Auto refinancier and digital auto retail platform provider Upstart will begin to expand its indirect auto lending business to dealerships nationwide starting next quarter, the company said this week.

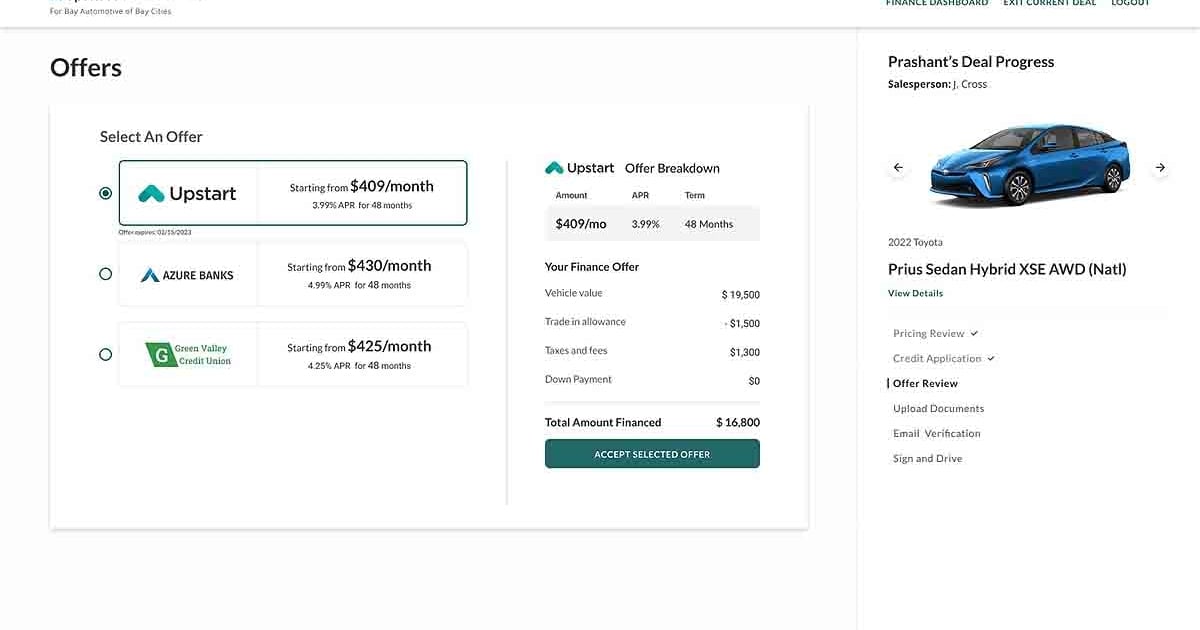

The company also will give dealerships using its Upstart Auto Retail platform the opportunity to let their customers obtain a car loan and even complete a purchase entirely online. These new features on what was once the Prodigy auto retail platform also will begin to roll out during the second quarter, Upstart said.

Right now, only about 30 of Upstart’s nearly 800 dealership customers have been able to use Upstart’s artificial intelligence-based, highly automated indirect lending system to find loans for their customers. The capability has only been available in-store, not for online retail, according to Alex Rouse, vice president and general manager of Upstart Auto Retail.

Rouse called results from dealership testing of Upstart loans “really, really impressive.”

The company’s partner lenders capture 24 percent of the loans pitched by dealers, Upstart spokesman Tom Brennan said. For 70 percent of the loans, Upstart was the only lender willing to finance the vehicle buyer, Rouse said.

“In 2022, we launched a successful pilot program with Upstart to extend our leadership in creating a best-in-class digital experience,” Del Grande Dealer Group CEO Jeremy Beaver said in a statement. “We expect to make further progress this year by completing our start-to-finish omnichannel sales approach. Upstart has enabled DGDG to help customers that would have otherwise not had access to reasonably priced auto financing options.”

Upstart uses AI and more data than in typical credit decisions to dig deeper into a borrower’s true risk and to match customers with lenders who believe in its underwriting assessments.

Rouse said the company’s AI has led to approvals of customers incorrectly perceived by the market as too risky and avoidance of loans customers incorrectly perceived as safe. This increased accuracy has led to approval rates rising 43 percent and interest rates falling 43 percent in the company’s personal loan business, according to Upstart.

Upstart automates all its credit decisions, according to Upstart CEO Dave Girouard, but it still might need to verify customer information. While AI helps here as well, only about one-third of indirect auto loans are truly automated without any additional customer stip activity, according to Rouse. But he said this proportion could grow, noting that Upstart’s personal loans were fully automated 75 percent of the time.

“That’s where we think we’re headed,” Rouse said.

Girouard said he thought the rate could even be higher for auto loans, as the risk of fraud in that sector is reduced by dealers’ ability to see the loan applicants in person.

Rouse said Upstart’s digital retail and lending services allowed for the addition of finance-and-insurance products to a deal.

“One of the value propositions of the AI-powered financing is we are able to approve people for larger loan amounts,” he said.

Girouard saw a role for Upstart in helping automaker-affiliated captive finance companies capture more volume with reduced losses, and he said the company has had discussions with those automaker-affiliated lenders.

“I think that’s something we would hope for in the future,” he said.

Upstart said it would start to introduce both auto finance and a means of e-signing contracts to its online sales platform in the second quarter. Rouse said dealerships would be able to pick and choose from its in-store finance, online finance and online sales services — it wouldn’t be necessary to switch digital retail providers to introduce Upstart lending to one’s customers.

“Engaging customers with a seamless experience — whether shopping from the comfort or their homes or in-store — is the key to winning in the next generation of auto retail,” Rohrman Auto Group sales and digital retailing director Jeremy Nowling said in a statement. “We are excited to continue our partnership with Upstart as it introduces a new range of increasingly flexible and cutting-edge retail and financing software solutions for dealerships.”

The broader Upstart lending rollout came later than the company had originally predicted. In late 2021, Upstart described it as slated for early 2022, and Girouard told a May 2022 earnings call it would happen in the third quarter of that year. The company has not yet returned an inquiry about the source of the delay.

Rohrman Automotive Group, of Lafayette, Ind., ranks No. 47 on Automotive News‘ list of the top 150 dealership groups based in the U.S., with retail sales of 20,024 new vehicles in 2021. Del Grande, of San Jose, Calif., ranks No. 78 with retail sales of 13,055 new vehicles in 2021.