| Three milestones say loads about the auto business |

We bring three very noteworthy milestones to your attention in this week’s issue.

First is the milestone that Lithia Motors just skipped past AutoNation to become the biggest auto retailer in America.

That’s a landmark moment.

AutoNation pioneered the notion of a publicly held auto dealer group, and it proved to the business world that car dealers were not merely lucky and crafty. AutoNation made it clear that success in auto selling comes from a systematic and repeatable equation of strategic planning and business fundamentals. And that approach paid off by making AutoNation king of the industry year after year until — well, until now.

Second, please note that the official count is in on U.S. new-vehicle registrations for the full 2022 year, and it reveals that Tesla — the opaque, unpredictable and often second-guessed automaker — is officially a force majeure in the market. Tesla registrations rose 41 percent last year while the industry as a whole declined by 11 percent. Many people have been speculating that Tesla would slip past BMW this year to become the industry’s top-selling luxury brand. In fact, Tesla roared past BMW, and that includes all of BMW’s big-selling gasoline engine products.

Why do we keep making a fuss over registration numbers, as opposed to good old fashioned sales numbers? Simple — things have gotten inconvenient in some sales reporting. Case in point: Tesla. Tesla won’t tell anybody how many vehicles it’s selling in America. But with registrations, there’s no hiding the numbers.

The third milestone comes to us from California.

Again, looking purely at new-vehicle registration data in the nation’s single biggest market, Reporter Laurence Iliff points out that Tesla’s juggernaut may soon do to Toyota — king of California — what Lithia Motors just did to AutoNation. Tesla’s Model 3 just overtook the Toyota Camry, a development that was unthinkable only a couple of years ago. And now Tesla is gunning to upset the rest of it.

Pause to consider that for just a moment.

A respected brand … a time-tested manufacturer… a paragon of a retail organization … Toyota is in real danger of being swamped by the business equivalent of a hurricane. Has Toyota done something wrong? Hardly. But suddenly, its key market is shopping for a different kind of product.

Frankly, each one of these milestones deserves much, much more analysis. And you can count on us to deliver that in the weeks ahead.

|

|---|

|

|---|

In Monday’s Automotive News:

California dreamin’: Tesla’s Model 3 has been jokingly referred to as the “California Camry” for its ubiquitous presence in the nation’s biggest car market, where Toyota’s sedan has been the top seller. As this Automotive News story explains, the Tesla reference is no longer a joke. Indeed, Model 3 registrations in the Golden State in 2022 surpassed those of the Camry, along with every other passenger car, according to the California New Car Dealers Association. Further, Tesla’s Model Y crossover was the top light truck in California new-vehicle registrations last year, beating Toyota’s RAV4 for a second year in a row. No doubt the Toyota brand is still strong in California, with a 17 percent share last year with 289,304 registrations, while Tesla had 11 percent with 186,711 registrations. But the sales trend is moving in Tesla’s direction.

Speaking of EVs: Commenting on his competitors’ slower move to electric vehicles, Volvo Cars’ chief Jim Rowan said it’s a bad idea to tiptoe toward an electric future while continuing to develop combustion engine models. Indeed, according to Rowan, hedging bets by investing in internal combustion engine and battery-electric vehicles “risks missing the market.” Automotive News looks at the Swedish automaker’s electrification timetables, one of the industry’s most aggressive, with plans to go all-electric globally by the turn of the next decade. Volvo will bookend its crossover lineup with two new electric models this year and launch a new EV model every year for the next three or four years. “The market is moving towards electrification, and you best get ready,” Rowan said. “We’ve been bold enough [to] invest ahead of that inflection point, which we know [will] come.”

