| Carvana faces ultimate challenge in new year |

When you see a stock fall by 98 percent, questions are going to come up.

When a company restructures its staff twice in a year, one has to wonder.

When a still-young company loses about half a billion dollars in each of three straight quarters, you have ask: Are these guys gonna make it?

As we near the end of this 2022 that has been a terrible, horrible, no good, very bad year for Carvana, the online, used-vehicle retailer, reporter C.J. Moore set out to ask that fundamental question — and the others surrounding it — in this week’s front-page story:

■ Is Carvana getting tossed around simply because its business is concentrated on the most-challenging part of the consumer-facing auto industry?

■ Or does it have special liabilities, such as under-developed title processing, that acts as a bottleneck on growth?

■ Did the acquisition of ADESA’s physical auction business stretch the company too far?

It’s been a rough time for used-vehicle retailers across the board. Prices rose almost all of last year, and now they’re falling fast. It’s easy to get on the wrong side of those kinds of trends. Other online used-vehicle specialists, Vroom and Shift Technologies, have struggled. So has CarMax and so have the publicly owned dealer groups in their used-vehicle businesses.

Like so much in this COVID economy: We’re living in exceptional times that may not fully reflect the long-term outlook.

But Carvana is a special case. Its Super Bowl ads may have been less pejorative than Vroom’s, but they’ve been no less insulting. Carvana has positioned itself as the Tesla of retail: The disruptor that aims to clean the clocks of the fat-dumb-and-happy incumbents. So the collapse of its stock must inspire a certain amount of schadenfreude – pleasure at someone else’s misery – within the established retail network.

And yet, Carvana’s successes are not to be ignored. The company has demonstrated the value that consumers place on the convenience of online shopping — whether or not that proves they are forever set against traditional franchisees. Even if Carvana fails (or restructures under the protection of the bankruptcy courts), it has undoubtedly changed the course of the industry. All dealers have had to step up their digital-retail game: Either compete with Carvana CEO Ernie Garcia or cash out and move to Florida.

As C.J.’s reporting shows: Carvana is not dead yet. It has cash; it has land it can sell for cash. Regardless of the alliance formed by its biggest debtholders, there’s little risk that Carvana will become insolvent in the first half of 2023.

It will be a pivotal year for this upstart retailer with the volatile stock. Its fate will be defined by its own actions and the larger economy’s influence on consumer spending and credit availability.

My best prediction for 2023: C.J. is going to be writing a lot more about Carvana.

|

|---|

“Instead of trying to find loopholes within these credits, domestic automakers should be seizing the opportunity to solidify our country’s role as the automotive superpower we can and should be.” |

— SEN. JOE MANCHIN, D-W.VA., ON SOME AUTOMAKERS AND FOREIGN GOVERNMENTS ASKING FOR A BROAD INTERPRETATION OF EV TAX CREDITS THAT WOULD ALLOW RENTAL CARS, LEASED VEHICLES AND RIDE-HAILING VEHICLES TO QUALIFY FOR THE FULL $7,500 COMMERCIAL CREDIT |

|

From “Manchin urges Treasury to block ‘loopholes’ in EV tax credits” |

|

|---|

In Monday’s Automotive News:

Next-gen owner experience: Honda’s 11th-generation Accord, on sale in January, will offer a glimpse of how technology will be used to customize and enhance the vehicle ownership experience in the future. The Accord’s top trim will have a system called Google Built-In, essentially tethering the car to its owner via their Google profile and enabling a connected in-car experience without using a cellphone. Automotive News looks at how the tech offers more than a bespoke, streamlined driver experience: It’s the first step toward the next phase of vehicle ownership, which includes adding functions to the car via over-the-air updates.

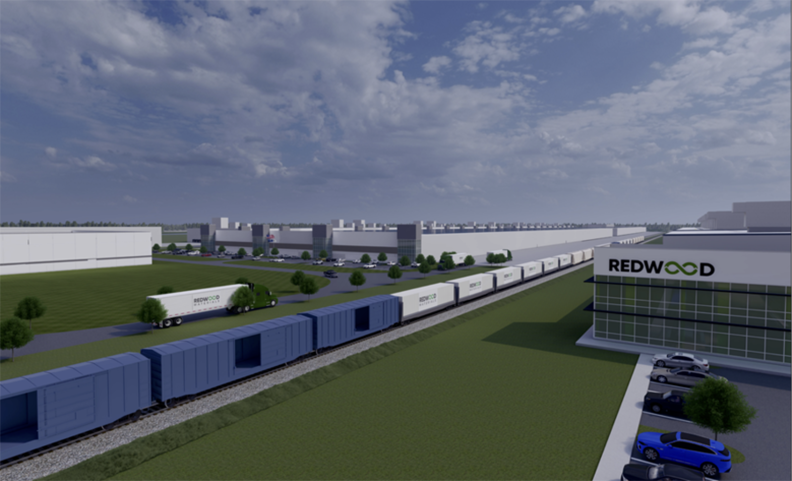

Domestic battery plants on the rise: The latest in a spree of multibillion-dollar battery plant announcements comes courtesy of battery recycling startup Redwood Materials. The company will build its second major campus in the U.S., investing $3.5 billion to build a battery materials plant in South Carolina. Automotive News explains how Redwood wants to become a U.S. source to fill a role now satisfied by foreign suppliers, in an effort to lower the cost and reduce the carbon footprint of battery production. That’s more important than ever, with the Inflation Reduction Act changing federal sales incentive eligibility to favor vehicles with batteries and materials made in North America.

Weekend headlines

Elon Musk restores Twitter accounts of journalists: Elon Musk reinstated the Twitter accounts of several journalists that were suspended for a day over publishing public data about the billionaire’s plane. The reinstatements came after the unprecedented suspensions evoked stinging criticism from government officials, advocacy groups and journalism organizations from several parts of the globe on Friday.

|

|---|

Ford, CATL mull battery plant in Michigan: Ford and China’s Contemporary Amperex Technology are considering building a battery manufacturing plant in Michigan in a complex arrangement designed to reap new tax benefits without running afoul of U.S.-China political sensitivities. The state has emerged along with Virginia as a potential home for the multibillion-dollar facility, according to people familiar with the matter.

Ram recall: Stellantis is recalling 1.4 million pickups worldwide because tailgates might not latch properly and could open while the vehicle is being driven. The recall covers various 2019-22 Ram 1500, 2500 and 3500 trucks. The automaker said it has no reports of crashes or injuries but more than 800 warranty claims and other reports potentially related to the issue.

Asbury sells stores: Megaretailer Asbury Automotive Group sold nine North Carolina dealerships to Hudson Automotive Group. Stores involved in the deal represent Acura, BMW, Chrysler, Dodge, Jeep, Ram, Ford, Honda, Nissan and Volvo brands. The transaction represented Asbury’s second big batch of divestitures this year.

|

|---|

|

|---|

|

|---|

|

|---|

|

|

|---|

Dec. 23, 2008: Production ends at General Motors’ SUV plants in Janesville, Wis., and Moraine, Ohio, where 2,600 workers were employed.