| Deploy technology for a better dealer, customer F&I experience |

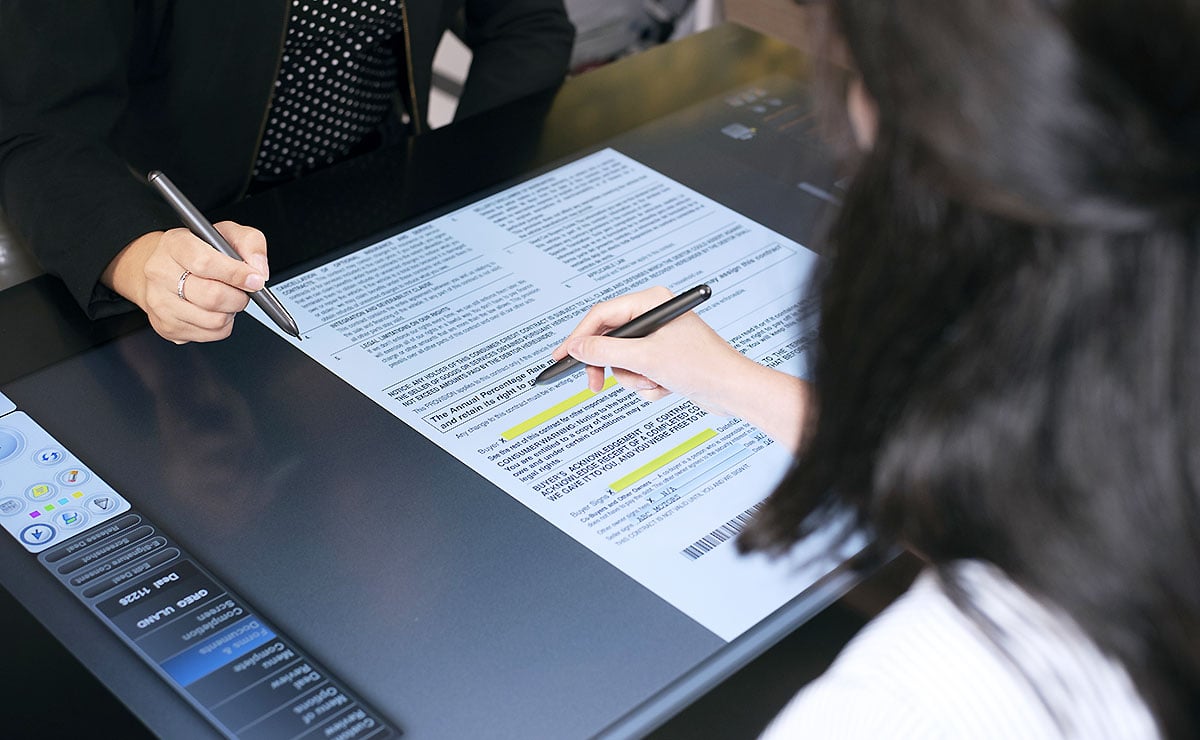

The auto finance office might be the last place that comes to mind when considering which areas of the dealership could benefit from new technology or new practices reflecting innovations in the auto retail or auto lending industries.

After all, the finance managers are spinning deals and hitting their gross profit targets having face-to-face conversations with customers. No need to fix what isn’t broken, right?

But you might be surprised at how much better things could be with a little more technology.

Automotive News‘ second-quarter finance-and-insurance special section focuses on technology that could enhance the F&I process.

Read how lenders are growing more receptive to the notion of electronic contracting with auto dealers — and being encouraged by CDK Global and Reynolds and Reynolds to do so. Working with the captive finance companies and other lenders embracing this capability can mean faster deal funding, cleaner paperwork, juggling fewer systems and less FedEx-ing.

Speaking of cleaner paperwork, there’s a lot of room for improvement in the industry. A poll of auto finance professionals by Informed.IQ found many agreeing that at least 1 in 4 auto deals contains an error, introduced either internally or by the dealership. Screening and addressing these errors wastes both the dealership’s and the lender’s time and can involve awkward customer interactions. But technology at the lender or dealership can help catch these problems earlier in the process.

Errors also abound within dealership online payment quotes, a poll by eLEND Solutions found. These issues aren’t the fault of the F&I office, but finance managers find their work hindered by these flaws nonetheless. Dealers polled by eLEND overwhelmingly agreed that payment quotes matching what a lender would fund — including the dealership’s own margin — would improve F&I penetration by 10 percent or more and cut at least 15 minutes of time the customer spent in the F&I office. We talk to eLEND Solutions about how such quotes might be accomplished and why dealers might still set the bar for them too low.

