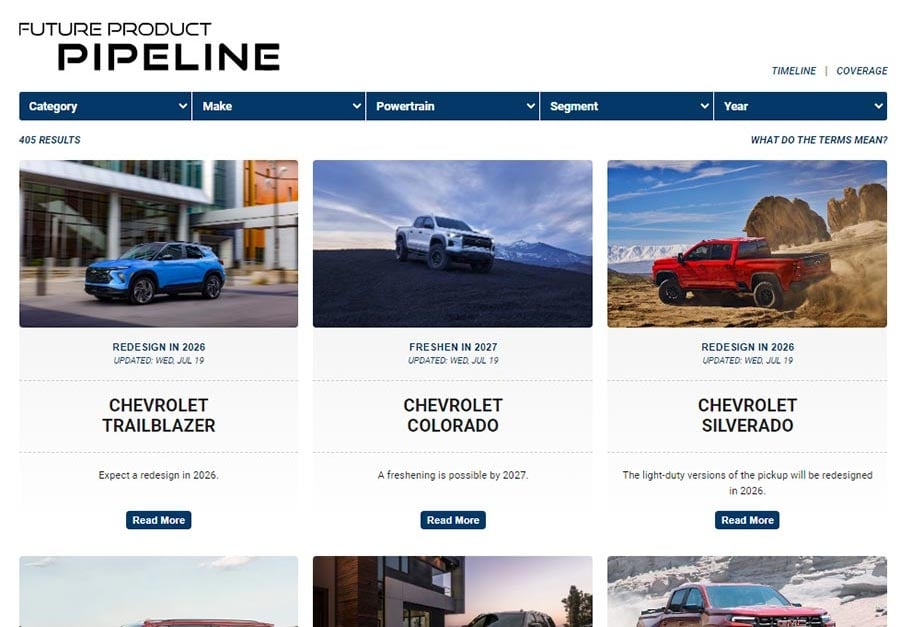

| Our annual Future Product Pipeline: Redesigned for 2023 |

The definitive guide for all-new, redesigned, freshened and reengineered vehicles hitting the market in the next five years just got an update.

Our annual Future Product Pipeline series kicks off this week with a new, interactive tool that allows you to filter our vehicle database by brand, segment, powertrain, year and type of update. This puts the entirety of our Future Product intelligence at your fingertips.

The new feature adds to the breadth and depth of coverage from our staff experts.

Our first deep dive covers the new metal coming from General Motors, which is in the early stages of its electrification transformation. After starting its journey with higher-end models, EVs are coming to more mainstream segments. Production has begun or is scheduled to begin this year on electric versions of the Chevrolet Silverado pickup and Equinox and Blazer crossovers.

GM CEO Mary Barra has said getting more affordable EVs in mainstream segments to market is a critical step.

“These products are so important because they’re core and critical to our EV growth strategy through 2025,” she said.

Check out the five-year lineup for all GM brands and stay tuned each week through Oct. 2 as we detail what’s coming and what’s going for all automakers and brands.

Signing up for our weekly Cars & Concepts newsletter is the best way to keep track of all product news.

