| The dealership buy-sell market was a different kind of busy in 2022 |

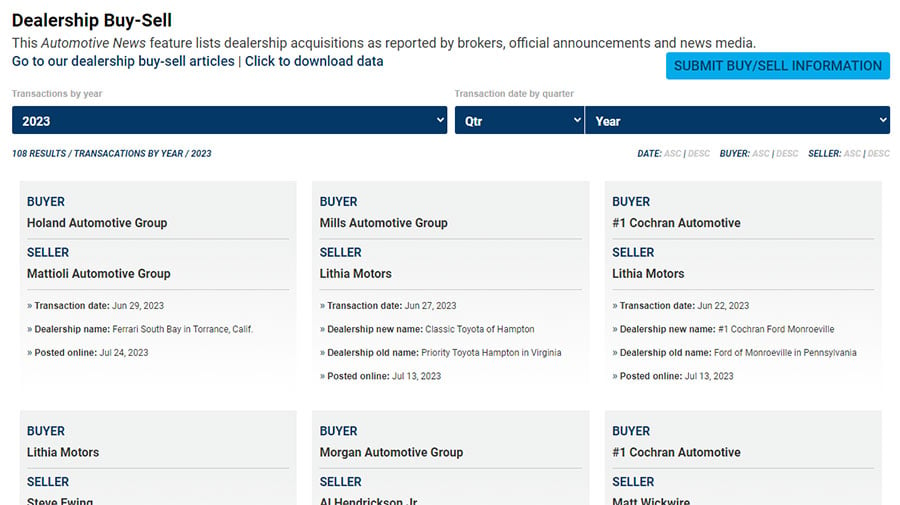

For the second year in a row, Automotive News rigorously documented the dealership buy-sell market. This data served as the foundation for our package of stories in this week’s issue that examine 2022 and beyond.

For subscribers, it’s a one-stop shop of buy-sell data that won’t be found anywhere else.

One key takeaway? The dealership buy-sell market in 2022 was a different kind of busy.

As we document in our package of stories, the theme of the buy-sell market last year was that private dealers and groups — not publicly traded auto retailers — were collectively the most active buyers.

This was a significant change from 2021 in which four public groups completed four of the largest acquisitions in auto retail history on top of what was already an active year for buy-sells.

In fact, the number of transactions in 2022 was actually higher than 2021’s, Automotive News found. But the number of dealerships sold in 2022 was down from 2021, largely because of another trend: no megadeals similar in size to those four blockbuster transactions of 2021.

Dealership lawyer Stephen Dietrich, a partner with Holland & Knight in Denver, described the 2022 buy-sell market as consistent.

“People were still seeing the value [of buying stores], still wanted to get deals done and I think people were very energized to get deals done,” Dietrich told Automotive News.

And the deals, and buy-sell tracking, continues.

Automotive News so far this year tracked at least 90 first-quarter transactions, up 9.8 percent over the number of transactions in the first quarter last year. And for the second quarter, Automotive News has noted at least 93 transactions, though recording for those three months continues.

In addition to the stories, our interactive buy-sell data, now under the Automotive News Research & Data Center umbrella, has been redesigned to give subscribers the information they seek in a clearer, more detailed way.

Subscribers can now search for transaction data by year or quarter, sort by buyer or seller and download our complete data as an Excel spreadsheet.

— Jack Walsworth, reporter covering dealership buy-sells

|

|---|

“You don’t buy software, you buy the car. Nobody goes out and says, ‘I want to get a virtual version of the Peugeot 2008.’ No, they buy a 2008 to drive themselves. And so I’m still a big believer that you need to build an amazing car and the software is there to make it more amazing.” |

— STELLANTIS CHIEF TECHNOLOGY OFFICER NED CURIC, IN AN INTERVIEW WITH AUTOMOTIVE NEWS EUROPE ABOUT TECHNOLOGICAL CHALLENGES AHEAD |

|

From “Stellantis Chief Technology Officer Ned Curic: ‘You don’t buy software, you buy the car’” |

|

|---|

Automotive News Editors’ Picks:

July sales show continued rebound: Interest rates grew, credit standards tightened and vehicle prices were at near-record levels, but pent-up demand continued to fuel a buying spree in 2023 that boosted the auto retail market by 13 percent in the first six months of this year. “The first half of 2023 has proven once again that one shouldn’t doubt the spending capacity of U.S. consumers,” says Chris Hopson, principal analyst at S&P Global Mobility. Notable performers for the period included Toyota, Ford, Honda, Hyundai, Kia and Mazda, which saw sales continue to climb, helped by rising inventories, higher retail and fleet business and more generous discounts. Analysts are revising their outlook for the year upward for U.S. sales. Automotive News covers the sales data and the broader story it tells.

Electric latecomer Subaru amps up EV plans: Subaru has been skeptical of consumers’ interest in electric vehicles. The automaker’s first electric vehicle, the Solterra, didn’t come on the scene until late 2021, and the brand popular with environmentally conscious consumers has been an outlier in the race to ramp up EV production. But times change, and new CEO Atsushi Osaki said EV demand has grown faster than Subaru expected, especially over the last year. He notes the growing number of Subaru owners who also park Teslas in their garages. The company now plans a rapid ramp-up by offering an eight-EV lineup globally, from an earlier envisioned four, and it is targeting 2027 to begin EV production in the U.S. Subaru expects to sell 400,000 battery-powered cars in the U.S. by 2028. Automotive News looks at the company’s new EV agenda.

Weekend headlines

How each Detroit 3 automaker is positioning itself to bargain with Canada’s Unifor: The latest round of contract negotiations comes as Ford, General Motors and Stellantis commit billions of dollars to new battery production plants and electric vehicle retooling projects at vehicle assembly sites throughout North America, including plants across the border from the U.S. in Ontario.

