DETROIT — Before the coronavirus outbreak hit the U.S. in March, General Motors’ North American team had four major initiatives for the year: grow retail share, prepare for an electric vehicle future, improve dealer relations and enhance the customer experience.

The crisis led to plunging sales, significant financial losses and a nearly two-month production shutdown. Despite the business strain, GM has barely adjusted its to-do list, said Barry Engle, GM’s president of North America.

“The fact that we were able to accelerate our progress in each of these four areas was a reinforcement that we were on the right track,” Engle said. “If we concluded that we needed a whole new set of priorities, it would have thrown into question, do we really have the right long-term strategies in the first place? But if anything, it just reaffirmed we’re on the right track.”

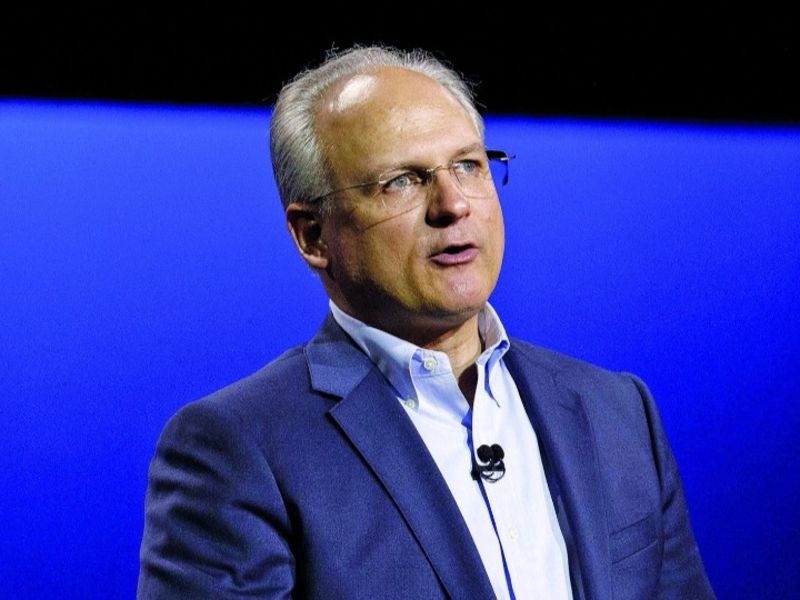

Engle, 56, spoke last month with Staff Reporter Hannah Lutz about the company’s coronavirus response, pickup sales, EV future and more. Here are edited excerpts.

Q: What progress have you made in your top objectives — retail share, EVs and dealer relations — so far?

A: I’m very pleased with what we’ve been able to do in growing our full-size pickup business. During the crisis, you have seen how resilient the truck business has been. Within a very strong segment, we’ve been able to continue to grow. In the first quarter, our retail market share on trucks was 41 percent, which was more than an 8-point growth year over year within the segment.

Through the crisis, we have reaffirmed our commitment to electric vehicles. As we make difficult decisions around capital allocation, we continued to protect and make sure that those programs continue on track. Unfortunately, we did need to delay the reveal of the Hummer. But we also at the same time confirmed that we were holding our [launch] timing.

We never would have made it as we have through the crisis were it not for the relationship with the dealers. We’ve been meeting with the dealer council since the beginning of the crisis literally on a daily basis. More recently, it’s once or twice per week. Working very closely with them allowed us to understand what some of the dealers’ issues were, which we were able to respond to and help our dealers make their way through during the crisis in as strong a way as possible.

And what about digital retail?

Originally Shop-Click-Drive was envisioned as a lead generation tool. What we saw in the crisis was that in many states, dealers were not able to operate in the showroom, but they were able to operate online. They were able to do home delivery. And in states where they could operate a showroom, people’s safety and priorities were different. Their health became top of mind.

So we saw a significant interest and shift toward online shopping. We jumped on that and we’ve accelerated our work around Shop-Click-Drive. We already had high participation, and we had 750 additional dealers that signed up during the crisis. Ninety percent of all of the dealers have agreed to do home delivery. And we have been moving very quickly to expand the capability of Shop-Click-Drive so that it has truly become a transactional tool.

It’s just another example of during the crisis, we have taken a step back and agreed that we’re on the right track and we have put the pedal to the floor and have accelerated on through.

Despite coronavirus-related losses, GM made $2.2 billion in North America in the first quarter. What drove that growth?

There’s no doubt that we performed very well in terms of revenue and mix and were able to post significant year-over-year improvement in our truck business. In fact, our truck sales were up 27 percent in the first quarter. A year ago, we were still in the middle of a ramp-up for our new truck, and our capacities were limited. There’s no doubt that we felt the effect of that in the marketplace. As we entered the year, all our facilities were running. We had decent truck availability. The share results speak for themselves. At the heart of those Q1 results is a very strong truck business.

How will you compete for pickup market share against the Ford F-150 and Ram? Is it more important to you to have the highest share, or would you rather be disciplined on incentives even if that means settling for lower share?