— Terry Kosdrosky, audience engagement editor

|

|---|

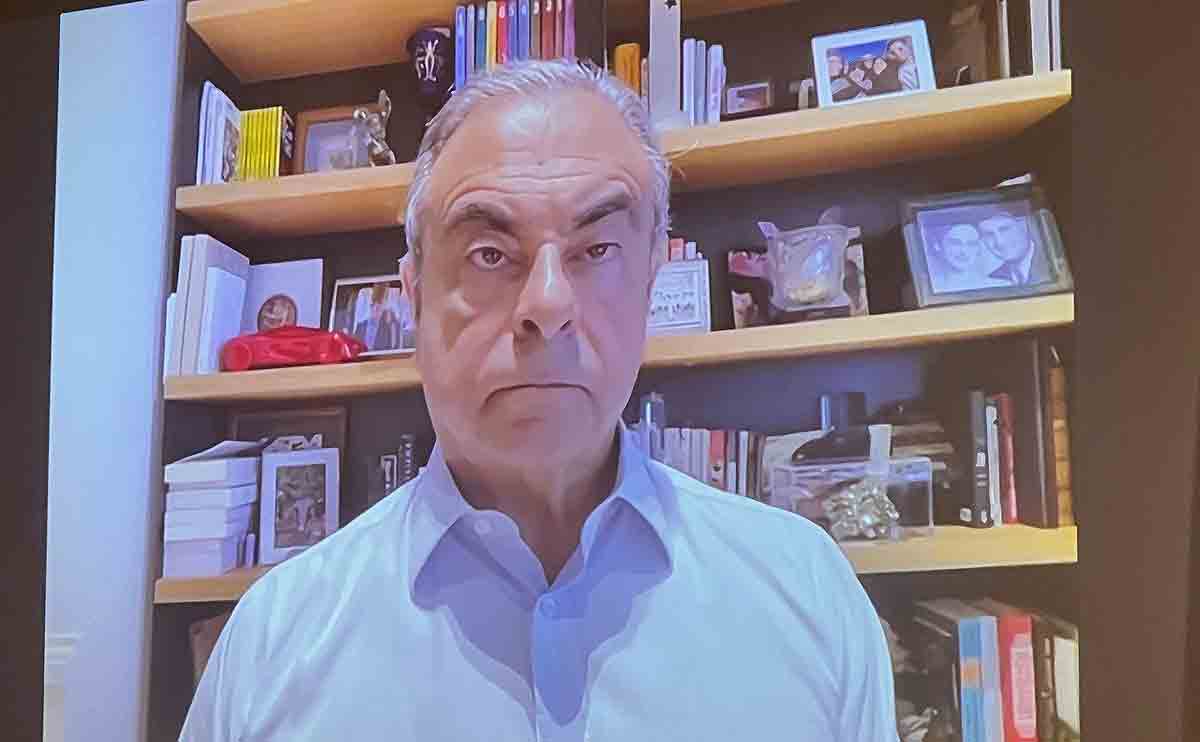

“What I’m looking for is no revenge. I’m trying to have part of my rights back. And I just want to make sure that all the criminals and plotters cannot sleep quietly in their beds.” |

— FORMER RENAULT-NISSAN-MITSUBISHI BOSS CARLOS GHOSN ON THE CRIMINAL COMPLAINT HE FILED IN MAY AGAINST NISSAN IN A COURT IN LEBANON, WHERE HE REMAINS PROTECTED FROM JAPANESE EXTRADITION |

|

From “Carlos Ghosn, following lawsuit, blasts Renault-Nissan as retreating to ‘mini’ deals” |

|

|---|

In Monday’s Automotive News:

