The new-vehicle market is on the mend in California, the nation’s top volume state, thanks to pent-up demand and booming sales for electric and hybrid vehicles. Toyota remained the market leader last year, while Tesla displaced Honda for the No. 2 spot.

The California New Car Dealers Association forecast a 5.5 percent increase in new-vehicle registrations this year to about 1.8 million. That’s still short of the 2 million vehicles the state registered in each of the five years before the pandemic hit in 2020.

“Due to pent-up demand and low vehicle inventory availability since the pandemic, an estimated 43 percent of sales have been delayed,” the association said Tuesday. Better supply should push down prices and drive deliveries, the association added.

But the group warned that higher interest rates and lingering supply chain issues remain a drag on the market.

As a trendsetter for the nation, California is bolstering its leadership role in sales of battery-electric, plug-in hybrid and standard hybrid vehicles, according to a 2022 sales report from the dealers association.

Registrations of full-electric vehicles rose to 17 percent of the California market last year from 9.5 percent in 2021, while plug-in and standard hybrids captured 14 percent of registrations, about the same as a year earlier, the association said.

“While vehicle pricing was a major concern in 2022, sales of pure EVs increased by over 50 percent from 2021,” the association said. “California is clearly doing its part to increase EV sales.”

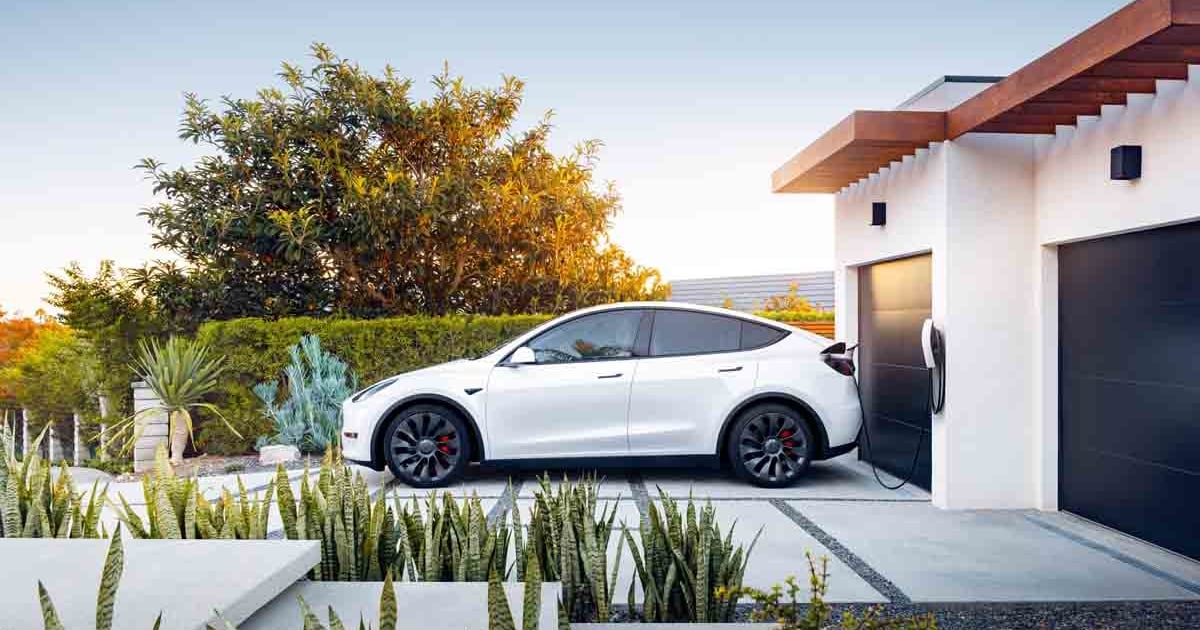

Tesla had the top two vehicles in the California market last year.

The Tesla Model 3 was the top car, with 78,934 registrations, beating the Toyota Camry, at 55,967. The Tesla Model Y crossover led the state’s “light trucks” category, with 87,257 registrations, compared with 59,794 for the Toyota RAV4, the association said. Ford F-Series pickups were third in the light-truck segment, with 40,232 registrations.

Overall, Toyota was the bestselling brand in the state, with a 17 percent share, compared with Tesla’s 11 percent in 2022. Ford was third, at 8.4 percent, and Honda fourth, at 7.9 percent. In 2021, Honda was second, and Tesla was fifth.

Total California registrations for all brands fell last year by 10 percent, but the fourth quarter was a bright spot, with a 14 percent increase, suggesting some momentum going into 2023.

Tesla was the big winner in last year’s supply-constrained sales race, with registrations growing 54 percent over 2021. The only other brands with gains were Genesis, with a 27 percent increase, and Cadillac, Mercedes-Benz and Kia, which all notched single-digit improvements.

“California’s appetite for Tesla vehicles is much larger than the nationwide average, which accounts for only 3.5 percent of the brand market share,” the association said.

Tesla sells directly to consumers and does not have franchised dealers.

The chairman of the dealers association, Tony Toohey, said California buyers are embracing new zero-emission vehicles as quickly as they are introduced to the market.

“With ZEV product announcements every day, we’re seeing the latest and greatest in technology and innovation in new-car makes and models by the major automakers,” said Toohey, owner of Auburn Toyota. “California drivers want these cars now.”