| Stress test for the EV transition |

A business’ survival is dependent on smart risk management. As the auto industry takes its biggest risk in the era of mass production — the electrification transition — this week’s Automotive News highlights the magnitude of the bets being made.

Ford Motor Co., for example, for the first time publicly disclosed how much money it lost in its Model E electric vehicle division last year ($2.1 billion) and how much it expects to lose this year ($3 billion). Offsetting these large losses, if Ford’s projections hold true, will be large profits from its Ford Blue internal-combustion arm and its Ford Pro commercial business. A cynic might say Ford is chasing bad money with good, as the company plows those divisional profits into EV-related investments such as new factories and R&D on alternative battery chemistries. But that is a risk the company is willing to bear, and it is confident the payoff is not far away.

Newcomer EV companies and other industry startups that are competing with big, well-funded rivals are confronting the fallout from this month’s collapse of Silicon Valley Bank. Breaking into the automotive industry is already a capital-devouring endeavor fraught with peril. As access to capital becomes more difficult for these startups in the aftermath of SVB’s downfall, it’s a reminder to carefully weigh which financial institutions you do business with and spread cash around to reduce your exposure.

On the supplier front, the stress of the EV transition has weakened some companies and exposed skills gaps at others. As a result, Plante Moran projects that auto supplier M&A deals may be heating up again after the pace cooled down last year. Private equity firms, armed with hundreds of billions of dollars, have their eyes on EV growth projections and see the parts business as a good way to get some undervalued assets.

We’re only in the early stages of this high-risk, high-reward game. Over the months and years ahead, Automotive News will keep you up on how these separate but related plots play out.

|

|---|

“This isn’t a situation where they can sit back and wait for the OEMs to tell them what to do.” |

— ELLEN CLARK, CO-LEAD OF PLANTE & MORAN CORPORATE FINANCE’S INDUSTRIALS TEAM, ON SUPPLIERS HAVING TO ‘RETHINK EVERYTHING’ AS MORE EV PROGRAMS LAUNCH |

|

From “EV push could spur more supplier mergers and acquisitions” |

|

|---|

In Monday’s Automotive News:

CPO sales at 8-year low: U.S. sales of certified pre-owned vehicles fell 9.4 percent in 2022 to their lowest level since 2014. Why? Dealers grappled with a stunted supply of certifiable used vehicles returning to market, and some customers switched back to purchasing new vehicles as production improved. Automotive News looks at the reasons behind the drop.

Lessons from SVB failure: What can the industry learn from the collapse of Silicon Valley Bank? Well, it definitely shows auto tech and retail tech startups the benefits of spreading assets among multiple financial institutions. As Automotive News explains, crisis plans are also key when a bank fails. Auto industry startups were already struggling to access new capital, and the demise this month of SVB, an influential player in the country’s innovation economy, could make those problems even worse.

Weekend headline

Shawn Fain wins election as UAW president: Shawn Fain, a member of the UAW international staff in the Stellantis department who ran as a change agent for a union rocked by scandal, will become the next UAW president following a historic election that broke the so-called Reuther Administrative Caucus’ decades-long stranglehold on power.

|

|---|

Why Jaguar is asking some dealers to give up their franchises: A picture is starting to develop of what Jaguar’s U.S. dealership network might look like in 2025 when an all-electric and far more expensive three-vehicle lineup replaces today’s models. It will be smaller — perhaps dramatically so — and many sales could take place digitally.

Why Jaguar is asking some dealers to give up their franchises: A picture is starting to develop of what Jaguar’s U.S. dealership network might look like in 2025 when an all-electric and far more expensive three-vehicle lineup replaces today’s models. It will be smaller — perhaps dramatically so — and many sales could take place digitally.

End of the road for the Camaro? The last sixth-generation Chevrolet Camaro, which debuted as a 2016 model, will leave General Motors’ Lansing Grand River Assembly plant in January. There was no immediate plan to replace the Camaro, though the brand hinted at a future possibility. In a statement, Scott Bell, vice president of global Chevrolet, noted that “this is not the end of Camaro’s story.”

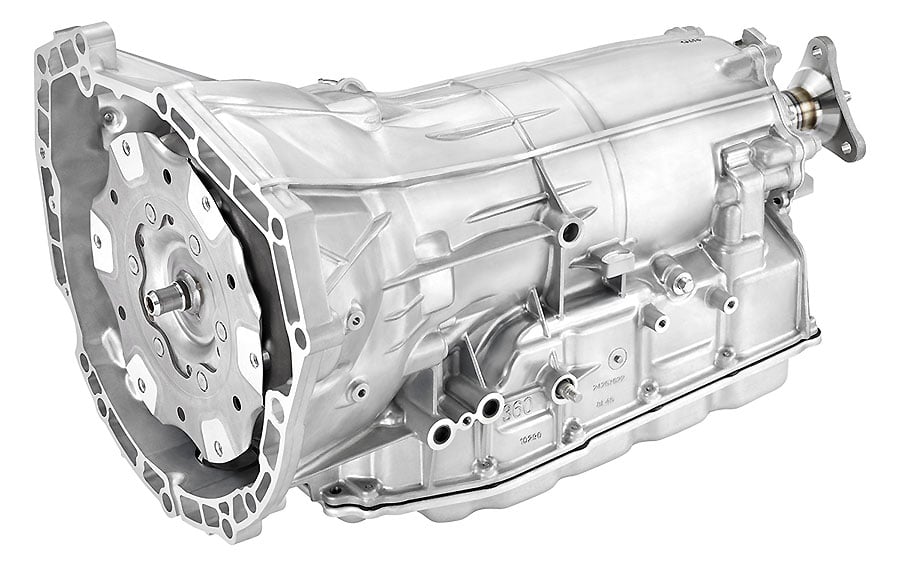

GM must face class actions: A federal judge in Detroit certified class actions for drivers in 26 states who accused GM of producing faulty transmissions for about 800,000 vehicles from the 2015 to 2019 model years. The decision covers several vehicles equipped with 8L45 or 8L90 eight-speed automatic transmissions, including Chevrolet and GMC pickups and SUVs, several Cadillac models and the Chevrolet Corvette and Camaro.

|

|---|

|

|---|

|

|---|

April 1, 2021: Veteran powertrain engineer Toshihiro Mibe becomes CEO of Honda Motor Co.