Auto dealers fear higher interest rates will affect consumer vehicle demand in 2023, and some expect the increased borrowing cost to erode finance and insurance product sales volume or force lower rate reserve margins.

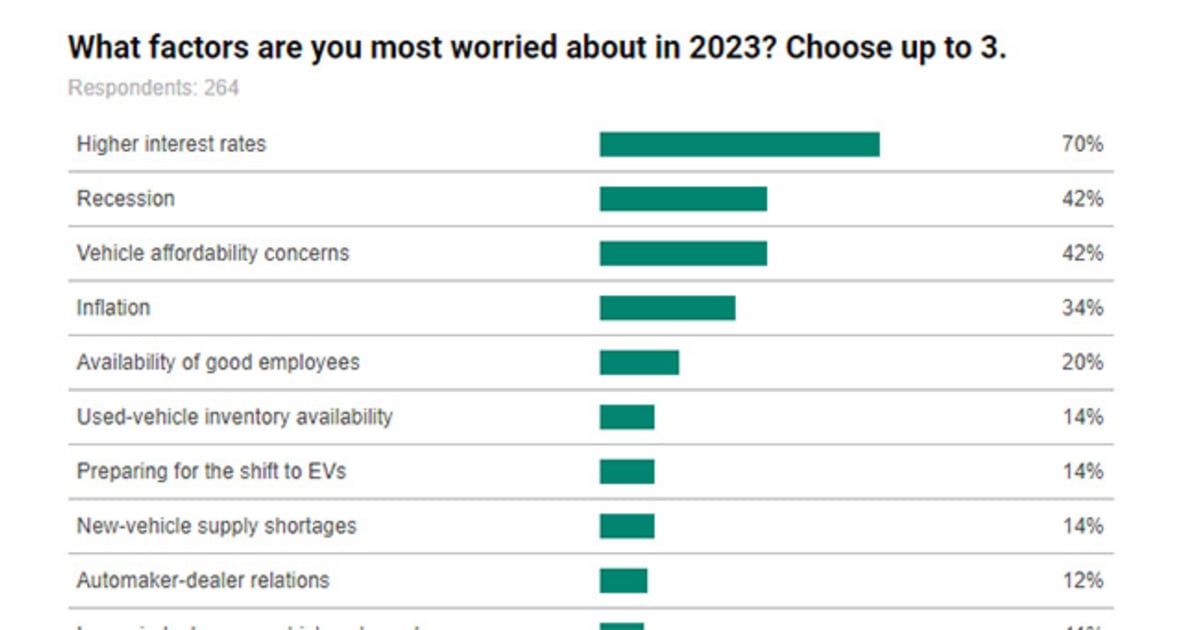

Automotive News‘ 2023 Dealer Outlook Survey of 264 dealers and dealership managers in January found interest rates were overwhelmingly dealers’ biggest concern for 2023, with 70 percent of respondents ranking higher rates among their top three worries for the year.

Dealers said higher interest rates would affect not just their ability to sell vehicles but their ability to stock them, with higher floorplan costs expected by many dealerships.

Thomas Castriota, dealer principal of Castriota Chevrolet in Hudson, Fla., said dealers are beginning to regain access to inventory and vehicles are not turning as quickly. So inventory expense is likely to grow in 2023, he said.

But he thought dealers also were concerned about interest rates “because of the cost of money to the consumer.”

The Federal Reserve’s benchmark interest rate target, which can have a ripple effect on consumer interest rates, rose to 4.25-4.5 percent on Jan. 31, 2023, from 0-0.25 percent on Jan. 31, 2022. On Feb. 1, the Fed increased its interest rate target again, to 4.5-4.75 percent, and the central bank might not yet have finished raising rates to fight inflation.

The average new-vehicle loan in January 2022 charged 4.1 percent interest, according to J.D. Power. Last month, the average new-vehicle borrower accepted a 6.8 percent annual percentage rate.

Castriota said most highly creditworthy customers faced APRs of 5-6 percent, and those with marginal credit are nearly into double-digit rates.

“Every consumer that’s borrowing is paying more,” he said.

Jack Schmidt, principal of Jack Schmidt and Associates who has a financial role at Adventure Subaru of Painesville, Ohio, called affordability and inflation concerns but didn’t view higher interest rates as a top challenge for 2023.

“That’s just an excuse not to sell a car,” Schmidt said.

Sixty-four percent of retailers polled in a different Automotive News Dealer Outlook Survey question thought higher interest rates would reduce consumer new-vehicle demand, and 53 percent said used-vehicle demand would fall.

Smaller but still significant percentages of dealers anticipated interest rates would cause headaches for their F&I staff. Forty percent thought F&I staff would sell fewer products per deal compared with 2022 because of the interest rate environment. More than 1 in 4 dealers — 28 percent — said they would be forced to reduce reserve below 2022 levels to close sales.

F&I product acceptance rates had been “sky high” during the recent vehicle inventory shortage, according to Tim Blochowiak, vice president of dealer sales at Protective Asset Protection. But interest rates were “chewing up the amount of payment that the consumer can afford that could have gone for products,” he said.

Castriota expected interest rates would lead to both lower reserve and lower product sales per deal at his store. He said the dealership wants repeat business and won’t overcharge customers trying to work out a deal.

“We’ll find a way,” he said, giving the examples of cutting interest rate reserve, F&I products or overvaluing a trade to make a transaction work.

Schmidt said it was easier to remove products from a deal to meet a customer’s budget than cutting reserve.

Sixty-four percent of dealers predicted interest rates would mean higher floorplanning costs in 2023, and 50 percent foresaw higher “overall costs.”

Schmidt said he thought interest rates would affect Adventure Subaru’s floorplan, but he described floorplan as a manageable issue for dealers able to properly balance their vehicle supply and the speed at which it sold. He remembered keeping few vehicles on lot and pursuing a “fast turn” during a time of 21 percent interest rates.

“I have seen a lot of dealers go broke by having too much inventory,” he said. “I’ve never seen one go broke by selling out of cars.”