General Motors ambitious push into electric vehicles could pose a near-term risk as the automaker spends less to replace its more profitable gas-powered vehicles, according to a Bank of America Global Research report.

GM’s $20 billion investment in electric models and self-driving technology over the next five years makes it one of the most aggressive automakers when it comes to rolling out plug-in models, along with Germany’s Volkswagen Group. But the Detroit-based company plans to refresh only about 65 percent of its current sales volume with revamped vehicles, which is third-to-last among major manufacturers. VW is just ahead of GM at 66 percent.

Fewer updates for popular gasoline-powered models may hurt market share, underscoring the quandary the industry faces as companies try to fund an electric-focused future. The billions spent on plug-in vehicles that typically lose money — and that no one besides Tesla Inc. has sold in large numbers — takes investment dollars away from their bread-and-butter vehicles at a time when the global pandemic has hurt sales.

“The very active shift GM is making shows the confidence that they have to move where the market is going,” BofA analyst John Murphy said on a conference call. “It may result in lost market share.”

Over the next four years, Toyota Motor Corp. and Fiat Chrysler Automobiles will refresh less than 60 percent of their current sales volume. That turnover ratio belies the cadence of product updates, which in Toyota’s case reflects a lull after a spurt of new models in the past few years, Murphy said.

Honda Motor Co. topped BofA’s ranking with plans to refresh 91 percent of current models and Korean brands Hyundai Motor Co. and Kia Motors Corp. set to revamp 90 percent. Ford Motor Co. was third at 83 percent.

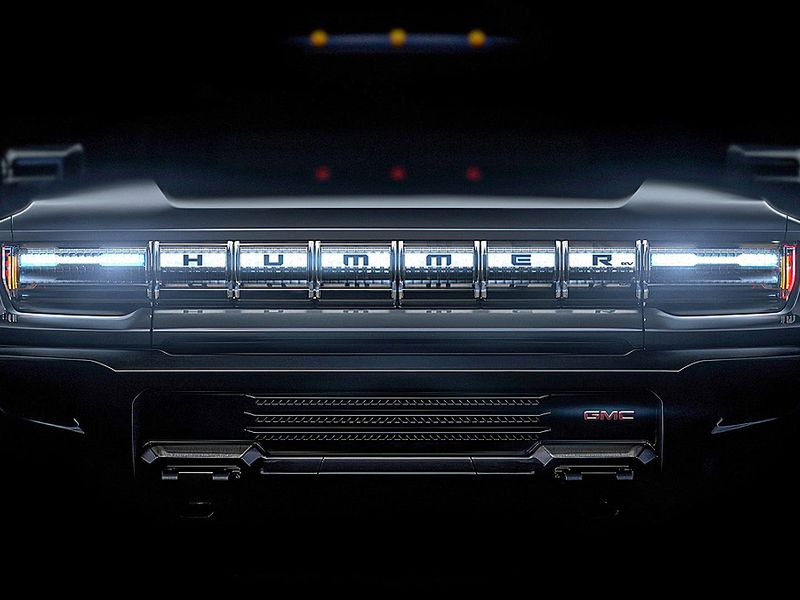

GM will move 30 percent of its vehicles to electric, up from just one U.S. model today: the Chevrolet Bolt. It plans to launch two more next year, the Cadillac Lyriq crossover SUV and a Hummer pickup truck. Both vehicles likely will sell for more than $50,000, which is what it takes to make money on electric models, Murphy said. But the bigger price tags will mean lower sales volume.

Making it tougher are the COVID-19 shutdowns, which will reduce sales in North America by 25 percent this year to 15.2 million vehicles and trigger a 20 percent drop globally to 71.4 million, according to BofA estimates. Deliveries should recover next year to almost 80 million.

Murphy said GM’s strategy could be a longer-term game changer, giving the company a leadership position as consumers shift to electric vehicles. That’s GM’s goal, said company spokesman Jim Cain, who contests the notion that the company’s shift will cost it market share. “We are very confident in our plan,” he said.

One change that could help GM bridge the gap in its transition to EVs is its recent launch of several new crossover SUVs and the Chevy Silverado and GMC Sierra pickups. Later this year, the revamped Chevy Tahoe and GMC Yukon large SUVs come to market. All of those have gasoline engines — and fat profit margins.

“They can ride the profit from those vehicles,” Murphy said.