The top two dealership management systems this year seek to grow e-contracting between dealerships and lenders, initiatives the vendors say will benefit retailers.

Reynolds and Reynolds announced in January more than 100 lenders already participate in its e-contracting option, with more than 150 expected to join “in the coming months.” The technology would result in deals “funded in a matter of hours, not days” and allow borrowers both inside and outside the store to sign contracts, the company said.

And CDK Global product marketer Jason Swiech in March told Automotive News the company’s finance-and-insurance priority likely was bringing lenders into the DMS workflow. Dealers would no longer have to switch between systems and conduct “multiple signing ceremonies” to digitally contract a deal, he said.

Swiech estimated the system already worked with more than 70 lenders in 11 states, and CDK had turned its attention to incorporating captive finance companies.

Dave Bates, Reynolds customer relations vice president, in April said the auto finance industry resisted e-contracting for two or three years. That’s no longer the case. Lenders now recognize the efficiency, value and information flow benefits of such a format, he said.What about dealers? “More and more, they’re begging for it,” Bates said.

Bates in April said Reynolds had added about another 50 lenders to its e-contracting system since its January announcement.

“It continues to be a priority” for Reynolds, dealers, lenders and captives, he said.

Greg Uland, vice president of brand marketing at Reynolds, told Automotive News in January that his company had focused on streamlining the process so dealerships could e-contract with the lenders they use to fund consumer auto loans.

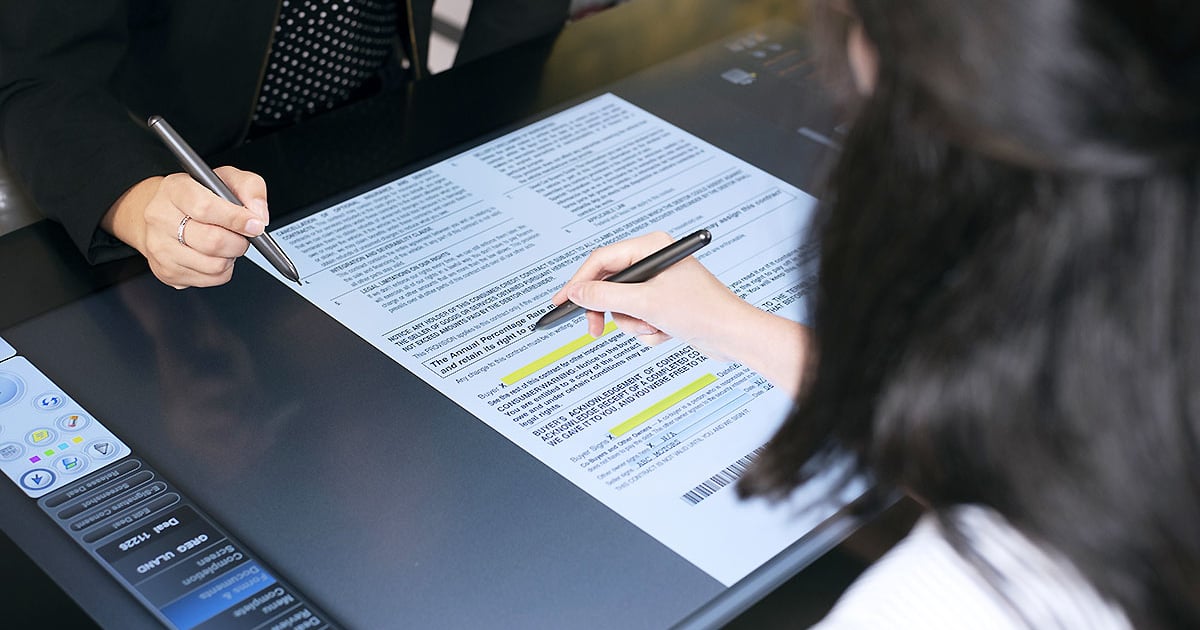

E-contracting as Reynolds defines it here goes beyond a dealer collecting signatures electronically — a scenario that can still end with the dealership forced to print and FedEx paperwork to the lender. Reynolds is offering a means for a contract to pass to and be accepted by the lender electronically.

“There is never a piece of paper that is needed or printed,” Uland said in April.

Under a status quo without e-contracting, dealers can wait days for lenders to fund a deal — which means waiting on cash flow. A retailer might FedEx documents to the lender, a transmission that can take more than a day in the physical world but “about three seconds” in the digital realm, Uland said in January. Then the dealer must wait for the lender — which could be handling a few hundred deals daily — to review and approve the loan documents and send over the money. A dealer who sells a vehicle on a Friday might have to wait until the following Thursday for the money, he said.

But the e-contracting system Reynolds has developed is resulting in funds sent in four hours or less, according to Uland. It can even be instantaneous for certain captives, Bates said.

“If you look at contracts in transit, we’re seeing a several-day reduction,” Bates said.

Uland said the accelerated time to funding with an e-contract can be attributed both to lenders not having to wait on documents as well as the ability for a digital workflow to catch errors in advance.

This capability also could be leveraged for deals involving remote buyers, including scenarios with one customer in the dealership and a co-buyer at home, Uland said. The second borrower could sign without having to enter the dealership, he said.

CDK also is seeing lender buy-in for its e-contracting option.

“I think a lot of lenders are seeing this as the way to go,” Swiech said in March.

They recognize dealerships don’t want to switch between systems to complete a transaction and see building the process into a DMS as a positive.

“We’re getting a lot of help from the lenders,” he said.

Swiech said CDK had been conducting “pre-work” on the project for two to three years. It began to accelerate its work integrating lenders into the system in 2022.

He said it was easier to start the process by adding noncaptive lenders to the system because many of them use a standard contracting format.

“That’s why our main focus this calendar year is to really knock out as many of the captives as possible,” Swiech said.

The technology also looks for mistakes in the deals sent to lenders, such as a mismatched name or an unapproved interest rate, according to Swiech. The idea is to catch the errors in advance and prevent the need for a consumer to return and re-sign a deal, he said.

Swiech said dealers new to the system originally demonstrate a significant error rate when checked through the validation, but he attributed this to retailers being unfamiliar with the new process.

“We see a huge drop-off within a month of the workflow,” he said, with the error rate falling to less than 5 percent.

The system relies on CDK’s digital deal jacketing and e-filing software and allows retailers to submit deals, Swiech said. It also allows for a centralized document management system, eliminating the inefficiency of errors that arise when documents from a different piece of software must be transferred, he said.