As America becomes a nation of older cars, technicians and the aftermarket may see boom times, according to analysis by S&P Global Mobility.

The average light-vehicle age currently stands at a record-high 12.5 years, surpassing what S&P Global Mobility considers the “repair business sweet spot” of 6 to 11 years old. Vehicles 12 and 13 years old are now becoming a bigger part of the automotive repair business.

Because of this, the aftermarket is likely to see growth in repair and maintenance work as older cars will see more miles driven than traditionally expected.

The surging new-vehicle supply, after two-plus years of diminished inventory, could further boost expansion of the used-vehicle fleet and bring more high-mileage vehicles into service bays. While new-vehicle production is expected to grow, inflation and high interest rates are keeping many car buyers away from showroom floors and toward the used-car lot instead.

The share of 7-year-old vehicles in operation is expected to decline through 2028, but vehicles more than 8 years old will grow by 25 million in the next five years, said Todd Campau, associate director for aftermarket solutions for S&P Global Mobility, which provides analysis of automotive markets.

“As vehicles with more electronic sophistication continue to age and increase in overall share, the aftermarket’s role in maintaining the aging vehicle fleet will become increasingly critical,” he said. “That’s where the real opportunity is in the aftermarket space.”

But where there are opportunities, there also are challenges, Campau said.

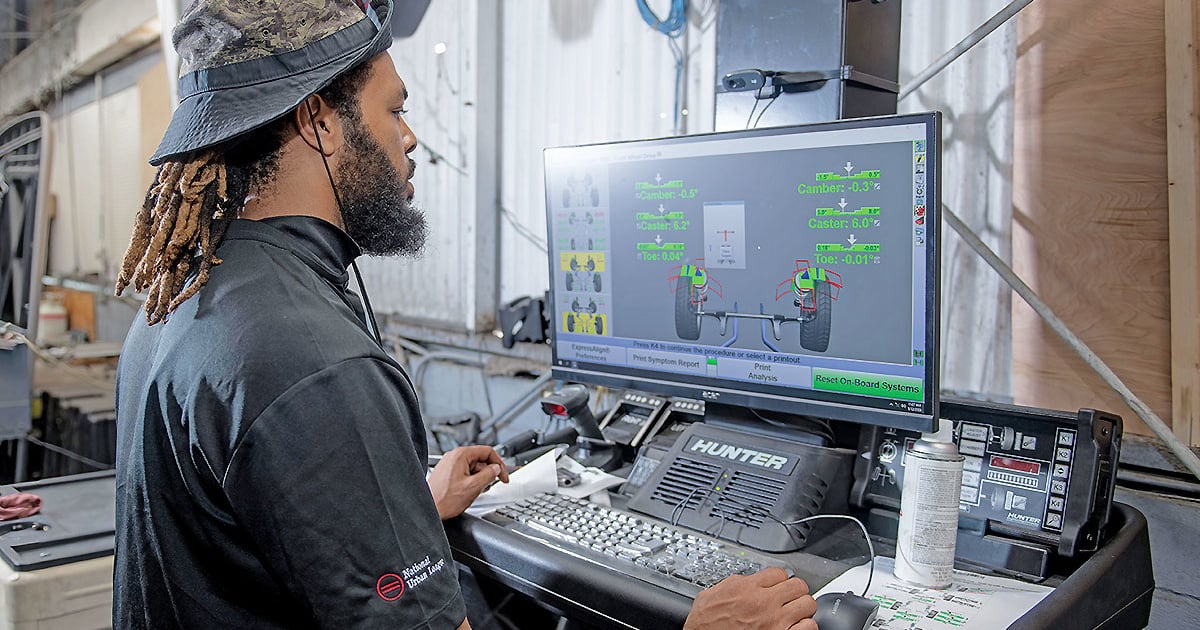

Vehicles in service bays will be increasingly loaded with sensors for infotainment, communications and advanced driver assistance systems such as adaptive cruise control, lane departure warning and collision avoidance. Fixing or replacing these systems can be difficult.

A February survey by the Insurance Institute for Highway Safety reported about half of the vehicle owners who had a repair involving at least one of their applications said they had issues with the system after the job was complete. The high incidence of issues after the repair suggests technicians are having difficulty with the calibration process.

“I think sensors are where the next big opportunity is for the aftermarket,” Campau said.

As the used-vehicle population grows in technological sophistication, right-to-repair issues can arise as automakers balance wanting to maintain control over intellectual property while service bays become more crowded, he said.

“For consumers, the option to have the choice to maintain their vehicle in a timely fashion where convenient will be increasingly important,” Campau said. “The volume of the vehicle fleet will make cooperation between OE aftersales service and aftermarket service shops a requirement to keep the nearly 300 million-vehicle population working as safely and efficiently as possible.”