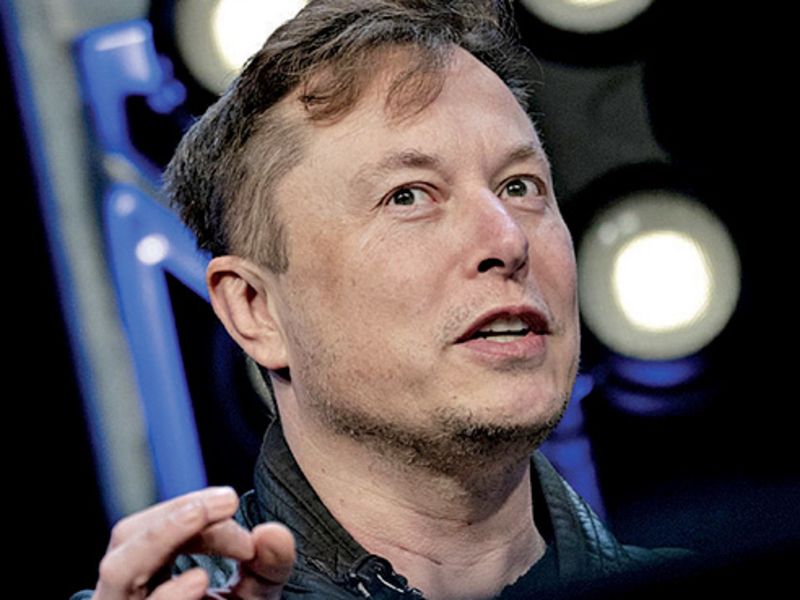

Inconsistency has always been a hallmark of Tesla, whether in manufacturing, or quality control, or the messaging from CEO Elon Musk.

But as the coronavirus pandemic wreaks havoc with most rivals’ finances, Tesla has shown uncharacteristic stability where it matters most — the bottom line — by posting its first-ever streak of four consecutive quarterly profits.

The electric vehicle maker, which has yet to finish a calendar year in the black, again relied largely on the sale of regulatory credits to competitors to eke out a modest profit in the second quarter, and the four-quarter streak still makes it eligible to join the S&P 500 index. Analysts say Tesla’s recent performance, which helped unlock another big payout for Musk, is impressive given the industry’s struggles this year.

“As it flirts with sustained profitability, Tesla has to be celebrated for being one of the industry’s strongest brands,” Zo Rahim, industry and economic insights manager at Cox Automotive, said in a statement. “And while challenges remain — true for any auto company — we think Tesla should no longer be considered a start-up disrupter in the automotive space, but a legitimate player on a global scale.”

Musk insists there’s even more room to grow.

The company over the next 18 months plans to open factories in Texas and Germany, launch the Cybertruck, Semi and new Roadster, expand its insurance product and debut a self-driving system that Musk promises will “go down as the biggest asset value increase in history.”

While Musk is known to overpromise and often has missed ambitious production deadlines, Wall Street remains enchanted with the possibilities from some of the company’s future offerings. Even though shares dipped in May after Musk tweeted that Tesla’s stock price was too high, they have since more than doubled.

The company’s value could increase, according to Musk, as it improves its manufacturing processes, an infamous sore spot during the launch of the Model 3.

He argued that the company could boost efficiency, although he has backed away from previous talk about creating an “alien dreadnought” system that relies on robots instead of people.

“There’s far more opportunity for innovation in manufacturing than the product itself,” Musk said. “The long-term sustainable advantage of Tesla, I think, will be manufacturing.”

Beyond the vehicles and production processes, Tesla executives see value in data gleaned from its upcoming self-driving software, which Musk claims could be ready by the end of the year, as well as the insurance product it rolled out in California last year.

The automaker plans a telematics system that uses data captured by the vehicle and the driver’s profile to determine the probability of a crash and assess a monthly premium.

Executives said they hope to offer the product in a handful of states by the end of the year. The company did not disclose which states it’s considering.

“People can make a choice,” Musk said. “If they want to drive aggressively and in that case have higher insurance [premiums], or do they want to be more careful with their driving and pay less?”

Musk suggested that Tesla could adjust the design of its vehicles and how they are repaired based on the insurance data.

“This gives us a great feedback loop for improvement,” he said. “We’re building a great, major insurance company.”

Despite the recent success, not everyone is bullish on Tesla’s prospects.

In a research note last week, Morgan Stanley analyst Adam Jonas cited a number of looming challenges.

“Our long-term concerns around sustainability of profit in China, poor auto industry fundamentals, and what we believe to be inevitable competition in EVs and AVs from a host of well capitalized tech firms and OEMs are just not seen by the market as a big enough part of the narrative and the risks are under-appreciated by the market,” he said. “We see the risk/reward as tilted to the downside in the next 12 months.”

Mike Jackson, CEO of AutoNation, the largest U.S. new-vehicle retailer, last week criticized Tesla’s reliance on regulatory credits.

He called Tesla’s valuation, which has surged from less than $50 billion a year ago to nearly $300 billion today, “insane.”

“He’s got a great brand, he’s got good products,” Jackson said on CNBC following Tesla’s earnings report.

“But he’s got a business model that still remains very dependent on the government. If he’s making money and doing all of this without government support, I tip my hat. That would be impressive. But it’s not there yet. That’s got a ways to go.”