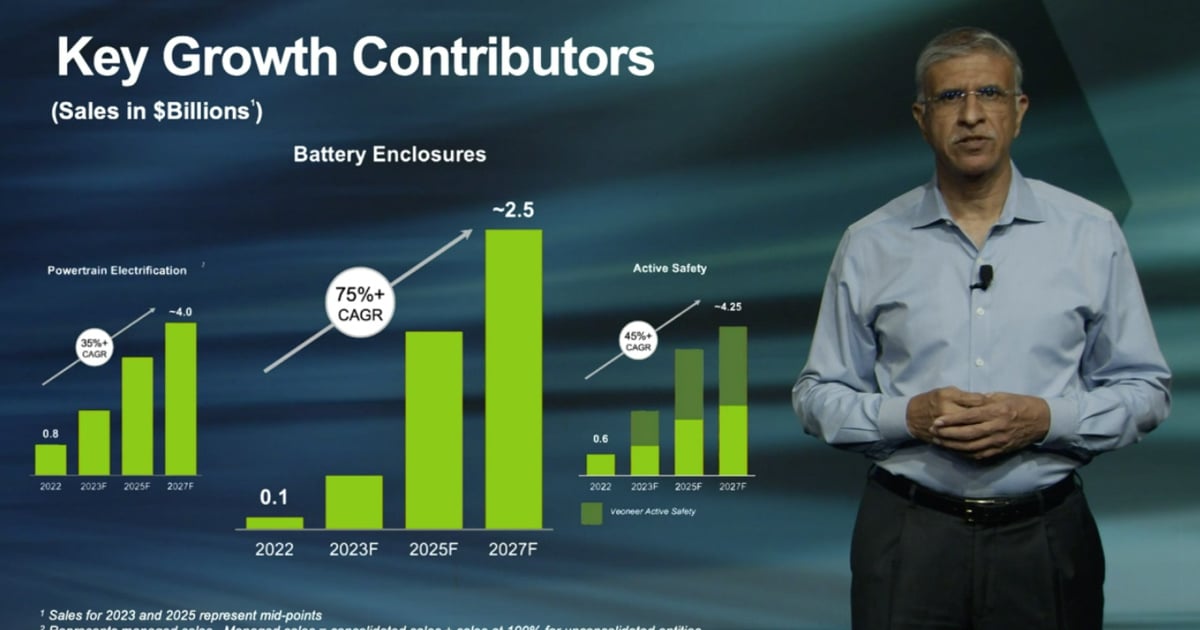

Diversified supplier Magna International Inc. said Thursday it expects to generate $2.5 billion in annual revenue from electric vehicle battery enclosures by 2027, up significantly from just $100 million in 2022.

The enclosures, which house high-voltage batteries and other important EV components, are seen as a major area of growth for North America’s largest parts supplier as it looks to position itself for success as automakers roll out new EVs. This year, the company committed around $700 million to expand battery enclosure production at two plants in Michigan and Ontario in order to supply battery enclosures for the Chevrolet Silverado EV and the Ford F-150 Lightning electric pickup.

The $2.5 billion estimate for 2027 battery enclosure revenue is significantly higher than last year’s estimate for 2027, when Magna expected around $1.5 billion. Magna expects sales of between $400 million and $500 million this year, with that figure rising to between $1.6 billion and $1.7 billion by 2025.

The battery enclosures business “has exceeded initial expectations,” Magna CEO Swamy Kotagiri said during a virtual presentation to investors. “We’re establishing a strong market presence in key regions and building a competitive mode, a strategy similar to the truck frame business that we initiated throughout North America in the late 1980s.”

In addition to the Silverado EV and F-150 Lightning business, Magna said it has been awarded business for seven other, unnamed models: two crossovers and a sedan from Asia-based automakers, two sedans and a crossover from European-based manufacturers and a large SUV from a North American customer.

“There are others in the market, but I don’t see anyone having as broad and nonconstrained a view of the product as we do,” Kotagiri said.

Magna also updated its 2023 and 2025 financial outlooks to reflect the acquisition of Veoneer Active Safety this year. It expects sales of between $41.9 billion and $43.5 billion this year, up from a previous estimate of $40.2 billion and $41.8 billion. It expects 2025 sales of between $46.7 billion and $49.2 billion, up from between $44.7 billion and $47.2 billion.

The revision solely reflects the addition of business from Veoneer Active Safety, with all other assumptions remaining unchanged.

The acquisition is expected to drive growth in Magna’s overall active safety business, increasing to about $4.25 billion in sales by 2027 from around $600 million in 2022.

The company also anticipates its electric powertrain sales to rise at about 35 percent annually to about $4 billion in 2027, compared with around $800 million in 2022. The $4 billion estimate for 2027 is lower than the $4.5 billion Magna had anticipated by then in 2022, a dip the company said is the result of foreign exchange.

Magna expects to “roughly” double sales at its unit that manufactures electric powertrains and parts for EVs this year as automakers rush to roll out more affordable, greener models.

The supplier also said it was intensifying its efforts to use automation and other smart manufacturing activities to help reduce costs from inflationary headwinds.

And it said it expects its joint venture with LG Electronics to become profitable this year. The JV, which supplies EV components to manufacturers, will open its fourth factory by 2025 in Hungary, the companies said this week.

Magna ranks No. 4 on the Automotive News list of the top 100 global suppliers with worldwide parts sales to automakers of $37.8 billion in 2022.

Reuters contributed to this report.