It’s not an either-or proposition. We really have to be able to do both. I’m really pleased with what the team and our dealers have been able to do growing that kind of share that we did. Eight points of segment share growth in a segment as disputed as that one — that doesn’t happen by accident. I think it speaks to quality of the product. We did it with controlled incentive spend, with a relatively rich mix of strong residuals. We were able to not only deliver volume and the share, but we were also able to deliver a strong financial performance.

But what you don’t see is crazy aggressive spending. We did not get that share by buying it. We earned it the old-fashioned way. We have some of the highest average transaction prices in the segment. We have a relatively low incentive spend. The turn on our inventory is the highest in the industry. We think we have a very strong product and the results speak for themselves.

How are you using the Bolt EV to inform your broader EV strategy?

The EV transition is something that will play out over the next several years. However, it is already underway. We have a focus on the Bolt EV and selling more and using it to attract more customers, to better understand the EV customer, who they are and what they want. Through Q1, sales were up 36 percent on the Bolt EV. Historically, it was a product that was sold predominantly in California. It’s an important market for us. But there are now many other markets around the country where customers have an interest in electric vehicles, so we are expanding distribution well beyond California. It’s an important part of our strategy.

GM took swift action in March when the pandemic really started to hit the U.S. by offering no-interest financing for 84 months. What are GM’s plans to further stoke demand during a recession brought on by the pandemic?

Certainly the Shop-Click-Drive initiative is important and at the heart of what we’re trying to do. We understand that people are perhaps reluctant to go out, and we want to be able to allow people to buy a new vehicle from the convenience of their home and have the vehicle delivered.

What we see across the country is that the virus has impacted each place a little bit differently. In some places there has been a significant impact, other states and markets much less so. As we think about this from the customer’s point of view, this is not a case of one size fits all. For those customers who are concerned about going out and returning to the dealership, we will absolutely be able to take care of those customers in the safety and convenience of their own home. For those customers who want to go to a dealership, we’re working with our dealers and have a variety of protocols in place to ensure a clean environment and safe place. We’re practicing social distancing and all of the other protocols around cleaning the facility, the vehicles, etc., so that we can ensure a safe, comfortable experience for the dealer employees as well as customers.

So as we go forward, it’s important to be sensitive to what’s on customers’ minds.

Does GM plan to take additional cost-cutting actions in North America related to the coronavirus impact?

We did take actions before others in terms of our own transformation that we embarked on a year and a half ago to become leaner and more efficient. There was quite a cost reduction that was already implemented. When the crisis hit, we moved very aggressively. We actually as part of our austerity measures did a zero-based approach. Travel, other discretionary spending — every line item was addressed. The objective here is to maintain the liquidity of the company. We drew down the revolving credit facility, which was roughly $16 billion, and were able to pull together roughly $33 billion in cash. And at the same time we took all the appropriate steps to reduce outflows, which included the austerity measures, included the deferral in capital expenditures and more recently we announced a suspension of the dividend as well as a pause in share repurchases. So I think the combination of all of those activities together is certainly a road map for us.

What is GM’s plan for North American factories in the event of another coronavirus wave?

We have had a variety of opportunities to learn about what makes for a safe operating environment. We worked closely with the UAW, as well as our supplier partners, as well as health officials. Following guidelines from the CDC and WHO, we believe that we have the procedures in place to ensure the safety of our people as they arrive for work, while they’re there with us and as they leave the facility. We have a responsibility to our employees, and we believe that under any circumstances we have in place proper procedures to protect people.

Going forward as the situation changes, we’ll need to evaluate, but we believe what is in place is a foundational set of protocols and procedures that is very robust and specifically designed to protect our people.

What kind of an economy and consumer demand do you expect for the second half of the year?

I am encouraged by the fact that the drop in sales that we saw in March was not as deep as we thought it would be and certainly not as deep as what we saw in China. As we move into April, a similar pattern emerged. The bottom of the trough appeared to have occurred in the first week of April. And every week since then, we’ve seen gradual strengthening and improvement in sales.

I’ve been pleasantly surprised on how robust sales have been so far. Yes, they are down but they’re not down as much as we thought they could be. And they appear to be strengthening more quickly than most people would have expected. There’s no doubt that 0 for 84 was helpful, although I would point out that interest rates in general right now are extremely low. Fuel prices are likewise at very low rates. There’s been a tremendous amount of incentive money — stimulus money — that’s been put into the economy. The trends at the moment are encouraging.

I think we need to wait and see how quickly people can get back to work and how quickly the economy can restart, but we do believe that the second half of the year could be — certainly by the fourth quarter — back to more normal run rates. And in the short term, there could well be some pent-up demand.

What do you want to see from the federal government in the next stimulus package?

Based on the consumer surveys we’ve done, we’re trying to understand what’s on people’s minds. Certainly they’re interested in purchase conditions and accessible credit at reasonable rates. Anything we can do as an industry to facilitate that is helpful.