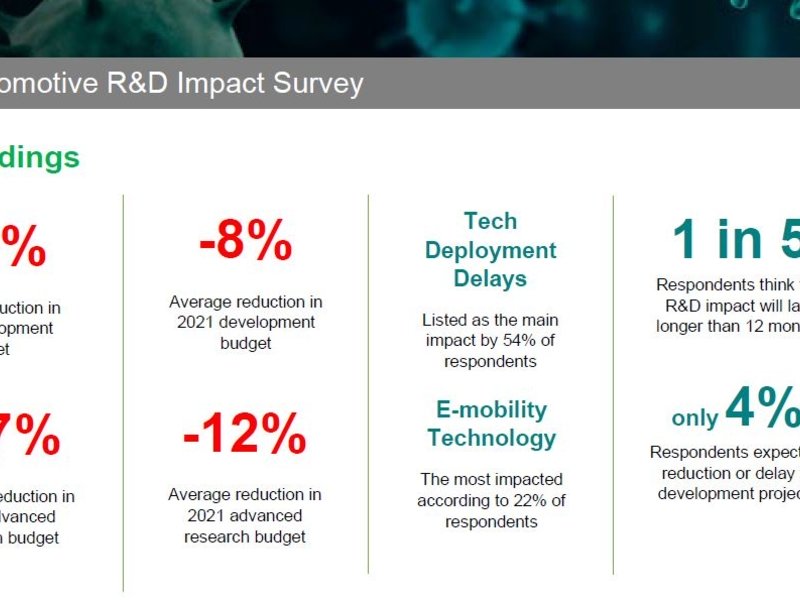

The COVID-19 crisis will cause automotive research budgets to plunge 17 percent this year and 12 percent in 2021, according to a new study.

IHS Markit, in survey results released Wednesday, said development budgets also are expected to suffer, dropping 13 percent on average in 2020 and 8 percent in 2021.

“With cash flow drying up due to sales activity grinding to a halt in core markets and little prospect for an imminent ‘return to normal,’ automakers and suppliers are looking to shore up their finances by preserving cash and other noncritical expenses,” the research company said.

IHS Markit’s automotive supply chain and technology team surveyed 140 suppliers and automakers in North America, Europe and Asia.

Twenty-eight percent of respondents said they expect revenue will be impacted beyond the next 12 months.

Respondents also said they expect some R&D activities now outsourced to be brought in-house, especially at medium and large automakers and suppliers.

Other projects are being postponed. According to the survey, there could be a six-month delay in mature projects and early-stage projects are most likely to be delayed by a year or more.

Automakers and suppliers plan to focus on projects that provide quick return on investment, IHS Markit analyst Matteo Fini told Automotive News. Projects that will take six to seven years to produce revenue are not a top priority right now. Companies are aware that the customer base for certain types of products and technologies won’t be there for a few years.

One survey respondent said: “As venture capital money dries up, many startups, especially in lidar development and autonomous-driving software, will disappear.”

For example, in the survey, suppliers said Level 3 and above autonomous-driving technologies will be impacted because they aren’t something that provides immediate benefit, Fini said.

The survey was conducted between March 30 and April 9. IHS Markit waited nearly three weeks into the crisis as it reached North America to send out the survey, giving companies time to work out their budgets and be able to share financial plans for the remainder of this year and for 2021.

IHS Markit said 30 percent of respondents worked at an automaker and 70 percent worked at a supplier.

Some growth is expected this year, but pre-COVID-19 levels most likely won’t be reached until 2022 or later, according to the survey.

Leslie J. Allen contributed to this report.