All this talk of technology might make finance managers uneasy — will they become obsolete as the contracting and finance process grows more streamlined and customers seek to do more of the process online? Our look at remote finance-and-insurance ought to provide reassurance. We talk to three technology vendors who say human interaction remains necessary for F&I success.

|

|---|

Ford’s efforts “to increase the exposure of the U.S. to depend on supply chains controlled by companies subservient to the CCP has grown more brazen and visible over time, especially with regard to critical minerals and EV batteries.” |

— U.S. SEN. MARCO RUBIO, IN A LETTER TO ATTORNEY GENERAL MERRICK GARLAND ABOUT HIS REQUEST FOR AN INVESTIGATION INTO FORD’S PLAN WITH INDONESIAN AND CHINESE PARTNERS TO BUILD A $4.5 BILLION NICKEL PROCESSING PLANT |

|

From “Rubio seeks probe of Ford nickel plant as Democrats renew efforts to counter China” |

|

|---|

In Monday’s Automotive News:

As automakers speed up new EV programs, the risk of expensive recalls will rise for suppliers: As automakers quickly bring dozens of new electric and software-driven vehicles to market, suppliers find themselves racing to provide parts and systems for those models. As development cycles tighten, the risk of costly recalls rises, and recall data seems to bear that out. According to Ernst & Young, the industry bears costs of between $40 billion and $50 billion annually due to recalls, and more than 40 percent of those recalls are now related to software. Automotive News looks at the dizzying pace of development and the unintended consequences of the speed-to-market push.

As automakers speed up new EV programs, the risk of expensive recalls will rise for suppliers: As automakers quickly bring dozens of new electric and software-driven vehicles to market, suppliers find themselves racing to provide parts and systems for those models. As development cycles tighten, the risk of costly recalls rises, and recall data seems to bear that out. According to Ernst & Young, the industry bears costs of between $40 billion and $50 billion annually due to recalls, and more than 40 percent of those recalls are now related to software. Automotive News looks at the dizzying pace of development and the unintended consequences of the speed-to-market push.

What’s behind Kia’s plan to push for EV leasing? The tax implications of the Inflation Reduction Act have been no small math problem for the industry, and the most recent changes to the act leave Kia’s South Korean-made EVs out of the running for the $7,500 tax credit. But there is a workaround. Until 2032, a provision in the law allows the full $7,500 to be used as a discount off if the vehicle is leased. Kia America wants to step up EV leasing to get customers in on the deal.

What’s behind Kia’s plan to push for EV leasing? The tax implications of the Inflation Reduction Act have been no small math problem for the industry, and the most recent changes to the act leave Kia’s South Korean-made EVs out of the running for the $7,500 tax credit. But there is a workaround. Until 2032, a provision in the law allows the full $7,500 to be used as a discount off if the vehicle is leased. Kia America wants to step up EV leasing to get customers in on the deal.

Weekend headline

VW to fire top executives at software unit Cariad: VW is set to dismiss all but one of the executive board members at its software division Cariad next week to try to resolve development problems, a person familiar with the matter told Reuters. The unit, which was set up under former VW Group CEO Herbert Diess. has exceeded its budget and failed to meet goals.

|

|---|

Former Audi CEO Stadler to make diesel scandal confession: Former Audi CEO Rupert Stadler is ready to make a confession about his role in Volkswagen Group’s diesel emissions scandal in exchange for a suspended sentence and a payment of 1.1 million euros ($1.21 million), his defense team said

Former Audi CEO Stadler to make diesel scandal confession: Former Audi CEO Rupert Stadler is ready to make a confession about his role in Volkswagen Group’s diesel emissions scandal in exchange for a suspended sentence and a payment of 1.1 million euros ($1.21 million), his defense team said

Hyundai launches U.S. hydrogen fuel cell truck strategy: Leveraging its experience offering fuel cell passenger vehicles, Hyundai Motor Co. plans to offer a hydrogen-powered heavy-duty truck in the U.S. this year. Hyundai unveiled the production version of its Xcient Fuel Cell Class 8 truck at the ACT Expo last week.

Hyundai launches U.S. hydrogen fuel cell truck strategy: Leveraging its experience offering fuel cell passenger vehicles, Hyundai Motor Co. plans to offer a hydrogen-powered heavy-duty truck in the U.S. this year. Hyundai unveiled the production version of its Xcient Fuel Cell Class 8 truck at the ACT Expo last week.

UberX Share to expand to 5 more cities: Uber Technologies Inc. said it plans to make UberX Share available in five more U.S. cities in the coming weeks. The service, which gives users a discount for sharing their ride with others, will soon be available in Baltimore, Miami, Nashville, Philadelphia and Washington.

|

|---|

|

|---|

|

|---|

|

|---|

|

|---|

May 11, 2017: The 1 millionth Porsche 911 — a Carrera S in Irish Green — was built at the factory in Zuffenhausen, a district of Stuttgart.