South Korea’s largest auto supplier, Hyundai Mobis, will mark a major expansion of its North American R&D operations center this week by welcoming customers, politicians and media to the Plymouth, Mich., site for a tech event showing off its newest electrification and autonomous driving technology.

Mobis Technical Center of North America has new or upgraded labs and engineering equipment, as well as a new customer experience center with 18 displays showcasing its latest technology. The investments allow for more development work to be done on site, as well as conducting more technical discussions with automakers such as General Motors and Stellantis locally instead of at Mobis headquarters in South Korea or at trade shows.

The expanded presence is one of the latest investments illustrating how auto suppliers are being nudged to step up with investment money as automakers pursue aggressive targets in EVs, driver-assistance systems and software.

It can be a difficult balance for suppliers, considering that the pace of EV sales over the next decade is difficult to predict and could fall short of automakers’ aggressive targets, said Sam Fiorani, vice president of global vehicle forecasting for AutoForecast Solutions.

“Manufacturers might be saying we’re going to build 100,000 of these things, but looking at the market, it might be 30,000 at this point,” Fiorani said. “It might be 100,000 units 10 years down the line, but it’s not there yet.”

Still, suppliers, not wanting to be left behind by electrification, are moving ahead with significant investment plans despite the uncertainty.

Japanese supplier Denso, a major parts maker for Toyota, said last year it will spend ¥10 trillion ($67.9 billion) on R&D and capital investments over the next decade. That’s up from the ¥8 trillion it spent in total between 2012 and 2021.

Denso COO Shinnosuke Hayashi reiterated those plans during the IAA Mobility show in Munich.

“We’re making huge strides in our own manufacturing activities, and by doing this, we believe we can empower the entire industry to do the same, to the benefit of society over the medium and long term,” he said, according to a news release.

Other recent, significant investments in future technology announced by major suppliers include German auto supplier Robert Bosch, which said this year it will invest about $2.67 billion in hydrogen fuel cell technology by 2026.

Magna International Inc. is investing heavily in its EV component manufacturing capabilities and anticipates its e-drive, battery enclosure and active safety divisions to account for about 15 percent of its business by 2027, up from just 2 percent today.

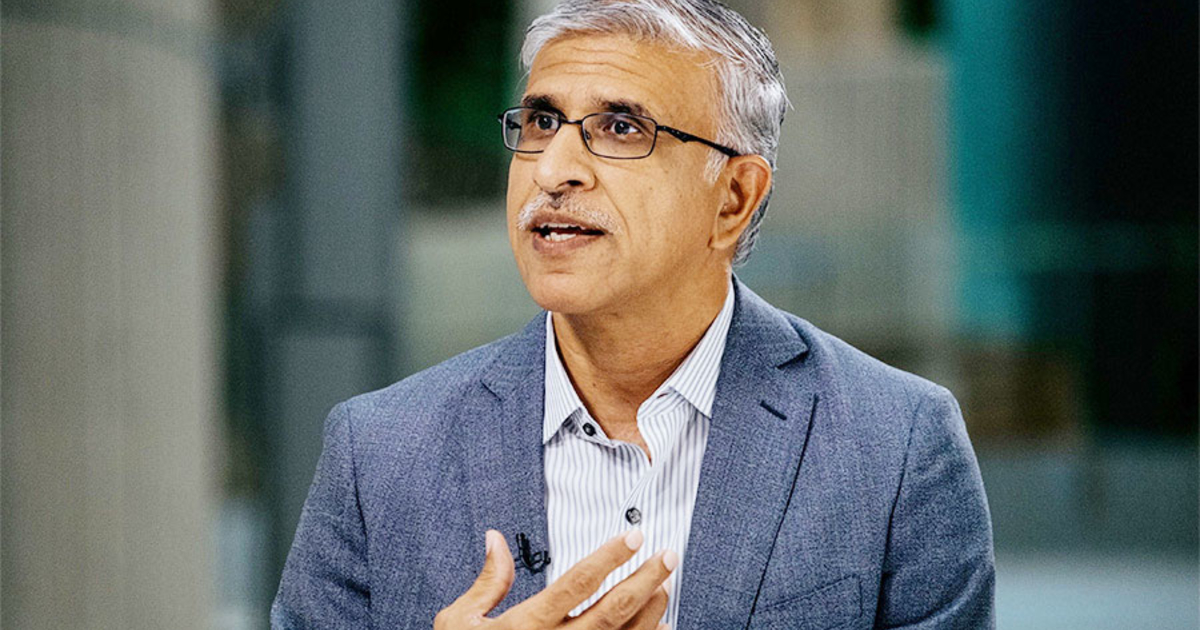

The shift to EVs and advanced driving technology is “irreversible,” Magna CEO Swamy Kotagiri said. But uncertainty around how quickly those technologies will catch on with consumers requires the company to work with its customers more than ever to ensure it invests properly, he said.

“It’s really difficult to pin down what the take rates are going to be, so you have to work with the customer to make sure you can invest in stages,” he said during a presentation to investors last week.