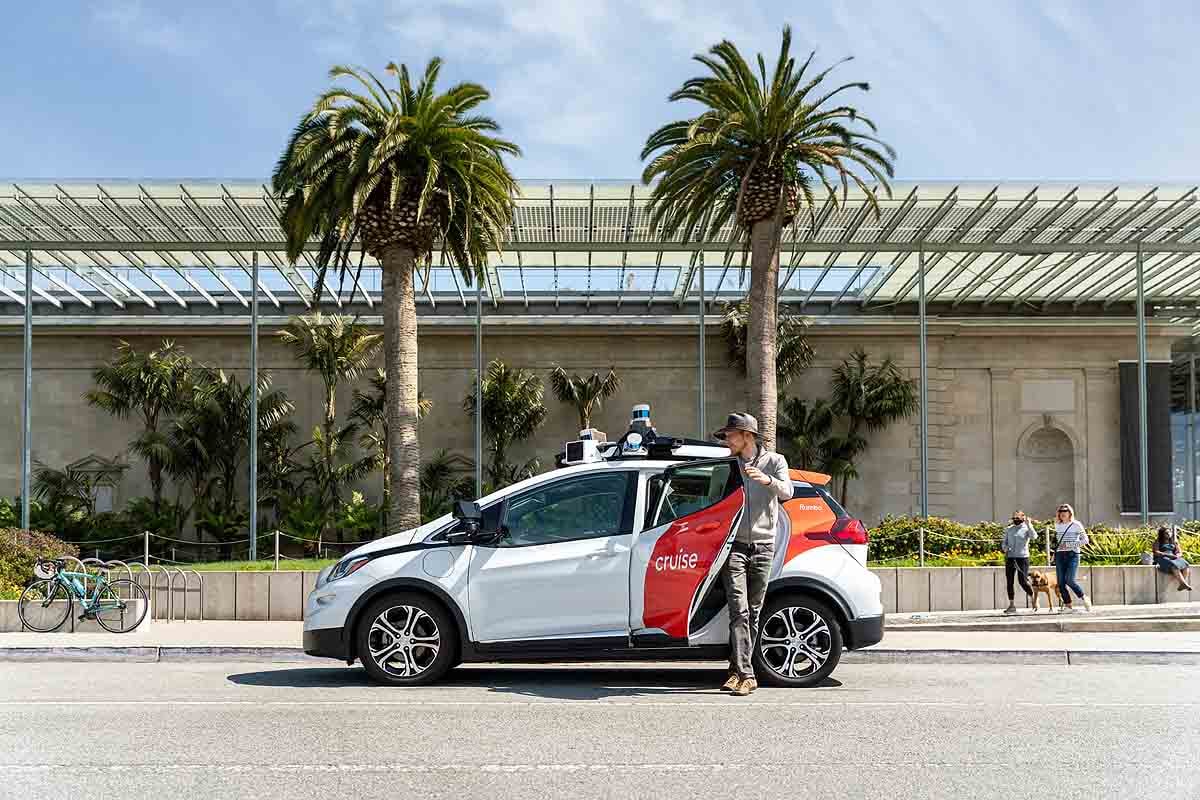

Great ad or messaging mistake? General Motors’ recent one-page advertisement in The New York Times and other papers saying humans were “terrible drivers” in a pitch for its autonomous driving startups Cruise drew the ire of former NHTSA administrator and safety advocate Joan Claybrook. The ad prominently featured the number of Americans killed in car crashes in 2022. Cruise won approval to charge for its robotaxi service in parts of San Francisco last summer and the ad came ahead of an expected vote by the California Public Utilities Commission on its request to expand service. Claybook took the opportunity to resurface self-driving issues that have snarled San Francisco roads, adding: “Using the pain and suffering of those deaths for self-promotion of an unproven and unsafe product is unscrupulous.” Automotive News looks at the issue and whether the dust-up will hinder GM’s Cruise plans.

Do U.S. EV manufacturers face a ‘Goldilocks dilemma’? That’s how Alliance for Automotive Innovation CEO John Bozzella describes the challenge facing U.S. EV makers as they position themselves to compete with China. If the U.S. moves too fast or too slow, he argued, it risks handing the advantage to China — the largest EV market in the world and a dominant player in the mining and processing of critical minerals used to make EV batteries. The alliance, whose members include Ford, GM, Toyota and VW and EV battery suppliers such as Panasonic and Samsung SDI, argued that the EPA’s proposal to significantly reduce vehicle emissions in the 2027-32 model years is pushing too quickly. The current EV supply chain, charging infrastructure and market conditions can’t support it. At the other end are climate advocates and major EV stakeholders such as Tesla, which are pushing for even tougher emissions standards. What’s the “just right” pace for the U.S. EV market? Automotive News examines both sides of the argument.

EV sales soar, but hard days may be ahead: Tesla led the pack — no surprise — selling 6 of every 10 EVs in the U.S. according to data reported by Experian for January through May of this year, boosting EV registrations to a record 447,514 vehicles. But legacy brands and some promising startups saw a cooling of interest, and analysts caution harder times are ahead. Ford, Kia and Lucid, hot EV brands last year, saw sales slow in the first half of this year. Cadillac and Porsche, which entered the EV market with some fanfare, are near the bottom of the 25 brands appearing in the latest registration data. According to Cox Automotive, “the days of 75 percent year-over-year growth” are over. Automotive News looks at the path ahead for EV sales.

|

|---|

Stellantis secures future microchip supplies: Stellantis, still recovering from microchip shortages for its vehicles, said it expects to spend $11.2 billion through 2030 to secure various semiconductors. The automaker said it expects semiconductor shortages to reemerge on growing demand from electric vehicles at a time of increased geopolitical risk, making the current respite short-lived.

Stellantis secures future microchip supplies: Stellantis, still recovering from microchip shortages for its vehicles, said it expects to spend $11.2 billion through 2030 to secure various semiconductors. The automaker said it expects semiconductor shortages to reemerge on growing demand from electric vehicles at a time of increased geopolitical risk, making the current respite short-lived.

Ford, following Tesla’s price-cutting playbook, takes $3.6 billion hit: The maker of the bestselling F-Series announced it’s going to triple the production rate for its first electric pickup, the F-150 Lightning, which it initially planned to sell for just shy of $40,000. Like Tesla, Ford jacked up prices during a prolonged period of parts shortages and battery raw-material inflation. Now that chips are more plentiful and the cost of battery inputs including lithium and nickel have eased, Ford is lopping thousands of dollars off what it’s charging customers.

Ford’s EV battery plant planned for rural Michigan stirs agriculture vs. manufacturing debate: What is the cost to farms and the environment when industrial production moves into a small community? That is the question many in and around Marshall have been asking as debates about impact and loss of agricultural land have raged since Ford announced it would build a lithium iron phosphate battery plant in Calhoun County, despite the promise of 2,500 new jobs.

|

|---|

|

|---|

|

|---|

|

|---|

|

|---|

July 23, 2013: William Symes, former president of the National Automobile Dealers Association, died at his home in Newport Beach, Calif., at age 92.

Symes was president of the California New Car Dealers Association in 1973, an NADA director for Southern California for about a decade beginning in 1975 and NADA president in 1985.

He was born on Dec. 24, 1920, in Winnipeg, Manitoba, and moved with his family in 1922 to Pasadena, Calif. He graduated from Stanford University with a degree in economics. While at Stanford, he played football and was a member of the winning team in the 1941 Rose Bowl.

After graduation, he enlisted in the 8th Air Force. Following World War II, Symes worked during the week for his father at Symes Cadillac, a dealership in Pasadena, and on weekends as a sportscaster. He later became the second-generation owner of Symes Cadillac, while continuing as a sportscaster, providing color commentary on radio and TV for the Los Angeles Rams and University of Southern California football teams in the 1960s and 1970s.