The dealership buy-sell market: Join us at noon Wednesday, Aug. 9, for a LinkedIn Live chat with Stephen Dietrich, partner at Holland & Knight, as he talks about the dealership buy-sell market.

|

|---|

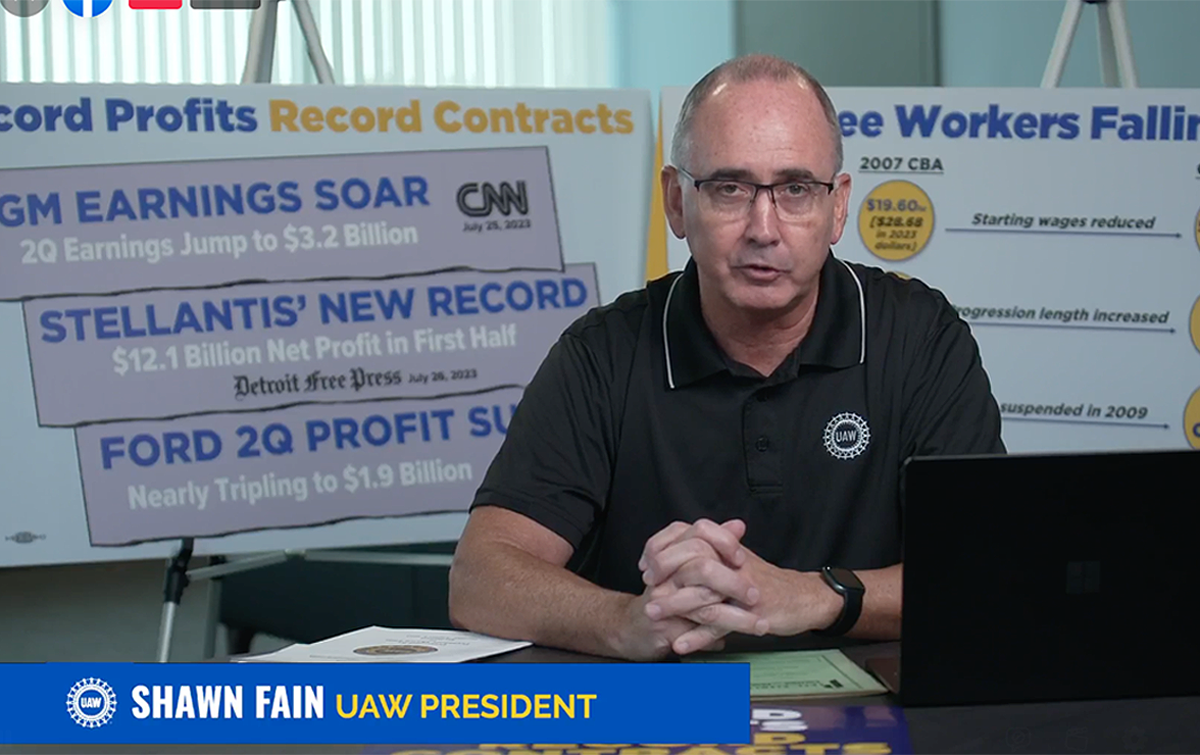

UAW to seek ‘most audacious and ambitious’ contract in decades, Fain says: The union will be seeking double-digit wage gains, restoration of pensions for all workers and better benefits for retirees, among other demands. UAW President Shawn Fain also said he plans to push for a 32-hour workweek.

UAW to seek ‘most audacious and ambitious’ contract in decades, Fain says: The union will be seeking double-digit wage gains, restoration of pensions for all workers and better benefits for retirees, among other demands. UAW President Shawn Fain also said he plans to push for a 32-hour workweek.

NHTSA probes 280,000 Tesla models after steering problems reported: U.S. auto safety regulators have opened an investigation into 2023 Tesla Model 3 and Y electric vehicles after reports of loss of steering control. NHTSA’s Office of Defects Investigation said it received 12 complaints alleging loss of steering control and power steering in those vehicles. There also has been one report of a crash or fire. The investigation could affect about 280,000 Tesla vehicles.

Uber posts first operating profit as ridership hits record: Uber Technologies Inc. reported its first operating profit, fueled by demand for rides and delivery, marking a significant milestone as the company seeks to move beyond its cash-burning past. The results showed that trips in the U.S. and Canada have recovered to pre-pandemic levels, while delivery demand hit an all-time high despite increased food costs. Uber’s second-quarter operating profit was $326 million.

Porsche marks 60 years with $291,650 911: Porsche is marking its 60th anniversary with a limited edition of a model that turned the German sports car brand into an automotive icon. Porsche said it will make just 1,963 of the 911 S/T, the lightest of the 992 generation, with a hefty starting price of $291,650. U.S. deliveries begin in spring 2024.

|

|---|

|

|---|

|

|---|

Aug. 7, 2020: Glenn Gardner, a key Chrysler engineer on the 1980s team that developed the industry’s first minivan and who later led Chrysler’s large-car development, died at 84. Gardner was the first chairman of Diamond-Star Motors Corp., the joint-venture auto production company created in the 1980s by Chrysler and Mitsubishi Motors in Normal, Ill. That role, which Gardner took in 1985 and held for four years, was supposed to be largely a job of guardianship — looking after Chrysler’s 50 percent stake in the undeveloped site. But Gardner pulled valuable learning out of the work with the Japanese automaker. He showed Chrysler the value of Mitsubishi’s methods of project management and the Japanese industry’s approach to empowering teams to make decisions. Gardner was a key architect of Chrysler’s efforts to overhaul product development and tap suppliers to lower costs and lead times.