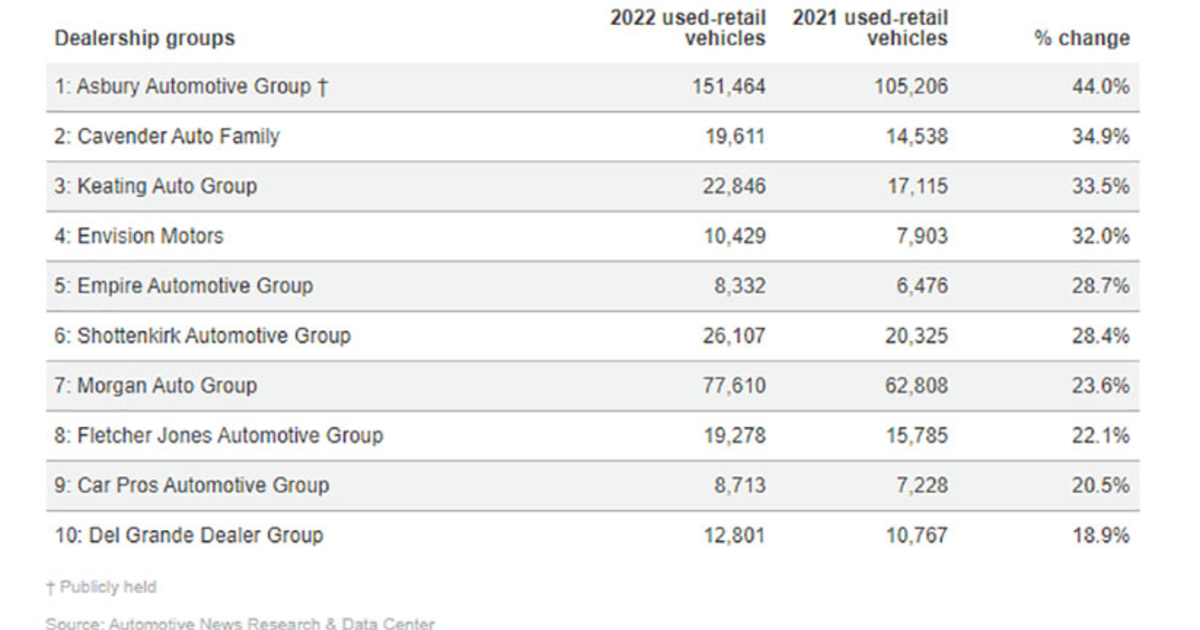

| Dealership groups | 2022 used-retail vehicles | 2021 used-retail vehicles | % change |

|---|---|---|---|

| 1: Asbury Automotive Group † | 151,464 | 105,206 | 44.0% |

| 2: Cavender Auto Family | 19,611 | 14,538 | 34.9% |

| 3: Keating Auto Group | 22,846 | 17,115 | 33.5% |

| 4: Envision Motors | 10,429 | 7,903 | 32.0% |

| 5: Empire Automotive Group | 8,332 | 6,476 | 28.7% |

| 6: Shottenkirk Automotive Group | 26,107 | 20,325 | 28.4% |

| 7: Morgan Auto Group | 77,610 | 62,808 | 23.6% |

| 8: Fletcher Jones Automotive Group | 19,278 | 15,785 | 22.1% |

| 9: Car Pros Automotive Group | 8,713 | 7,228 | 20.5% |

| 10: Del Grande Dealer Group | 12,801 | 10,767 | 18.9% |

† Publicly held

Source: Automotive News Research & Data Center

Twenty-three dealership groups on the list recorded double-digit percentage gains in used-vehicle retail units sold. Those with the highest increases largely achieved the gains as a result of dealership acquisitions made in 2021 and 2022, as the addition of more stores boosted overall sales volumes. The chart above shows the groups with the 10 highest percentage improvements for retail volume. Asbury Automotive Group Inc., of Duluth, Ga., ended up on top with a 44 percent jump from 2021; Asbury bought megadealer Larry H. Miller Dealerships in December 2021.