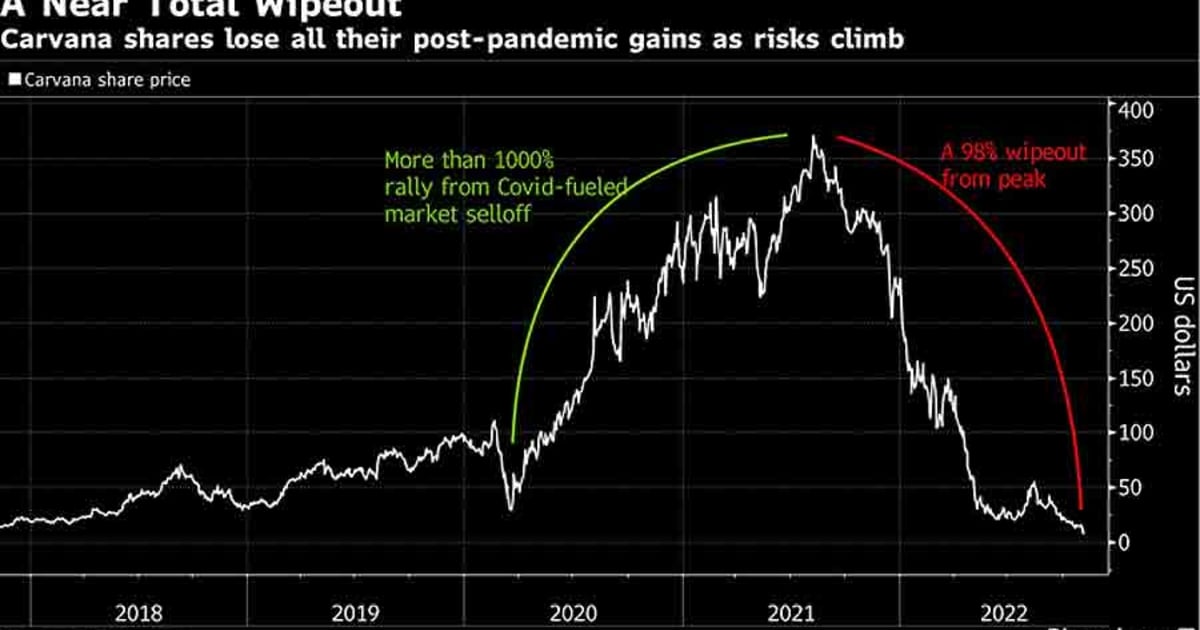

Carvana Co. is set to wipe out more than half of its market value in just two trading sessions as the stock plunged to an all-time low on deepening gloom about used-car sales.

Shares of the auto retailer have sunk more than 53 percent in the two trading days since the company reported disappointing third-quarter results late on Thursday, bringing its once-lofty market capitalization down to about $1.4 billion from $2.6 billion before the earnings miss. That’s a far cry from the $60 billion valuation the firm commanded last year.

The shares fell 15.6 percent to close at $7.39 on Monday.

Carvana — which allows its customers to buy a car from anywhere but also operates several high-visibility “vending machine” physical locations — saw its market value skyrocket last year when supply challenges in new-car production caused a surge in demand for used vehicles. That helped lure investors hungry for Covid-lockdown bets, especially given Carvana’s focus on at-home purchasing.

But the environment is changing as supply snarls ease, auto production gradually normalizes and the cost of used cars falls fast. Plus, the Federal Reserve’s fight against inflation has sent interest rates higher, raising the cost of financing vehicle purchases and weighing on consumer demand.

The closely watched Manheim Used Vehicle Value Index, which tracks used-vehicle prices, dropped in October for a fifth-straight month, down 10.6 percent from a year earlier. It’s the biggest such decline in the almost 28-year history of the index.

For Wall Street analysts, the shift presents a substantial challenge to Carvana’s business. On Friday, Morgan Stanley analyst Adam Jonas pulled his rating on the company, saying the stock could be worth as little as $1 as deteriorating used-car market and volatile interest-rate and funding environment “add material risk to the outlook.”

Analysts’ average price target on the company has fallen 30% since Thursday’s close.

“Cars are extremely expensive, and they’re extremely sensitive to interest rates,” Carvana CEO Ernie Garcia said on a conference call with analysts last week.