27 percent of U.S. consumers and 18 percent in Germany said they were confident in AV safety.

“AV manufacturers will have to do more than develop a good product,” the report said. “They will need to invest in consumer experiential marketing, work with regulators to show consumers that the infrastructure is ready for a safe introduction and — as a group — not scare off the public by having major incidents due to unsafe and under-tested solutions in consumers’ hands.”

“I would personally not consider that an impediment at this point, because we have not seen commercially viable options on the street just yet,” Marian said. “To be honest with you, even if 18 percent out of Germany, 28 percent out of France or 27 percent out of the U.S. are confident that AVs are capable of driving them, this is a really significant potential market.”