Weekend headlines

Gary Cowger, former GM North American chief, dies at 75: Over a nearly 45-year career with the automaker, Cowger negotiated labor peace with the UAW and mentored future CEO Mary Barra.

|

|---|

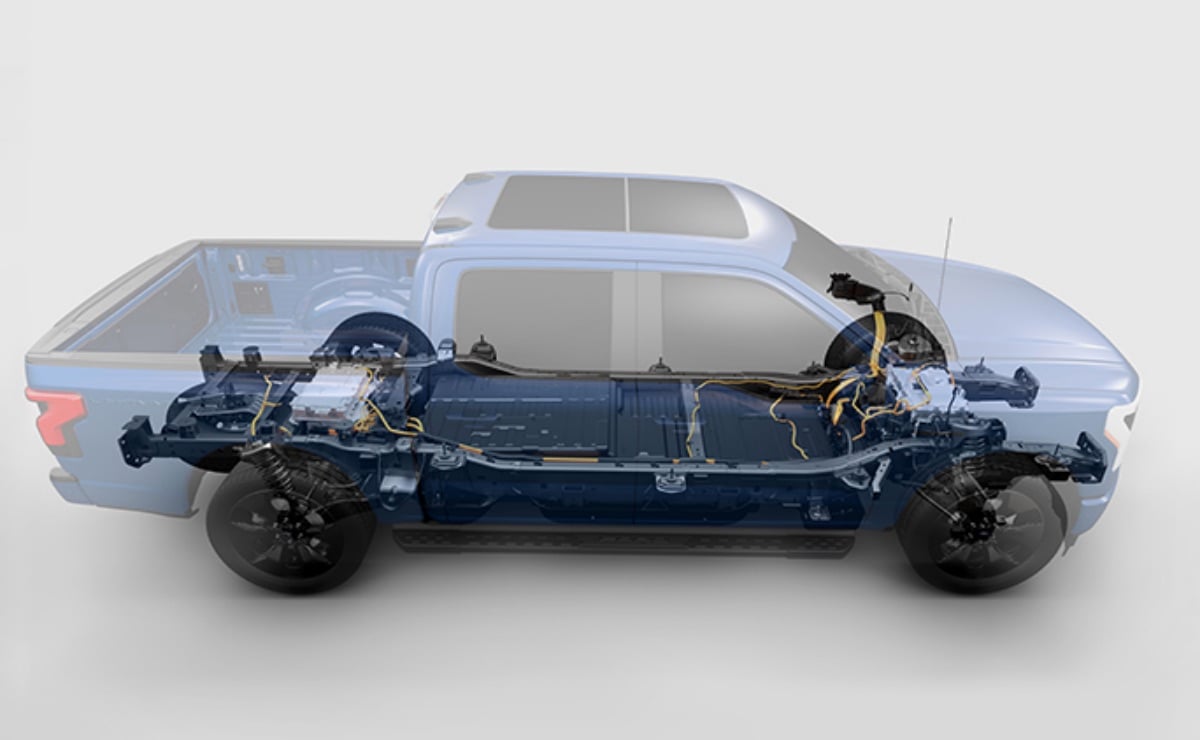

Ford production hiccups: Ford idled its Louisville Assembly Plant over a software issue that’s affecting the recently freshened Escape crossover and halted production and shipments of the F-150 Lightning, built in Dearborn, Mich., over a potential battery issue.

Ford production hiccups: Ford idled its Louisville Assembly Plant over a software issue that’s affecting the recently freshened Escape crossover and halted production and shipments of the F-150 Lightning, built in Dearborn, Mich., over a potential battery issue.

Magna’s Ontario investments: Auto supplier Magna will spend $350 million to open a battery enclosures plant in Brampton, Ontario, and expand five other plants in the province. The investment will create more than 1,000 jobs across the six sites.

Tesla to open charging network: Tesla will open part of its U.S. charging network to EVs made by rivals as part of a $7.5 billion federal program to electrify the nation’s highways to cut carbon emissions. By the end of next year, Tesla will open 3,500 new and existing Superchargers along highway corridors, as well as 4,000 slower chargers at locations like hotels and restaurants.

|

|---|

|

|---|

|

|---|

Feb. 23, 1880: Date of birth of Roy Chapin Sr., founder of Hudson Motor Car Co. and U.S. secretary of commerce in 1932-33. Fun fact: His son Roy Jr. was CEO of American Motors from 1967 to 1977.